A sideways look at economics

Since April last year, second homes and buy-to-let (BTL) properties have attracted an additional Stamp Duty and Land Tax (SDLT) levy of 3%, more than doubling the average effective rate previously charged. The intention of George Osborne, the then Chancellor, was to take some of the pressure out of the rapidly-growing BTL sector.

Has the policy worked? In some respects, yes – data published this week show that the surcharge raised more than £1 billion for the public purse through the second half of last year. But the additional tax has done little to diminish the importance of the BTL sector, with the share of BTL in the outstanding stock of all mortgages continuing to rise.

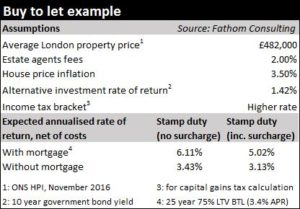

Why do BTL investors still appear so eager? Quite simply, the additional cost is too small to matter to those with the means to invest. To illustrate this point, we consider the potential return, both with and without the surcharge, to a BTL investor who is considering the purchase of a typical London property. Towards the end of last year, this was valued at just over £480,000.

Our table takes into account the expected capital gain, the net rental yield, and all costs incurred in buying and selling a property that is held for a period of ten years. The expected capital gain is based on an assumption that house prices move in line with incomes which, in a post-crisis world, with a 2% inflation target, ought to grow at an annual rate of some 3.5%. It shows that, with no surcharge, and no mortgage, our BTL investor might enjoy an annualised return of some 3.4% – well above the current yield on a ten-year government bond. For a leveraged investor, who takes out a 75% mortgage, the return could be as much as 6.1%. Following imposition of the surcharge, expected returns fall only slightly, to 3.1% and 5.0% respectively. Simple arithmetic suggests that the surcharge is not much of a deterrent!

Perhaps this was a stroke of genius from the former Chancellor? The surcharge is simultaneously filling the public purse, and it is progressive in nature, with only the wealthy able to purchase second homes. The difficulty, of course, is that the policy has done very little to limit the risks to financial stability from the burgeoning BTL sector. It is a case, then, of two cheers for the former Chancellor.