A sideways look at economics

Economic data are hard to measure. In most cases, we know what we’re looking for — inflation reflects changes in the average price level, GDP is a measure of domestic goods and services production, and unemployment counts the number of people who can’t find a job. For these indicators, the problem is often the resources required to collect the data in a comprehensive and accurate manner. But sometimes we don’t even have a clear definition of what we’re aiming to capture. I’d argue that AI falls into this category. For example, what do we mean when we say that we’re trying to measure its adoption? This week’s blog takes a sideways look at AI, through the lens of domain hacking…

What is domain hacking, I hear you ask? Well, a website’s domain is essentially its address — e.g. fathom-consulting.com. It contains two parts: the top-level domain (.com) and the second-level domain (fathom-consulting). Domain hacking essentially refers to the idea of combining these to assign a particular meaning — for example, radio stations’ websites often end in .am or .fm. (I’ll leave it to you to look up fun examples of clever domain hacking.)

But the question is what this has to do with economics and AI? Well it turns out that, while you can pretty much choose any second-level domain for your website, the top-level domains do actually have some meaning. For example, .com (the most common top-level domain) stands for .commercial, .edu is typically reserved for educational institutes, and .gov for public sector purposes. But countries have their own domains reserved too and, crucially, they can earn revenue from companies registering websites under those domains.

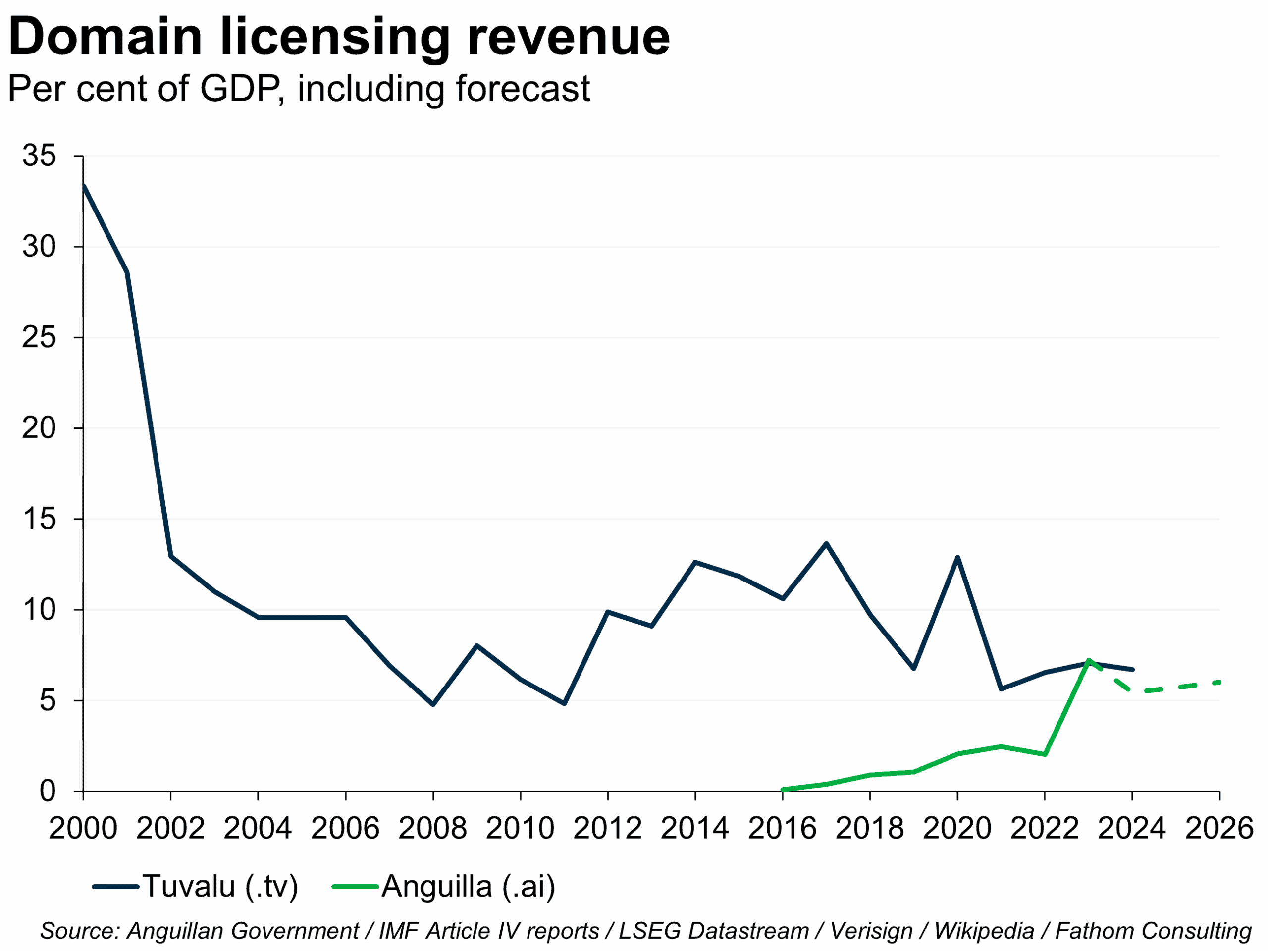

Anguilla has the fortune of possessing the .ai domain and, as an IMF blog pointed out last year, has been raking in revenue from this. In the last full year of reported outturns, it received more than USD30 million in revenue from it — small beer for most countries, but for an economy the size of Anguilla’s, this is equivalent to more than 5% of the country’s annual economic output. Based on the trajectory of this revenue (in the left-hand chart below), one might argue that the future of AI is highly encouraging.

Of course, Anguilla isn’t the first country to have enjoyed a boom in this way — 25 years ago, Tuvalu was enjoying similar success with its .tv domain. Tuvalu’s revenues were much lower in dollar terms, but higher when expressed as a share of GDP. There’s a question of what you do with this kind of windfall — do you use the money to pay down the national debt, invest in infrastructure, or pour it into a sovereign wealth fund? The disappointing news is that Tuvalu’s government didn’t manage to translate its extra revenue into strong economic growth — its annual real GDP growth averaged just 2.1% between 2000 and 2024. There are perhaps some lessons for Anguilla to learn from this.

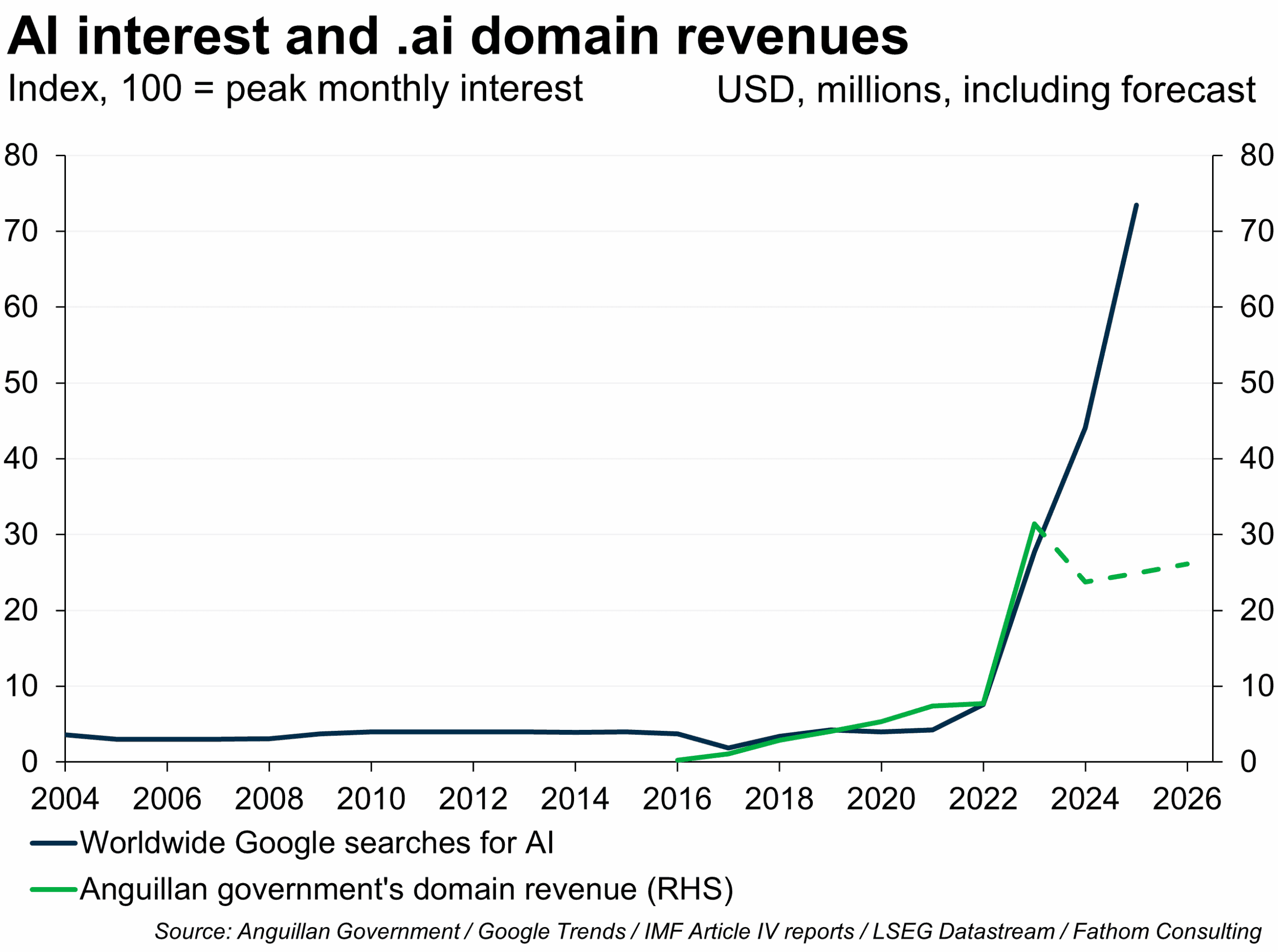

Returning to the Anguilla story and what it can tell us about AI adoption, what’s interesting is that domain-related revenue tracks another metric of AI progress — the share of Google searches that relate to AI. Both have been increasing rapidly in recent years, although it’s noticeable that the Anguillan government doesn’t forecast further revenue growth after 2023’s bumper year. (This may just be excessive caution — the Anguillan government doesn’t say.) But if the Google Trends data is a timely predictor of future revenues (and AI adoption), then it’s reasonable to expect that domain-related revenue could easily approach 20% of Anguillan GDP this year.

Regardless, it does seem as if the Anguillan government’s finances offer us an insight into AI adoption. They chime with other measures of AI’s progress, such as Google search interest, the profits of AI-related tech stocks, and Fathom’s own indicators of the gross value added provided by leading AI companies. Ultimately, none of them is definitive and all are shadow indicators of something that’s quite hard to measure. But the fact that they all point in the same direction maybe lends some extra credence to the lofty valuations of US tech equities, and suggests that the prices of those stocks could remain high.

Then again, isn’t that exactly how a bubble would look?

More by this author