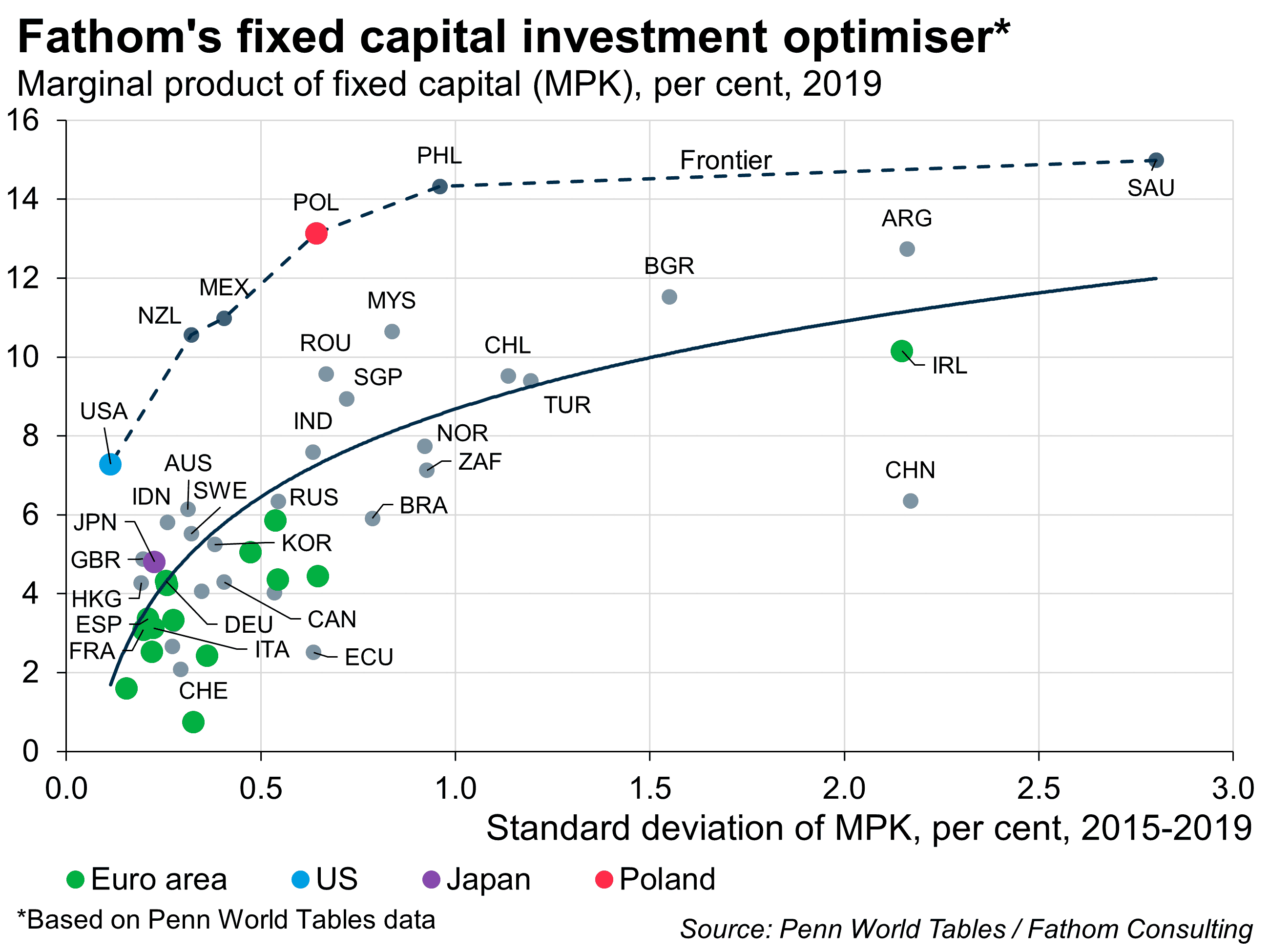

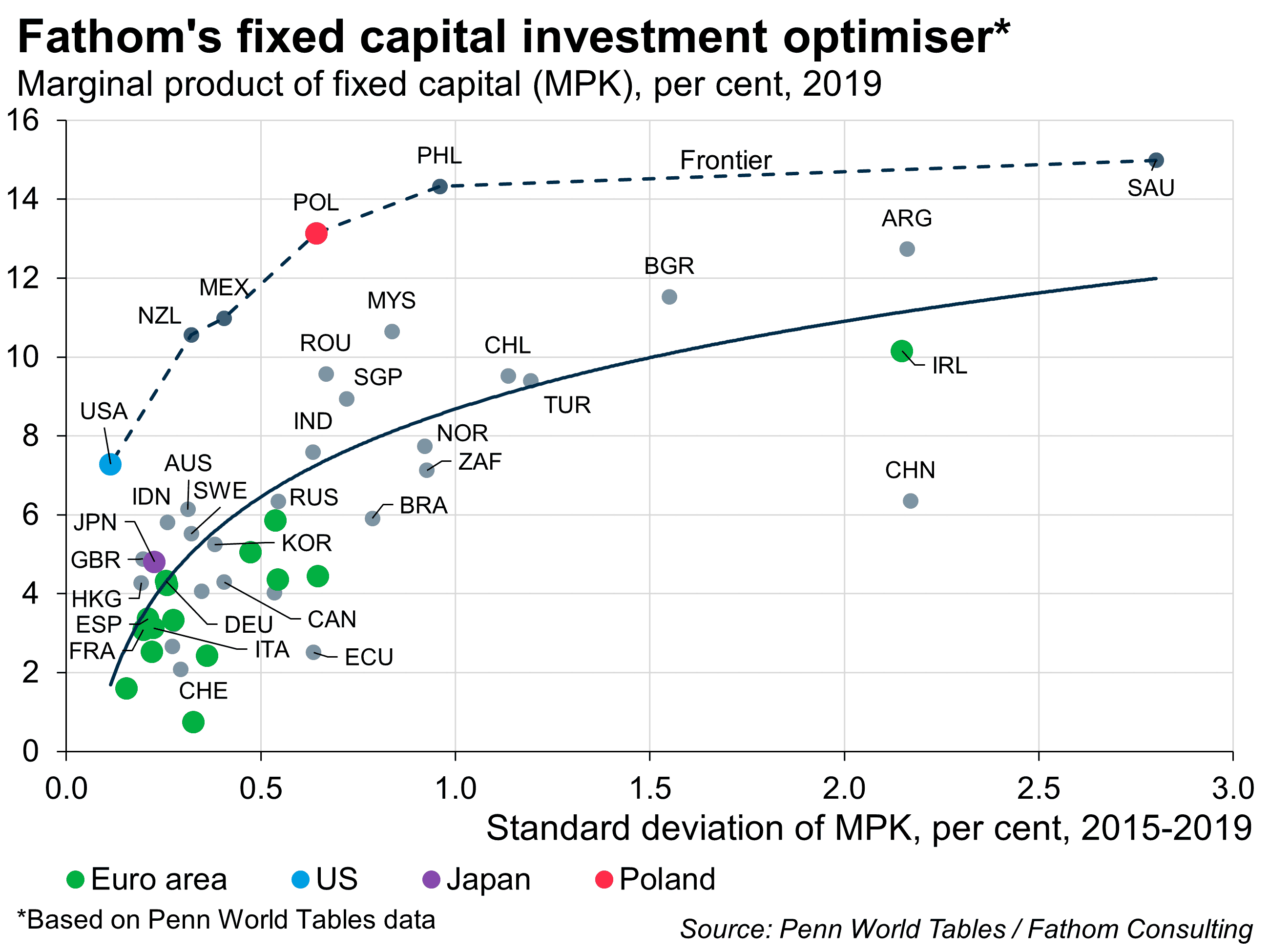

Fathom investment optimiser points to Poland and US

- Fathom’s fixed capital investment optimiser, outlined last week, indicates not only the US but also Poland as attractive options for investors

- Japan and the euro area are suboptimal options, due to the risk-averse attitude of their corporate sectors, and also chronic inefficiencies arising from Japan’s dependence on debt and the EA’s lack of integration

- Risk aversion ensures stability, but not dynamic growth

- Skilful innovators are stifled by Japan’s corporate conservatism

- The euro area’s approach to innovation seems counterproductive, or even destructive, towards innovators