A sideways look at economics

In much of Europe, mid-August is when the tempo drops. Offices empty, emails slow to a trickle, and for a few languid days you can drive across Rome or Paris with barely a touch on the brake. The workers’ day off on 15 August — or Ferragosto, to give it its Latin name — is not just a public holiday; it’s shorthand for the deep summer pause across much of the continent. Even financial markets, those famously restless barometers of sentiment and greed, seem content to take the day off. The scene writes itself: a handful of traders still at their desks, one eye on the Bloomberg terminal and the other on a gelato; liquidity so thin you could read a newspaper through it; price moves driven less by news than by the mechanics of empty order books. But how much of this is just market folklore — and how much actually shows up in the data?

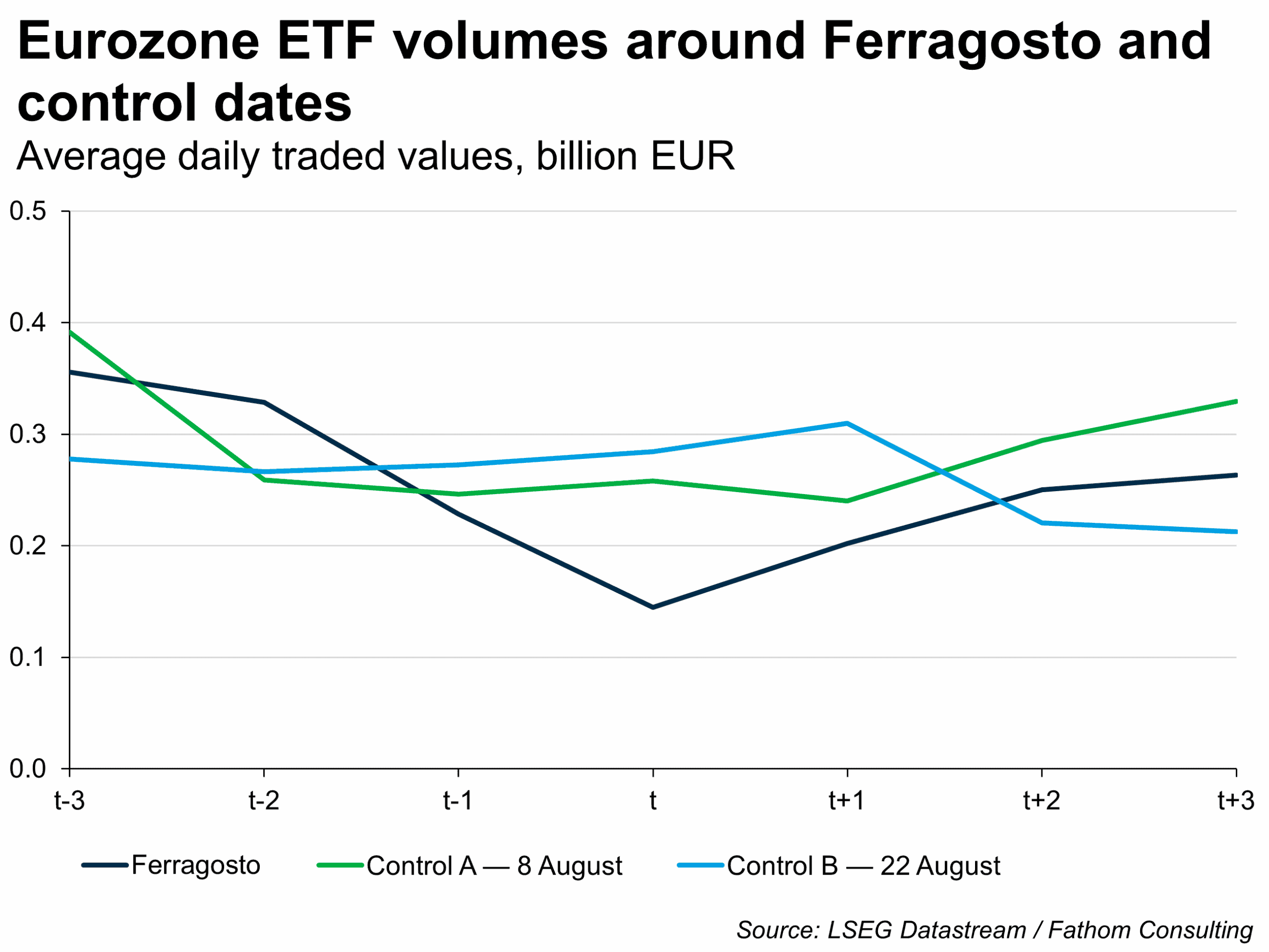

Curious to separate myth from reality, I lined up daily figures from 2010 to 2024 for the Euro STOXX 50 and two exchange-traded funds (ETFs) that track broad euro-area equity baskets — the S&P Euro STOXX 50 and the iShares MSCI Eurozone. Then I set out to see what happens to liquidity, costs, and returns in the three days either side of Ferragosto, using two other mid-August dates (8 and 22 August) as controls.

The first clue comes from daily turnover — price times volume. On Ferragosto, the drop is hard to miss. For the ETFs, it’s the market equivalent of a deserted beach, with trading value falling by roughly half compared with a normal August day. The Euro STOXX 50 index shows the same sag, confirming that even the region’s flagship benchmark is not immune to the summer slowdown.

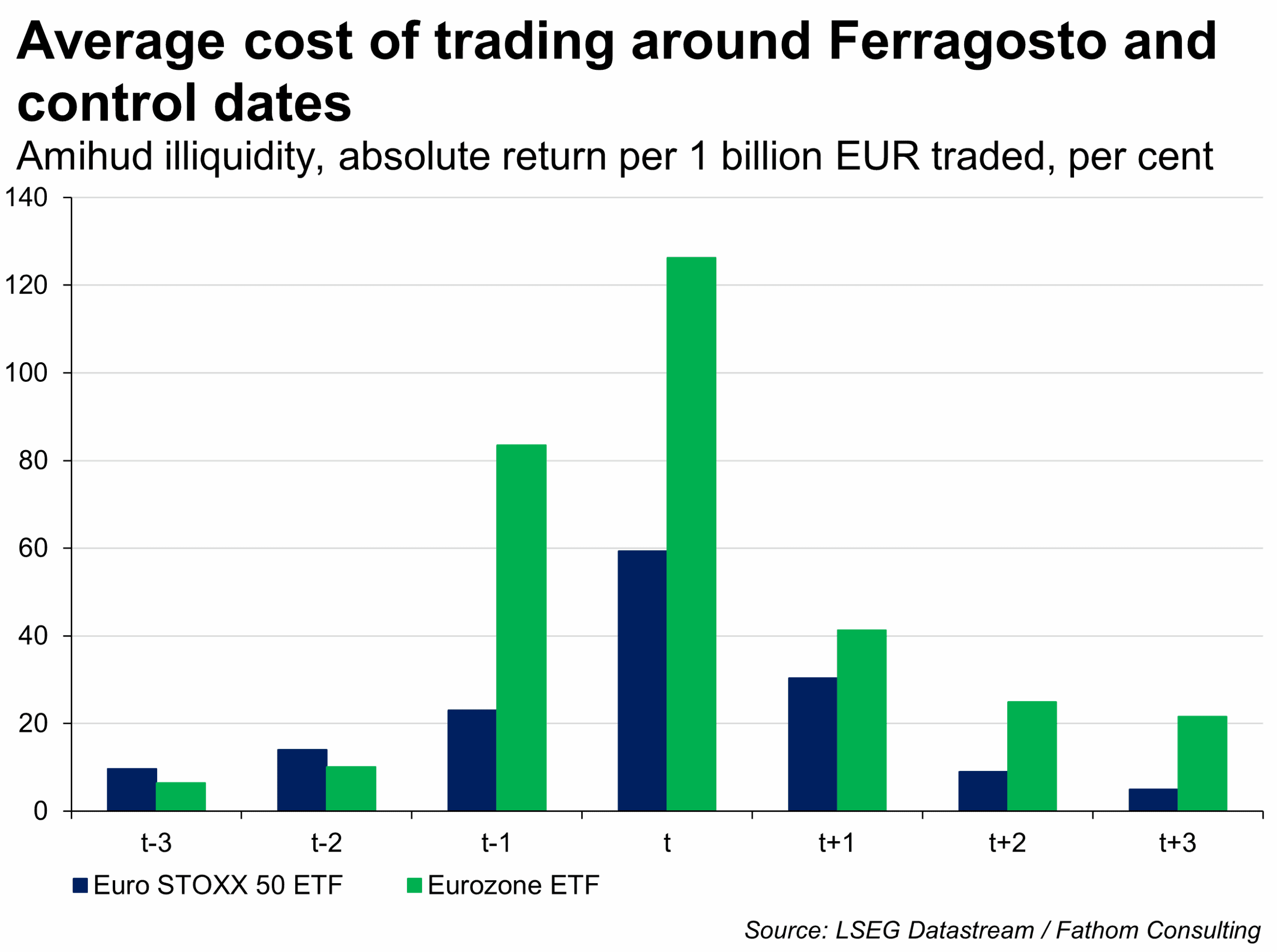

Thin markets (high illiquidity) change the rules of engagement.[1] With fewer counterparties and smaller resting orders, any sizeable trade shifts the price more than it would in busier conditions. That’s exactly what shows up in the Amihud illiquidity measure, which captures the average absolute price change per one billion EUR traded. On Ferragosto, that measure jumps — sometimes doubling for the ETFs compared with control days. In plain terms: you get less liquidity for each euro of trading value.

Taken together, these regional-level results make the point clearly: Ferragosto leaves a consistent, measurable microstructural footprint on euro area equity markets. The slowdown is not myth; it’s written into the data.

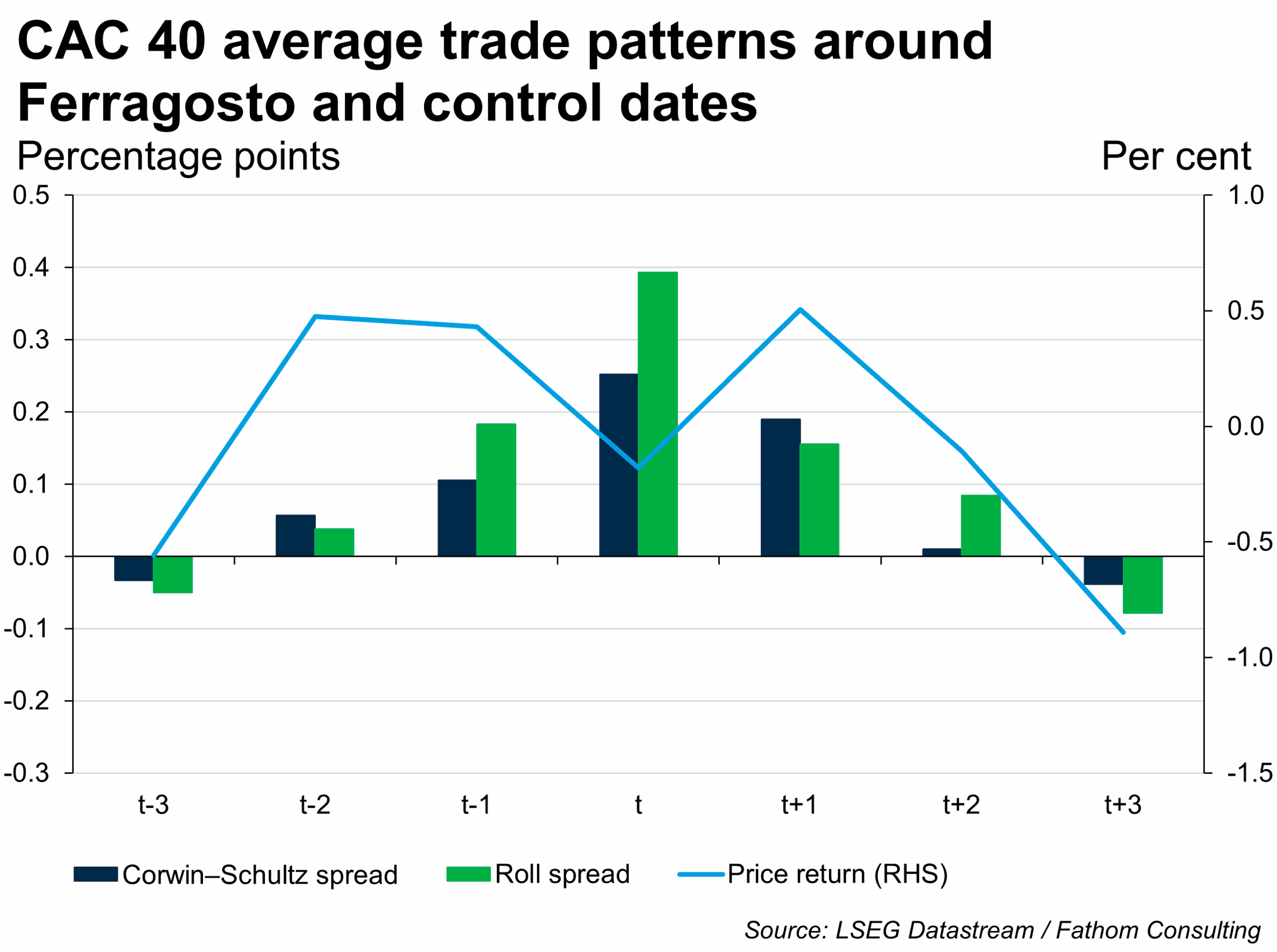

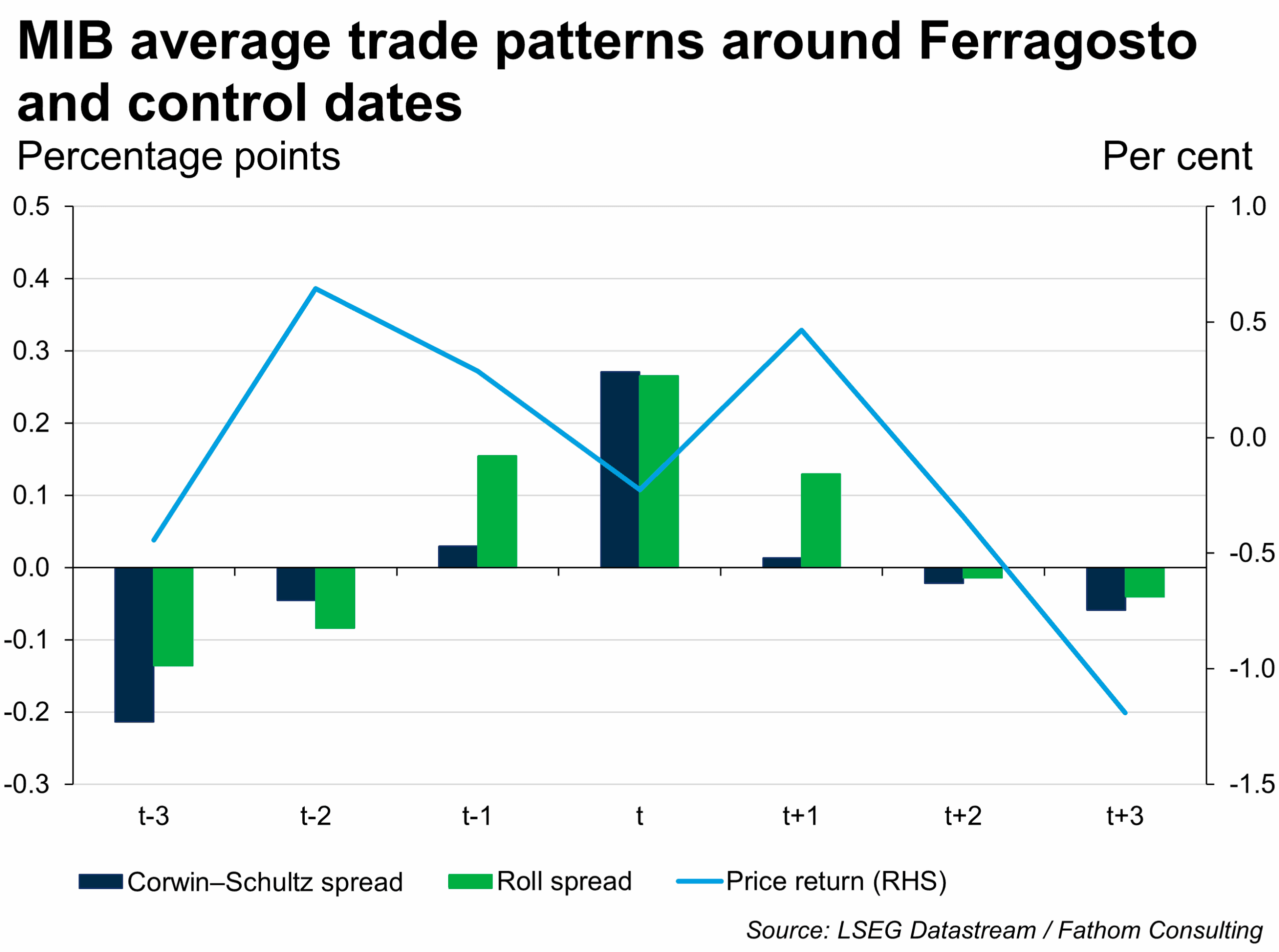

Only then do the national patterns add colour. The CAC 40 and MIB follow the ‘beach’ pattern almost perfectly — spreads widen, trading becomes more costly, and the market slows. Germany’s DAX 40, by contrast, not only avoids the slump but edges in the opposite direction, implying a slight pick-up in liquidity and lower costs. Whether this reflects German efficiency, Teutonic discipline, or just better air conditioning in Frankfurt, the effect is the same: no Ferragosto sag. And yet, the activity in the Euro STOXX 50 still dips. Which means that when France and Italy head for the coast, their absence is enough to pull the regional average lower — the holiday effect wins.

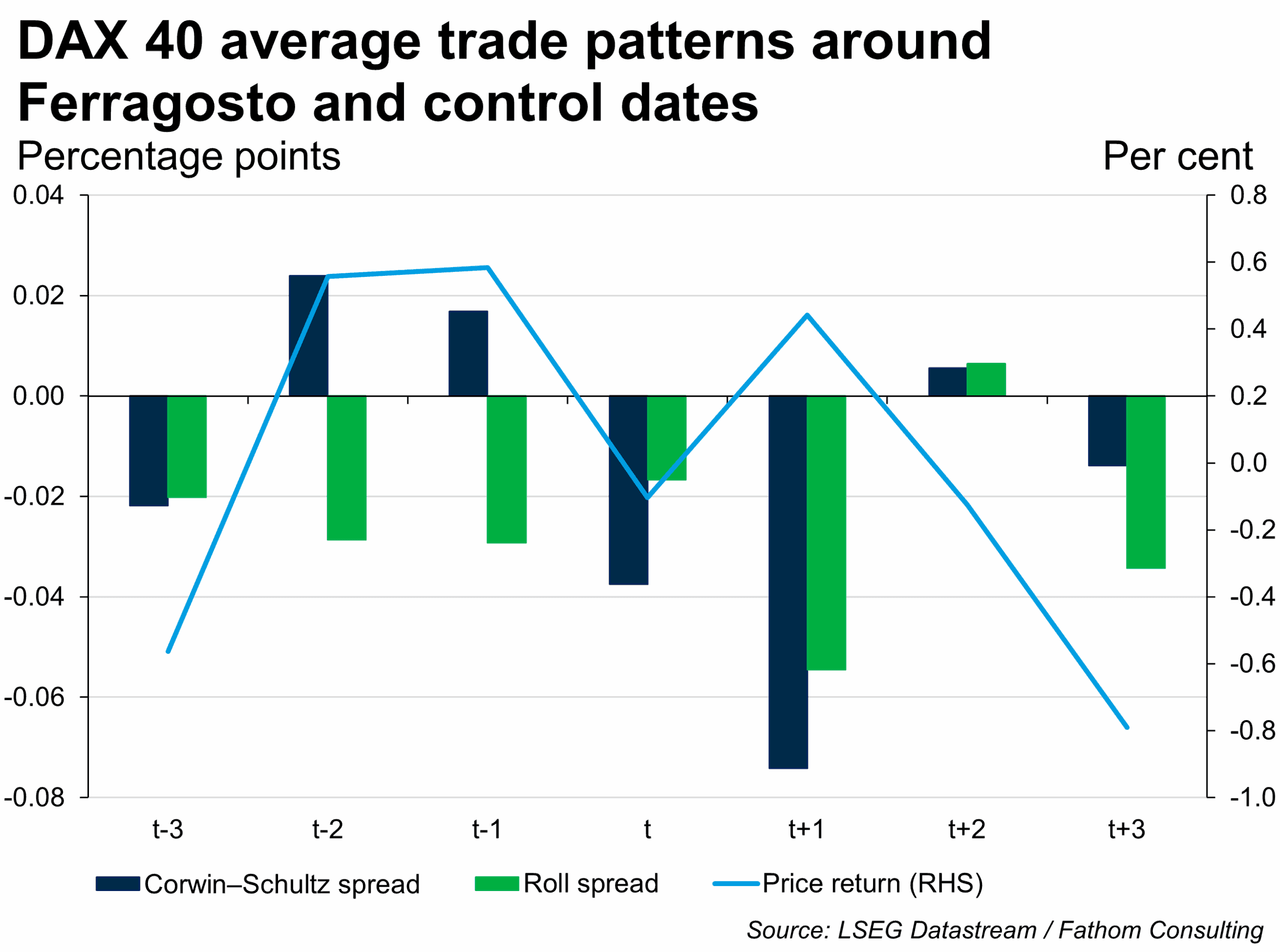

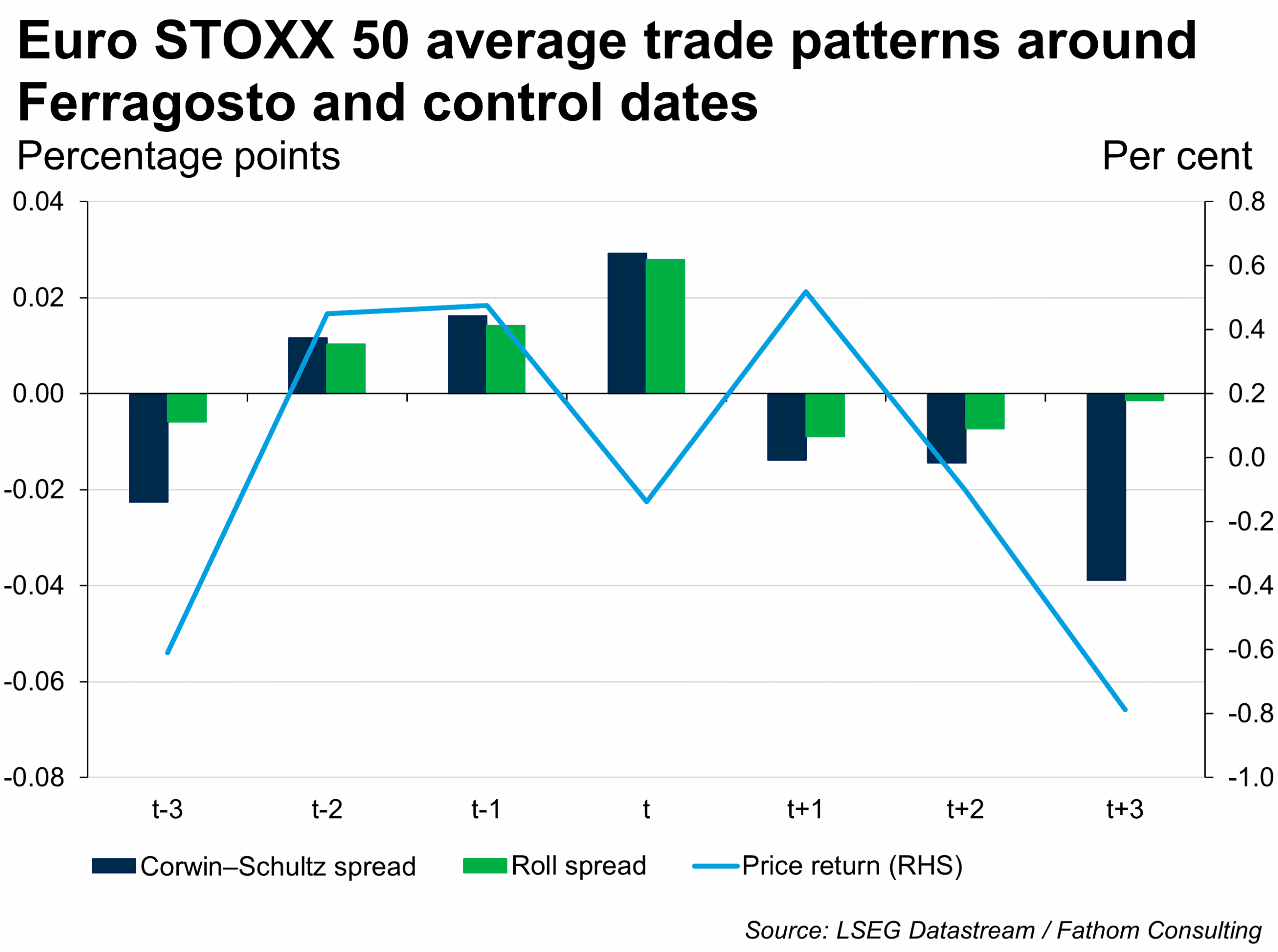

Trading costs, as captured by the Corwin–Schultz spread, show a neat Ferragosto hump in France and Italy: a small lift the day before, a peak on the holiday itself, and a quick reversion. In both markets, that peak can be 10–30 basis points higher than on a normal day. Germany’s DAX 40, meanwhile, leans the other way, hinting at narrower spreads and better liquidity. The Roll spread, based on return autocovariance, is noisier but broadly agrees — wider spreads when markets thin, but only in the more holiday-prone exchanges.

Given these wider spreads, you might expect Ferragosto to bring more volatile returns. In fact, the data say otherwise. From t–3 to t+3, average daily returns for Ferragosto and the control days hover near zero. No consistent bias up or down — no ‘holiday rally’ or ‘holiday slump’. This doesn’t mean surprises can’t happen — macro news doesn’t check the Italian calendar — but the seasonal effect is firmly in market microstructure, not direction.

Does any of this matter? For a long-term investor, probably not. But in the short term, liquidity is the oil that keeps prices aligned with fundamentals; when it dries up — even for predictable reasons — those prices can send misleading signals. For traders, the lesson is operational: avoid large orders on Ferragosto unless you’re happy to pay up for immediacy. For policymakers and market watchers, it’s analytical: don’t over-interpret moves on holiday-thin days. And for anyone programming trading algorithms, remember to code the holiday calendar as well as the clock.

Ferragosto is not unique. The US has its own quiet days — the Friday after Thanksgiving, the last trading session before Christmas — and similar pauses exist from Tokyo to Toronto. But Ferragosto stands out for its breadth: a cluster of major markets slowing together, making the effect larger and more predictable.

From 2010 to 2024, these patterns appear with remarkable regularity. Whether Ferragosto falls mid-week or on a Friday, the liquidity trough and spread widening show up almost every year in the CAC 40, MIB, Euro STOXX 50 and the euro area ETFs. In the DAX 40, meanwhile, they barely register. Perhaps German traders are simply too efficient to be distracted by sunshine and sea — or perhaps they’re quietly taking their laptops to the lakeside, executing trades between bites of Bratwurst.

Either way, the message is clear: in Europe, holidays matter — and when France and Italy lead the way, even the region’s most industrious market ends up following along in the averages. The holiday effect, in the end, wins. Think of it as a pan-European game of ‘follow the leader’, except the leader is already halfway to the Amalfi Coast. Markets, like people, have their rhythms — and Ferragosto’s is a slow one. Which is fine. After all, if the entire continent can collectively decide to down tools for a day, perhaps the rest of us should take the hint, close the laptop, and see if there’s any gelato left.

[1] Liquidity metrics are computed from daily prices, volumes, highs and lows for the Euro STOXX 50, DAX, CAC 40, MIB, and the Euro STOXX 50 and Eurozone ETFs. I estimate the Corwin–Schultz (2012) and Roll (1984) spreads as proxies for bid–ask spreads, and the Amihud (2002) illiquidity ratio as a price-impact measure, scaling in units of one billion EUR traded. Event windows cover t–3 to t+3 around Ferragosto (15 August) and two control dates (8 and 22 August) from 2010 to 2024.

More by this author

Built to last, struggling to change

Solving the iced coffee conundrum

Pic: Vicko Mozara, unsplash.com