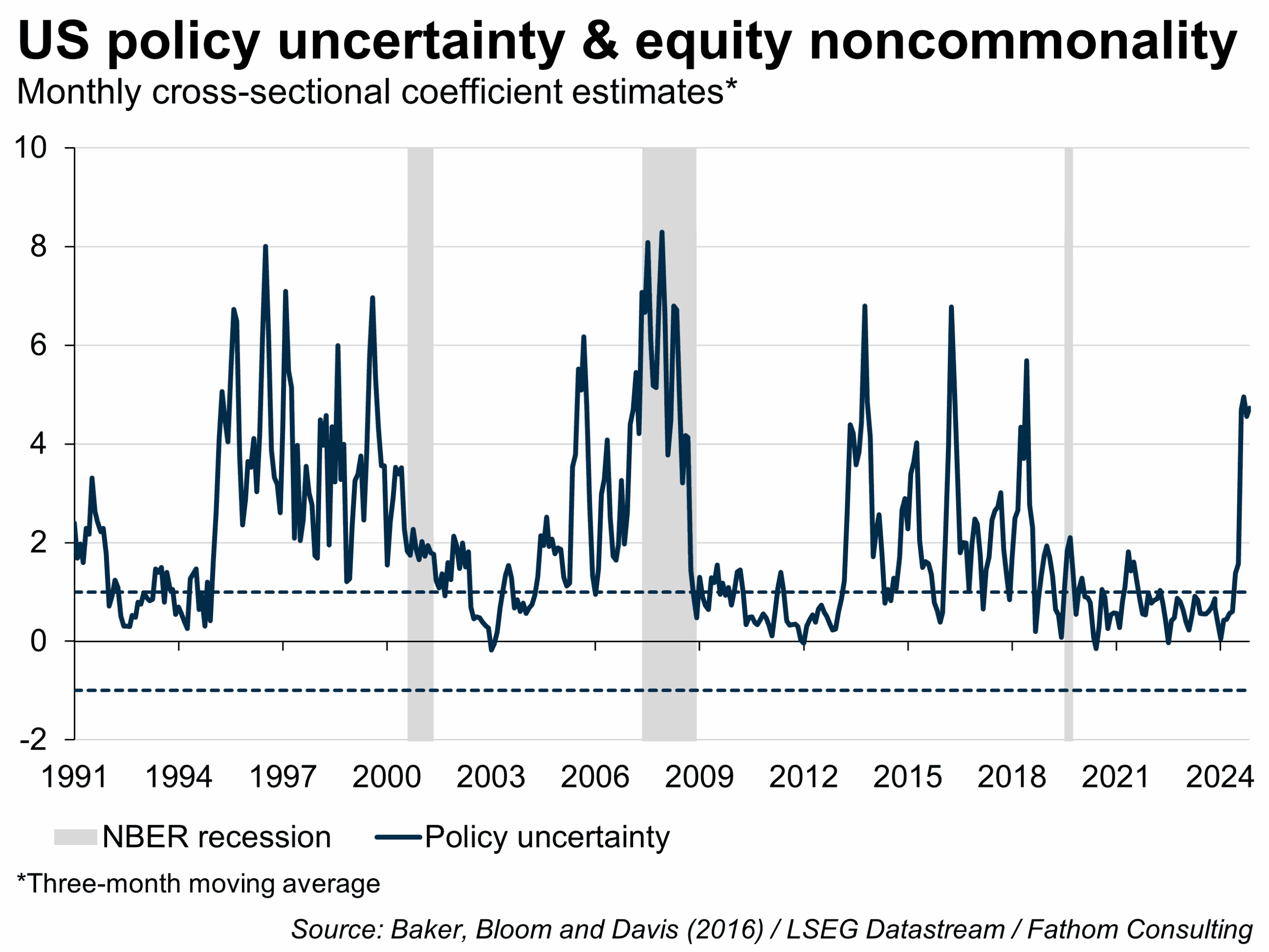

Since COVID, return noncommonality — the share of equity returns driven by firm-specific rather than market or industry factors — has remained lower than at any point since the early 1990s; this is a sign of unusually synchronised market behaviour over the past few years That may now be changing, as early 2025 has seen a tentative surge in noncommonality, hinting at growing fragmentation and a more uneven distribution of winners and losers Corporate fundamentals, such as hiring and investment

Please login to view this content

Lost your password?Not a research client? Click here to request access to notes.