Climate economics

Fathom takes a unique approach to climate-related work, centred on understanding how to reach net zero and allocate the world’s carbon budget in the most efficient way.

From this starting point we have developed novel datasets and powerful models and tools that identify the winners and losers from the energy transition, over time, helping our clients make investment decisions, manage risk and decarbonise their own operations with confidence. The rigour of our research and clarity of our analysis are why industry bodies, investors, corporates and different branches of government come to us for advice and solutions.

Details on the climate-related products and services we offer can be found below. For more information or to discuss your specific needs and how we can help, get in touch with Brian Davidson, Head of Climate Economics.

Our services

Data, models, tools

Fathom produces a range of data, models and tools focused on climate and the energy transition, which can be brought to life through presentations and user-friendly dashboards. In addition, we can build entirely new datasets, models and tools for consultancy clients, or existing products can be tailored to meet specific needs. Most of our climate-related data are available for 186 countries, meaning that virtually the entire global economy, population and carbon emissions are covered. Examples include:

Energy Transition Scores

Climate RiCArdo dataset

Other climate data, models, tools

Consultancy

Each organisation has its own unique operational needs around climate change, raising questions that can be complex to answer. Fathom can respond to any specific climate-related questions that relate to economics, finance or politics. We can offer quantitative analysis, such as financial modelling; or qualitative analysis, such as policy assessments or literature reviews.

One feature that sets us a part is our ability to use in-house data, models and tools to answer clients’ questions.

For example, in a study for BNY Mellon Investment Management we used our decarbonisation pathways with a range of financial metrics to produce sector-specific transition risk scores. For more on this work, see this case study.

In another example, we used our energy transition scores to produce groupings of countries, or ‘personality types’, which share similar profiles with respect to the economics of net zero. These have helped our client to better understand the geopolitical forces created by the transition.

Net zero strategy

We help organisations of various types and sizes to design and implement a net-zero strategy. Strategies can cover our clients’ operations directly, or indirectly via the economies they oversee (governments) or the assets they invest in (investors). We help clients to find, manipulate and create the data needed to set strategies and measure progress over time.

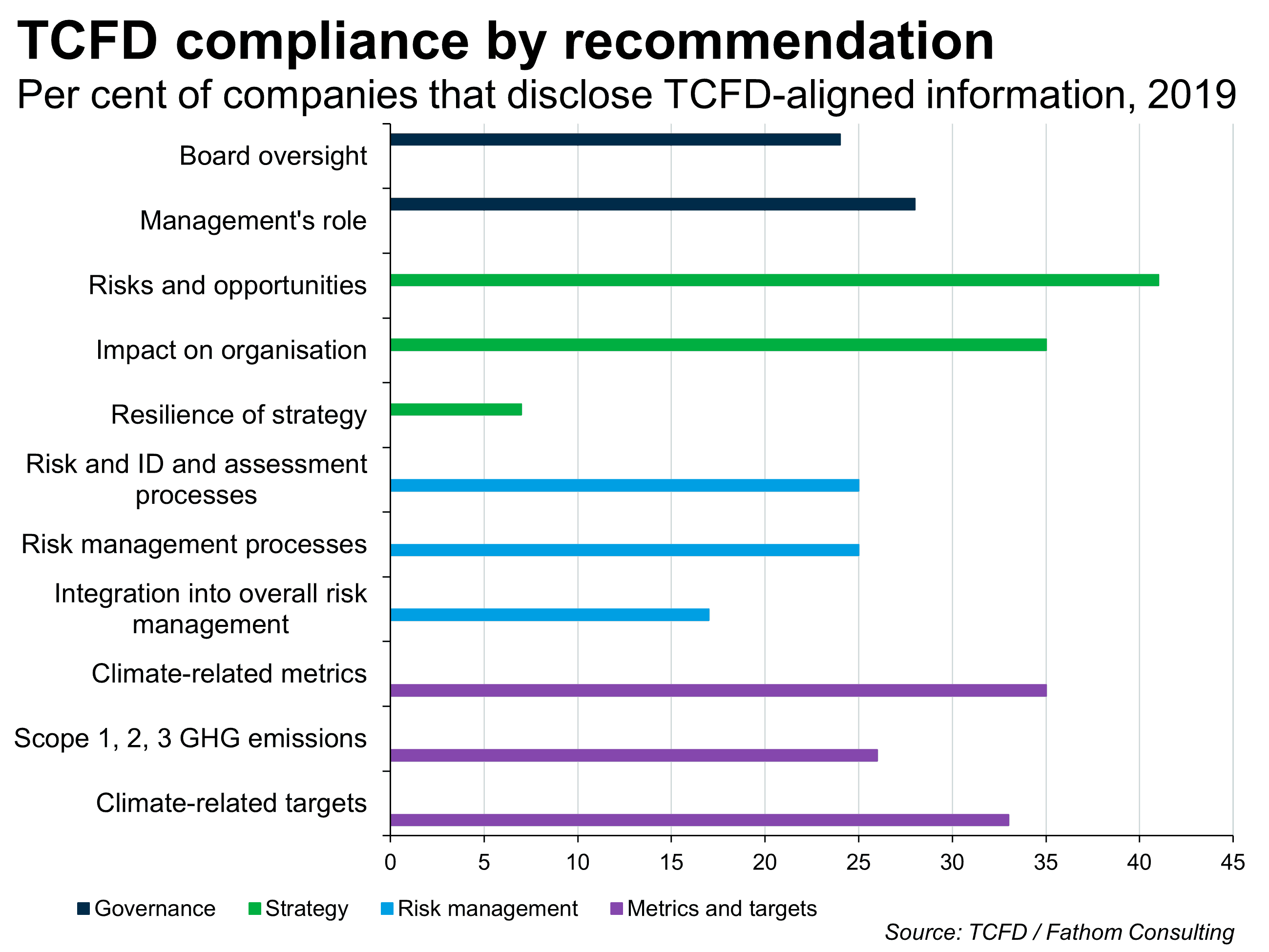

Regulations and TCFD

There are a growing number of regulations requiring that companies and investors have suitable protocols in place to manage the risks from climate change and the energy transition, and the rules are evolving fast. Compliance can be a daunting process. Fathom can help.

We track mainstream reporting regulations such as the Task Force on Climate-related Financial Disclosures (TCFD) rules and their timeline for implementation, and we also know how compliance differs between asset owners, asset managers and corporates. We offer qualitative and quantitative assistance, and work with clients to identify and quantify the issues specific to their organisations. Some clients want to know the bigger picture: how regulations have evolved, are likely to evolve in future and what this means for asset prices. We can help here too (see case study).

Global Outlook

Our consideration of the global economy, financial markets and geopolitics informs our thinking on climate issues. Likewise, we assess how climate-related issues affect those three areas. Our Global Outlook service incorporates climate-related research and material in our quarterly presentations. Subscribers to this service also receive invitations to roundtables and events hosted by Fathom.

Case studies

Insights

Get in touch

For more information about our climate economics services or to discuss your needs and how we can help, please fill out the form below.