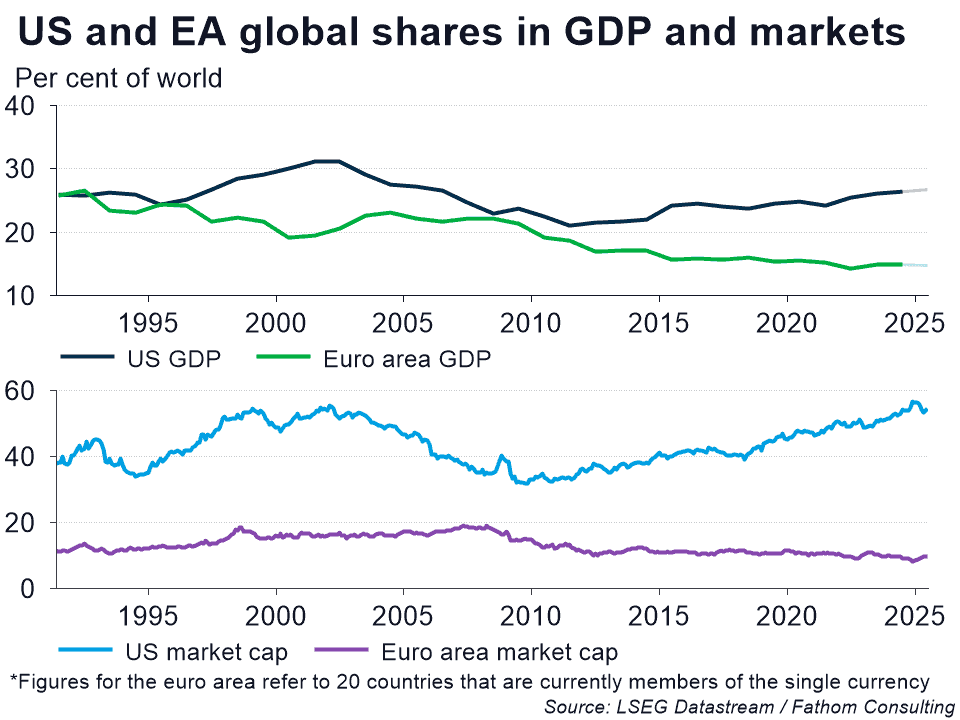

Jamie Dimon, the CEO of JPMorgan Chase, bluntly warned a meeting in Dublin on July 10 that Europe was ‘losing’ on competitiveness in a race with the US and China. It also lacked successful global corporations to rival America’s ‘Magnificent Seven’, Mr Dimon told an audience at the Irish foreign ministry. A look at the real economy and the capital markets reveals a story of divergence between the United States and the euro area that seems to confirm Mr Dimon’s point. The US share of world GDP (in nominal US dollars) has shown resilience, maintaining its portion in a range between 21% and 32%. In sharp contrast, the euro area’s share of the global economy has steadily eroded from a peak of nearly 27% in the early 1990s to less than 15% in 2025. And this trend of American outperformance is magnified dramatically when it comes to financial market dominance. The US share of global stock market capitalisation, while historically volatile, has had a dramatic upward trend since the 2008 financial crisis, now accounting for around 55% of the world’s total market capitalisation. In contrast the EU’s share has remained relatively stagnant and small at 15%, showing little if any growth since 2000.

Ultimately, the two trends tell a single story. While the US’s share of the global economy holds firm, it has simultaneously captured a larger piece of the world’s financial markets. The euro area, in contrast, is losing ground on both counts. This divergence solidifies a narrative of a widening transatlantic gap and cementing the US’s role as the world’s financial superpower.