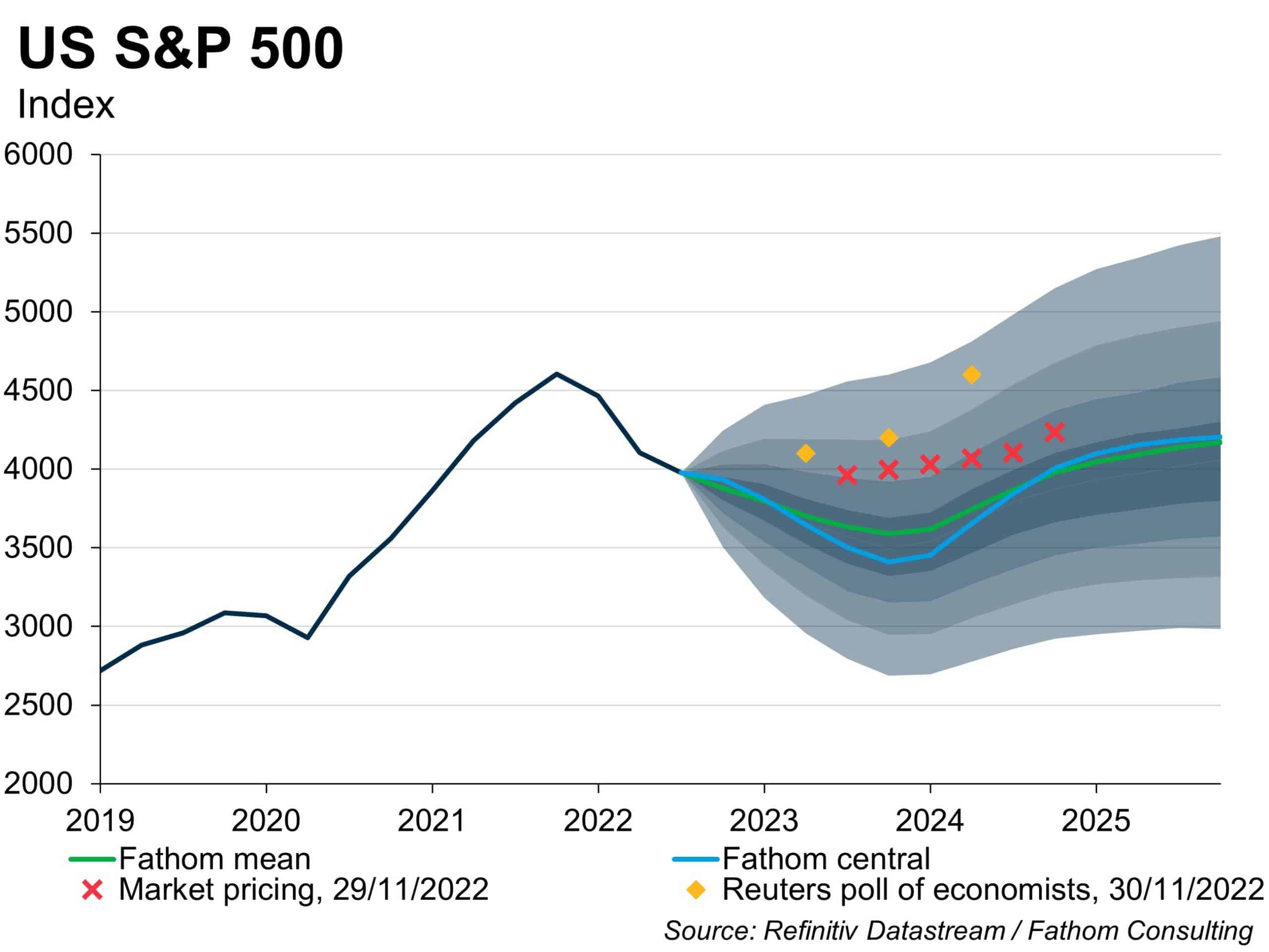

Following a downside surprise in October’s US inflation data, investors have increasingly (and correctly) priced in a much-discussed ‘Fed pivot’. Fathom is close to market pricing on US rates in the near term, and we expect the Fed’s policy rate to peak at around 5%; but we expect a slightly steeper pace of rate cuts than the market by the end of 2023. But with liquidity the key macro story driving markets, we think that equity investors are focused too much on the possibility of rate cuts, and not enough on the outlook for the real economy…

[Please click below to read the full note.]