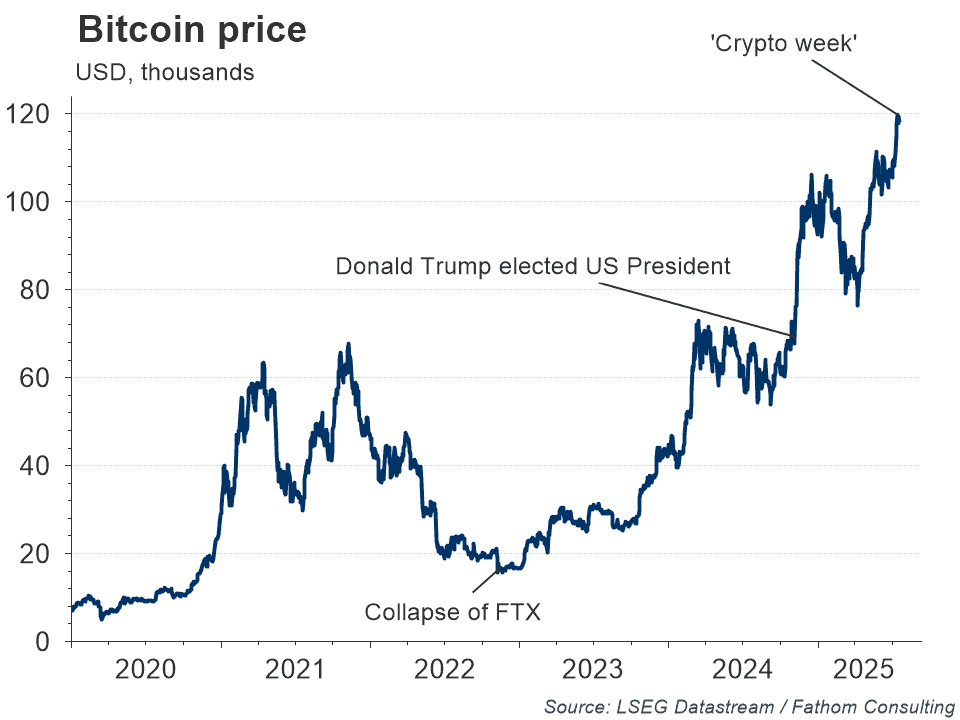

The value of the global cryptocurrency market surpassed $4 trillion for the first time on 19 July, according to CoinGecko, a digital-assets data provider, after Congress debated a series of crypto-related bills in what was dubbed ‘Crypto week’. On 18 July, Congress passed the Genius Act, to regulate tokens called stablecoins that are pegged to sovereign currencies (usually the US dollar). Two further bills — the Digital Asset Market Clarity Act, which sets out to establish a general regulatory framework for cryptocurrency, and the Anti-CBDC Surveillance State Act, which seeks to prevent Federal Reserve banks from creating digital currencies — were also passed by the House of Representatives, but still needed to be voted on by the Senate. Investors appeared to be betting on the stablecoin legislation paving the way for Wall Street banks, money managers and other companies to invest in digital assets or create their own tokens. Indeed, the heads of JPMorgan Chase and Bank of America have indicated that they would create their own stablecoins once the Genius Act was signed into law. Furthermore, the US Securities and Exchange Commission (SEC) is currently reviewing applications to launch over 70 exchange-traded funds (ETFs) backed by a wide variety of digital assets, which would allow a broader range of investors to enter the crypto market. US President Donald Trump, who has promised to make the US the “crypto capital of the world”, is also preparing to sign an executive order allowing the $9 trillion US retirement market access to crypto and other alternative investments. Some commentators have warned that binding cryptocurrencies closer to traditional finance poses perils in the event of future shocks. In November 2022 the price of Bitcoin dropped to about $16,000 following the collapse of the crypto exchange FTX, whose owner Sam Bankman-Fried was later jailed for fraud. In anticipation of Crypto week the price of Bitcoin reached a new record of more than $123,000 on July 14 before falling back slightly.