Headlines

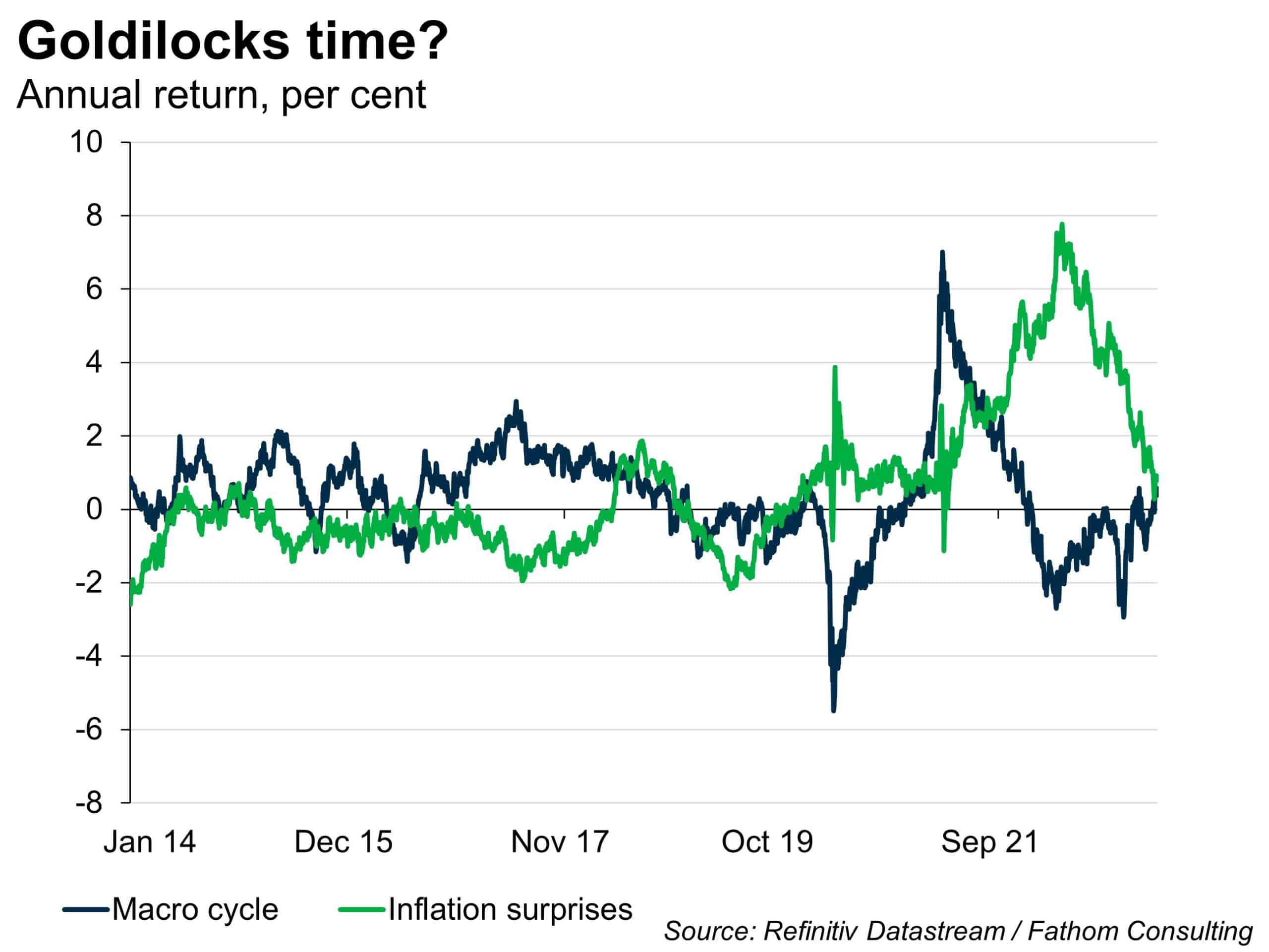

- Markets are close to pricing in a Goldilocks environment, consistent with low inflation and stronger growth

- We remain of the opinion that this is premature, and we offer evidence of a deterioration in economic fundamentals consistent with a recession that is not yet reflected in asset prices

- In Fathom’s opinion, the rebound in markets since summer 2022 is more of a victory parade for vanquishing inflation and for the potential end of the tightening monetary cycle than a true reflection of the macroeconomic picture

- We reiterate that it seems unlikely that we will escape a recession, and that central banks will deliver the expected interest rate path. Either of these two macroeconomic trends could end up disappointing increasingly bullish investors

- We maintain a cautious stance in our asset allocation, as signalled by the Fathom Risk-off Gauge

[Please click below to read the full note.]