Headlines

- A recession usually follows periods of high inflation and higher rates due to a slowing credit cycle

- Both the demand for and supply of credit are showing signs of weakening, particularly the former

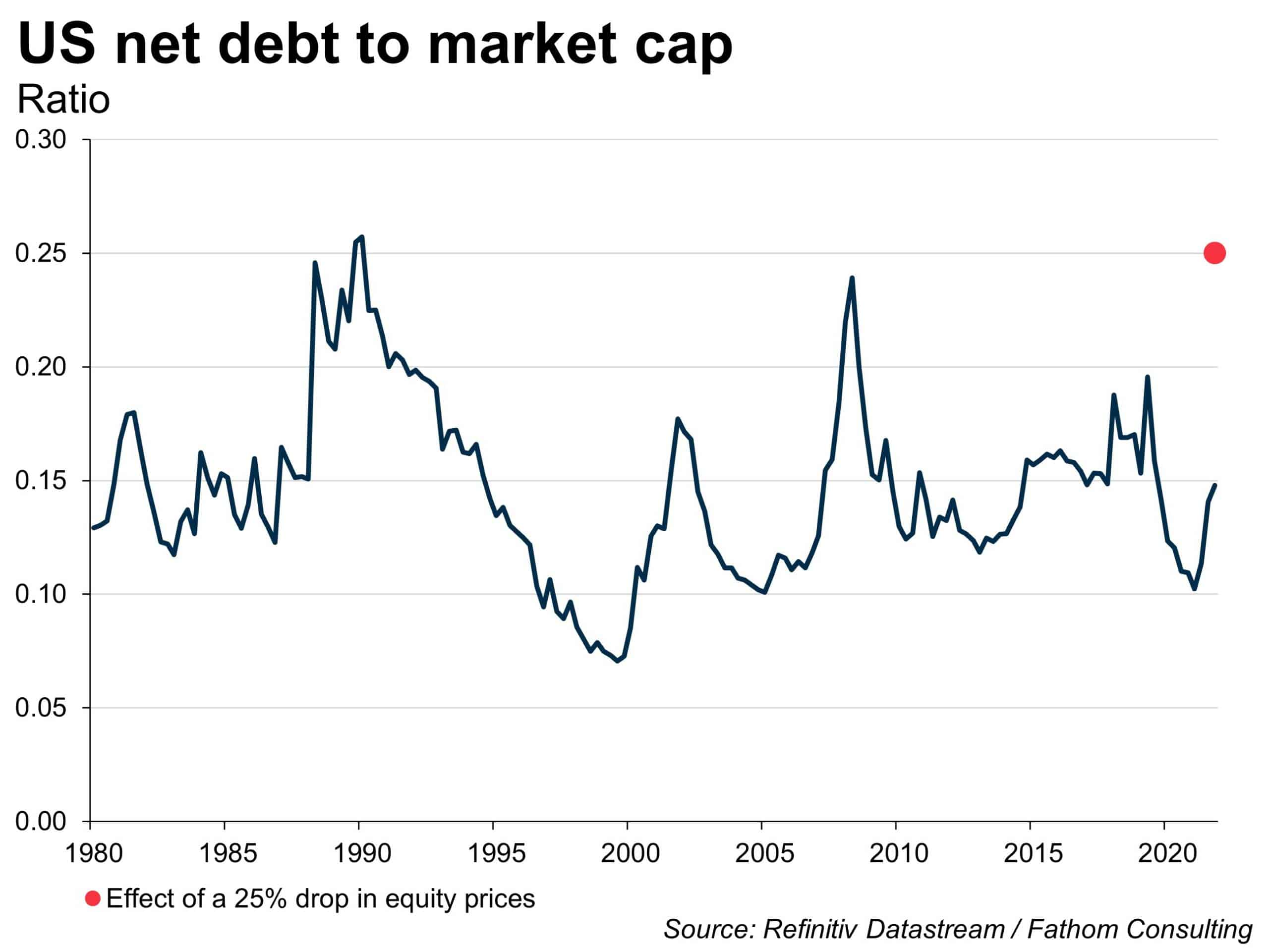

- It is leverage that determines the vulnerability of an economy to a shock, and leverage can increase because of high debt or falling asset values, or both

- High inflation and higher rates pose a significant risk to asset values, and thus could trigger sudden and aggressive episodes of deleveraging

- QT poses the highest risk, due to its untested nature and its potential to reverse a decade and a half of market-friendly ‘portfolio rebalancing’ effects

[Please click below to read the full note.]