Headlines

- The guarantee of ultra-low interest rates and quantitative easing – effectively a free put option provided to financial markets by the major central banks – has been removed and, as a result, market participants are having to pay for puts in a way we have not seen since the Great Financial Crisis

- The put/call ratio looks exceptionally bearish for equities, but it is driven at least in part by the removal of the Fed put

- In our central case, the worst news on inflation, growth and the rate cycle is in the past, and 2023 will not see a repeat of the carnage for long-only funds that we saw in 2022

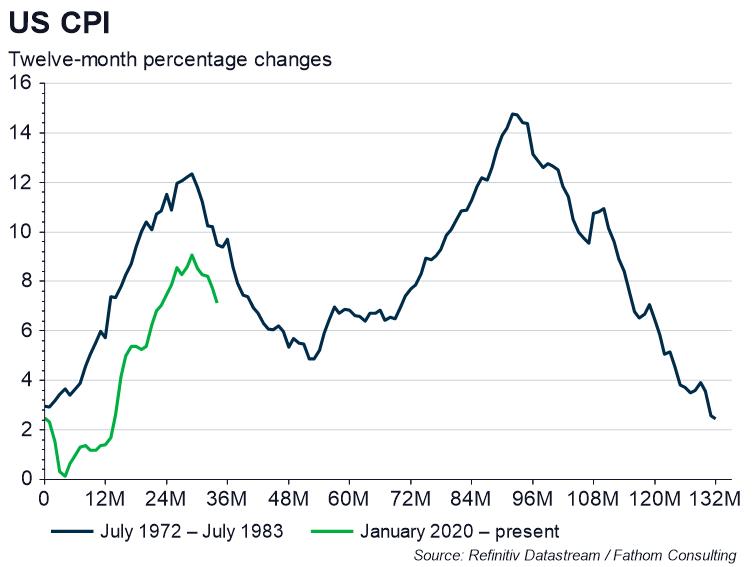

- The main downside risk is if falling inflation (as the first-round effects wash out) intercepts a rising wave of second-round effects: this has happened before and could happen again

[Please click below to read the full note.]