Headlines

- In the past consumer confidence has tended to start falling around nine months to a year before a peak in US economic activity

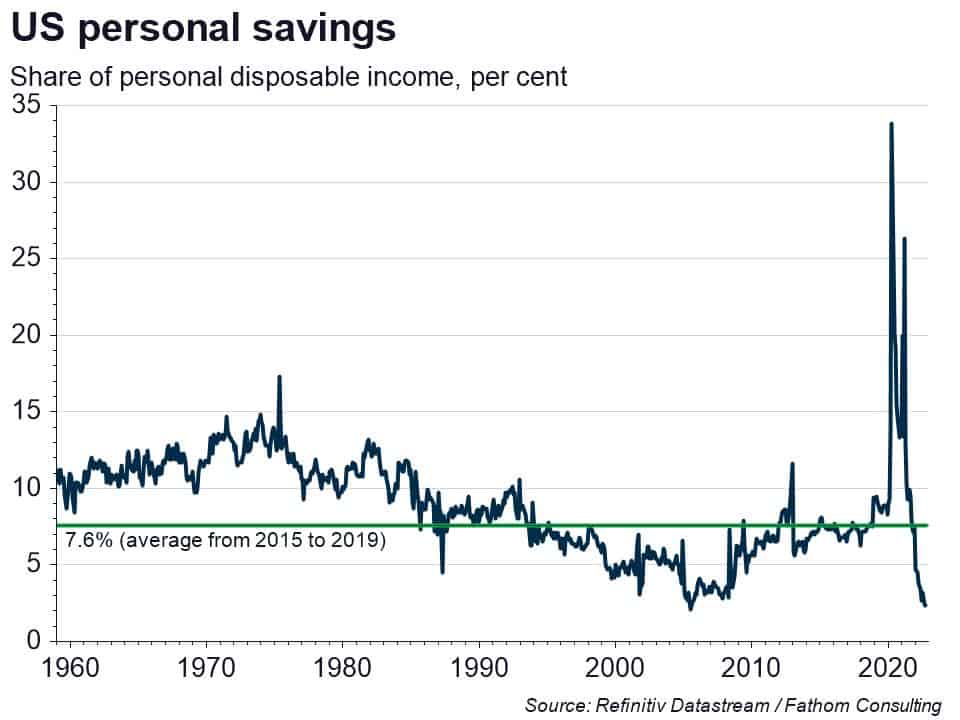

- It is likely that recent US economic activity has been supported by a willingness among households to eat into their pandemic savings, with the personal saving ratio falling dramatically in January of this year — nine months after consumer confidence began to fall

- In our central scenario the running down of savings does not continue for long, as interest rates rise, and broader measures of wealth fall — we estimate it would normally take a shift in sentiment that causes US households to save an additional $50 or more each week to push the US into recession

- The Bank of Japan this week announced a widening of the bands around its 0% target for the ten-year JGB yield — effectively a tightening of monetary policy, and one sufficient to cause a near 20-basis-points rise in yields, close to half the amount we think would be triggered by a total abandonment of yield-curve control

- Data from China for the month of November, on industrial production and in particular on retail sales, highlight the economic disruption caused by the recently abandoned zero-COVID policy

- With cases rising rapidly, this disruption is likely to continue at least in the short term, either as people withdraw from activities through fear of illness, or as renewed lockdowns are imposed

[Please click below to read the full note.]