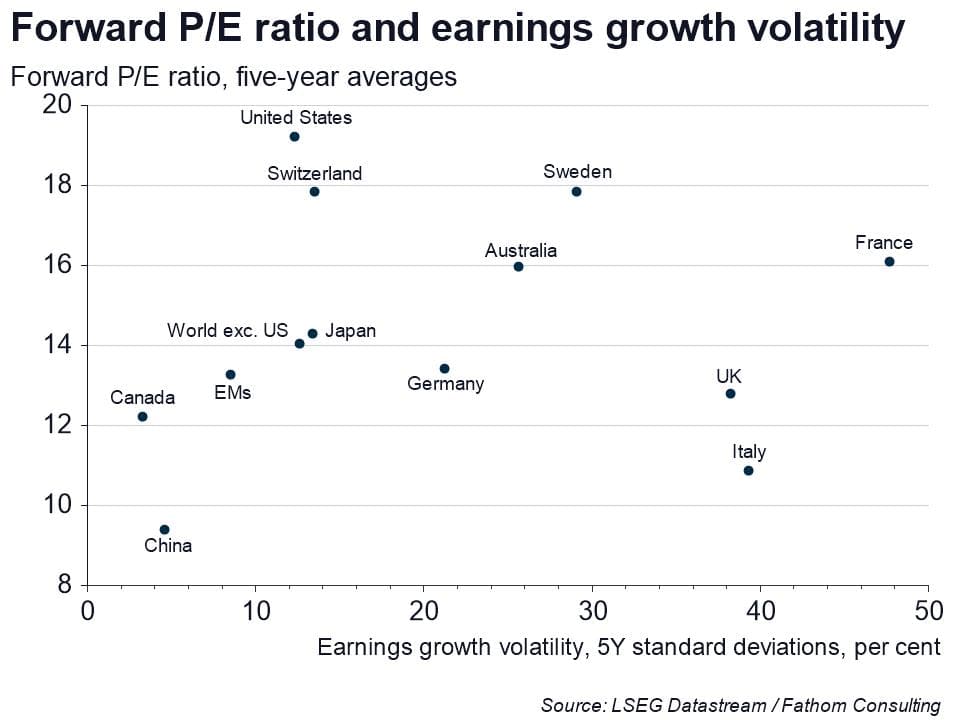

As wage inflation in the US continues to sink back to levels commensurate with a 2% inflation target, Fathom’s Global Outlook, Autumn 2023 singles out America as the major economy most likely to avoid a recession – indeed, in our central case it does just that. But does the US equities market reflect that outperformance? In short, it does; with rich valuations of US stocks reflecting this. As the chart below shows, the US market commanded the highest earnings multiple (forward price-earnings ratio) among major markets in the last calendar quarter, and that was not just down to positive sentiment. On the contrary, it mainly reflected the fact that even after a bad year, when rising costs were threatening profit margins, US corporate earnings remained high — because businesses succeeded in either passing on costs to consumers or tapping more and better-placed markets. When the volatility of US corporate earnings remains low even after such a challenging year, most investors would perceive the risk of throwing money into US equities as low.