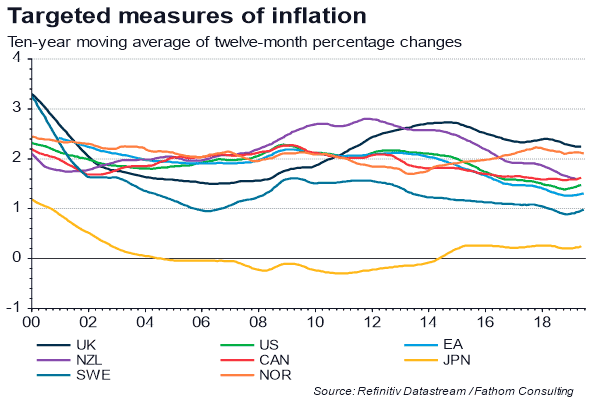

In this, Fathom’s first Viewpoint note, we invite Tony Yates, now working with us as a part-time consultant, to set out his views on the prospects for an increase in inflation targets — currently set at or close to 2% in most major economies. Tony, who worked as a Senior Advisor at the Bank of England, before moving to academia, including a position as Professor of Economics at the University of Birmingham, finds that there are sound theoretical arguments for moving the goalposts, and targeting a number somewhere north of 2%. In his view, the benefits of such a decisive move would far outweigh those of tinkering around the edges — for example by targeting a rate of 2% on average over time.

Unfortunately, Tony also concludes that such a change is unlikely to happen any time soon, in any of the major economies, with one possible exception, and that is the UK. The experience of Japan has led many to argue that an increase in the inflation target is unlikely to deliver higher inflation. That may be true, in and of itself, but Fathom’s view has always been that higher inflation can be achieved, if only policymakers are willing to be sufficiently bold, and that means using fiscal policy in tandem with monetary policy. A doubling of the inflation target, from 2% to 4%, that caused observed inflation rates to double would have profound distributional consequences. But it would also, in steady state, cause nominal interest rates to rise, restoring the process of creative destruction that is central to the efficient functioning of a market economy, and raising long-run growth in productivity.