A sideways look at economics

In a rare display of bipartisan unity, the US President and members of Congress from both parties appeared yesterday in Washington DC (1.30pm EDT) to address what they referred to as “a critical personal problem that has evolved into a corporate epidemic with adverse financial market implications: narcissism”. Speakers referred to “The impact of the CEO’s personal narcissism on non-GAAP earnings”, a research paper by four professors of accounting.

The paper focuses on the use being made by CEOs of the discretion to redefine the generally accepted accounting principles (GAAP) earnings, by excluding expenses or revenues that are not expected to recur in the future; and to publish these non-GAAP earnings in the annual report. The paper inquires whether narcissistic personality traits in CEOs are associated with an increased likelihood of using this discretion in an opportunistic way, in order to create a more positive appearance of their firm’s financial performance and (by association) of their own effectiveness as leaders. The authors find that CEOs who are prone to narcissism (a trait which is proxied by measuring the size and prominence of the CEO’s picture in the firm’s annual report – henceforth referred to as the ‘narcissism’ proxy), are indeed frequently using a non-GAAP figure that exceeds its GAAP counterpart; and that they arrive at that by aggressively excluding expenses from non-GAAP earnings.

“Most of us on Capitol Hill are appalled by managers’ inability to abstract from their personal tendencies and habits, jeopardising the health of our business ecosystem,” one Congress member stated. Another Congress member promised that they “…would task the Securities and Exchange Commission (SEC) to follow up from the paper and ascertain the impact of CEO narcissism on financial markets, and to propose ways to subdue it, if substantiated”. Intrigued by the press conference, I thought I would have a go at assessing the size of the problem myself — who knows, maybe someone from the SEC reads this blog and might afford me some fame (I hope this is not too narcissistic of me).

I am tackling this task with a factor investing approach:[1] can I exploit a corporate-related signal, in this case CEO narcissism, to create a tradeable strategy that generates high price returns which, moreover, are above what is fair for the intrinsic value of strategy? Luckily for me, the authors of the paper provide the narcissism proxies for a large sample of US public firm-years between 1994 and 2016. By matching their list with annual report items, I can measure the difference between non-GAAP earnings-per-share (EPS) and GAAP, i.e., actual, EPS. Then, I allocate firm-years into two portfolios: a ‘narcissism’ portfolio, which collects firm-years for which the difference between non-GAAP and GAAP EPS and the ‘narcissism’ proxy are in the top 30 percent of their distributions for the year; and a counterfactual, ‘self-effacing’ portfolio, which collects firm-years for which the difference between non-GAAP and GAAP EPS is in the top 30 percent of its annual distribution, but the ‘narcissism’ proxy is in the bottom 30 percent of its distribution for the year. Comparing the returns after the annual portfolio formations should show whether being a narcissistic CEO and acting accordingly pays off in crude, equity performance terms.

Surprise, surprise: it seems that it does. Within the examined period, the ‘narcissism’ portfolio ends almost two times higher than the ‘self-effacing’ portfolio — and almost five times higher than the S&P 500!

However, this does not necessarily suggest that we have a narcissistic-CEO-induced market problem — merely that successful firms tend to have vain CEOs. The problem exists only if the market falls for the narcissistic CEO’s “beatified” firm performance and pays more than is fair. In other words, I need to assess whether the prices attached to the ‘narcissism’ portfolio relative to the counterfactual are a fair compensation for the risk of the portfolio — or whether the market has overpriced. Evidence of market overpricing would substantiate Congress’s fears that narcissism poses a threat to the business ecosystem.

For each of the two portfolios and their difference (i.e., the hedge portfolio created by buying the ‘narcissism ‘and selling the ‘self-effacing’ portfolios), I regressed the excess monthly returns (Returne) on the Fama-French five risk factors: the excess return of the market portfolio (MKT), the small-minus-big factor (SMB), the high-minus-low factor (HML), the robust-minus-weak factor (RMW), and the conservative-minus-aggressive factor (CMA).[2], [3]

Returnie = αi+ β1MKT+β2SMB+β3HML+β4RMW+β5CMA+ εt

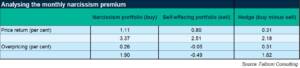

The constant,αi, effectively shows which portion of the average portfolio return is overpricing. The next table shows the returns and the overpricing, for each portfolio, the differences between the two portfolios and t-statistics, testing the null hypothesis for each figure directly above them.

‘Self-effacing’ CEO firms seem to command prices which are fair — overpricing is -0.05% and insignificant, essentially meaning that it is zero and that the monthly return is solely based on risk. On the other hand, ‘narcissism’ CEO firms seem to gain an unfair advantage, since 0.26% of their average return represents market overpricing. That is, the narcissistic CEO’s opportunistic reporting in financial statements has coerced, I dare to say, 0.31% of additional monthly price return from the equity market, relative to the financial statements signed off by a CEO who hardly looks in the mirror at all.

To rousing applause, Senator Ann T. Porkbarrel concluded yesterday’s press conference by asserting: “We should act quickly to ban the use of CEO photos on annual reports, to limit the instances of satisfaction that a narcissist could get.” The Congresswoman reluctantly added, “… if a detrimental impact of CEO narcissism is substantiated.”

So, if you work for the SEC, or are a US Congressman or -woman, or know someone with these job titles, kindly take note of my findings: CEO narcissism does indeed contribute to expensive investment (mis)allocation. For the love of God, do curb CEO photo opportunities; but do not question the discretion they have been afforded to report business developments and choices as they wish.

Today is April Fool’s Day. However, the “The impact of the CEO’s personal narcissism on non-GAAP earnings” paper and the description of what the authors do and find, as well as all sources cited in the footnotes are real! The portfolio strategies are my ideas but are not truthfully tested – to date, at least. The portfolios returns and asset pricing results are true, however: they come from a paper I co-authored with Ahmed Abdalla from Monash University, whereby portfolios are formed based not on CEO narcissism but on corporate-level earnings cyclicalities in aggregate investment and consumption.

[1]Leonard Zacks’s edited “The handbook of equity market anomalies: translating market inefficiencies into effective investment strategies” offers a review of the factor investing approach in Chapter 1.

[2] The Fama-French factors are made available by Professor French here.

[3] Excess returns are estimated by subtracting the one-month T-bill rate, also available in Professor French’s webpage.