A sideways look at economics

Many readers will have kicked off 2019 with an optimistic New Year’s resolution, whether that be dry January, more exercise or a healthier diet. Now that we’re halfway through the first month of the year, how many of those resolutions have already fallen by the wayside? After all, we’re approaching ‘Blue Monday’ — by which time most of us will have apparently failed to keep up our NY resolutions — conspiring with other factors, such as a maximum post-Christmas squeeze on personal finances, to make the “most depressing day of the year”, according to an (admittedly dubious) scientific formula.

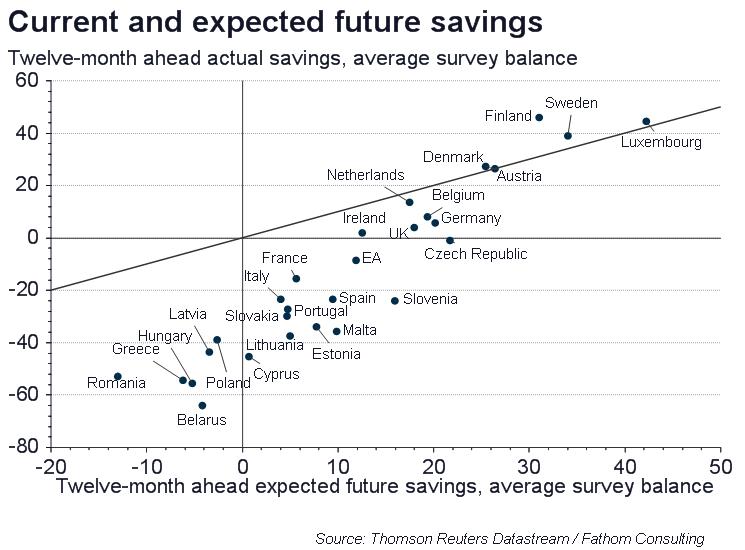

With millions of households in the UK reporting that they have no savings at all, it’s unsurprising that one of the most common resolutions is to spend less and save more. The European Commission’s monthly consumer survey includes questions that ask both about current savings and expected savings over the next twelve months. Interestingly, on average over the whole sample, respondents in most countries systematically expect to save substantially more over the coming months than they manage to achieve in practice — shown in the chart below by countries located below the 45° line. In fact, excessive optimism regarding personal savings in this survey is a year-round phenomenon and not limited to New Year’s resolutions.[1] Even when controlling for people’s expectations about changes to their personal or the general economic situation, survey respondents still expect to significantly improve their savings each year.[2]

Ambition is great, whether it’s to try a new diet, exercise or save money — but only if it actually leads to a positive change in behaviour. But the consistently higher expectation of future savings relative to current savings suggests that, for household savings, this isn’t the case. And it’s unlikely that other lifestyle-related resolutions consistently lead to outstanding improvement in well-being. It’s somewhat puzzling that people are so continually hopeful about their future savings, even after being proven wrong again and again. Surely, there must come a point where having positive expectations no longer serves a benefit. Does it make sense to attempt a new fad diet each year, when the necessity of repeatedly embarking on such diets suggests that they haven’t worked in the past?

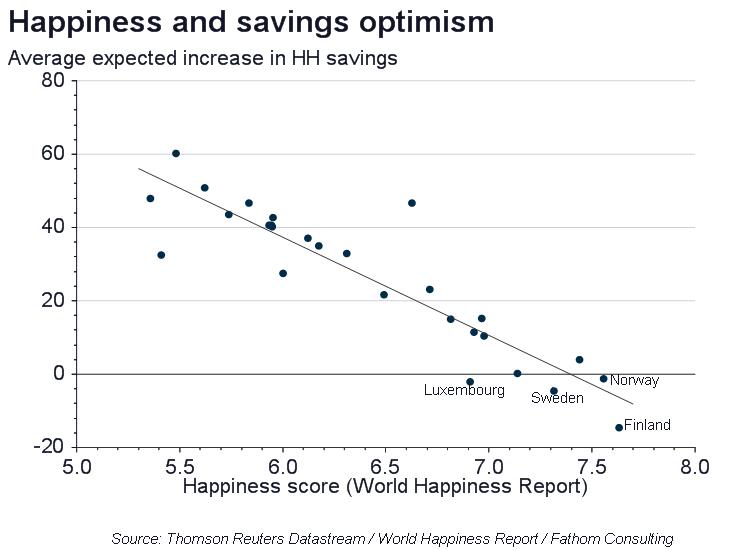

Notable in the chart above are the differences in savings expectations across countries — Finns, for instance, continually expect their savings to fall (and thus end up saving more than they had expected). Perhaps the long and grim Nordic winters have made the Finns and Swedes more downbeat and pessimistic than their European compatriots. However, plotting expected increases in savings against the national happiness score from the latest World Happiness Report suggests that countries that intend to save less in future tend to be happier.

While the causality of this relationship is unclear, it’s likely that happier people have less need to improve their savings, and thus don’t intend to. On the other hand, those with lower optimism about their savings might simply be realists rather than pessimists and better at managing their expectations. The lesson to be learned here may be that excessive and persistent optimism about something which is unlikely to change isn’t the way to achieve happiness and self-improvement. Low expectations leave more room for those expectations to be exceeded. While I applaud any reader’s efforts to approach the new year with motivation, perhaps it’s time to end the perennial dismay of finding that, yet again, that ambitiously bought gym membership has gone largely unused, or that this month’s paycheque has gone towards smashed avocado and artisanal coffee rather than the mortgage down payment. Without any resolutions to break, ‘Blue Monday’ might be slightly less blue. After all, aren’t afternoons such as today better spent with a pint at the pub, rather than suffering in solitude on a treadmill?

[1] A seasonal dummy variable for January is insignificant in a panel regression of a series of expected savings increases (expected future saving minus current saving).

[2] Adjusted savings expectations are obtained by saving the country-fixed effects (plus the constant) in a FE panel regression of expected improvement in personal financial situation on expected increase in savings. The results are immaterially changed in a regression that also includes expectations of the general economic environment (i.e. saving into recessions).