A sideways look at economics

The ongoing pandemic is both an economic and a health crisis. Fear and lockdowns have had a devastating impact on economic activity. Meanwhile, the novel coronavirus has resulted in at least two million fatalities. When it comes to the epidemiological response, political leaders often say that they are following the science. Who would argue with that? However, when it comes to the economic response, few would claim to be doing the same. Cynics out there might argue that economics is to science as Keeping up with the Kardashians is to art. But when it comes to fighting this crisis, economists were much quicker to throw away previous orthodoxies than epidemiologists, and have so far maintained unusual consensus on the appropriate response.

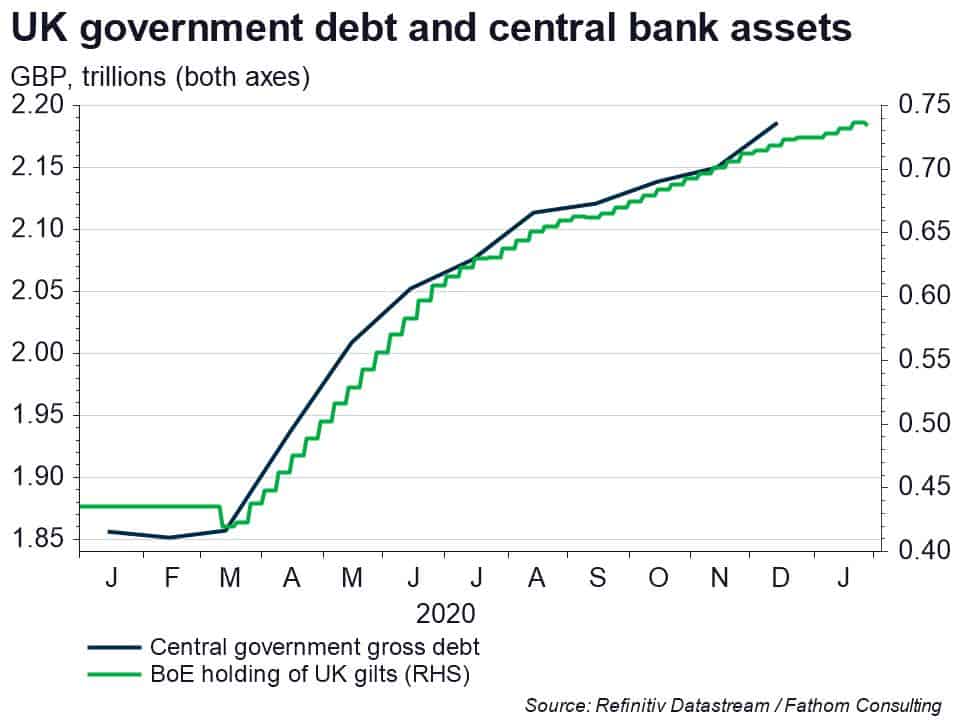

Scroll back one year, economists generally agreed that policymakers were running low on ammo and would struggle to effectively counter the next recession. The received wisdom was that fiscal and monetary policy were maxed out, by high public debt ratios and record low interest rates respectively. However, as the threat of the coronavirus became clear, these views went out of the window. Low interest rates quickly became seen as a reason why public debt ratios could rise ever higher. By mid-March, the US had recorded fewer than 100 COVID-19 deaths and under 5000 official cases. Nonetheless, the Federal Reserve cut its interest rate to zero and relaunched its QE programme. Soon after, a famously partisan US Congress approved a record fiscal support package — unanimously. On the economics, the consensus was quickly revised: with long-term interest rates below expected nominal GDP growth (r<g), borrow as much as required to keep businesses and households ‘whole’ as the scientists worked on therapeutics and vaccines. In some cases, developed market central banks engaged in asset purchases whose sums were curiously close to the amount of debt that their treasury counterparts were issuing. This flirtation with a previous bogeyman – monetary financing – was met with eerie silence.

On the scientific front, public health officials had their own crisis playbook. In February, the official advice from SAGE was that it ‘will not be possible’ to stop the spread of the virus and that trying to do so would be ‘a waste of public health resources’. Across the pond, the US Surgeon General was warning Americans that the flu posed a bigger danger to them than COVID-19. As the public decided to start wearing masks, experts warned against. The effort was pointless, we were told, as masks were only useful if worn by infected individuals. Officials advised that individuals with symptoms should isolate, but the rest of society could continue pretty much as normal, save for more regular handwashing. Certain politicians were worried about travellers bringing the virus to new locations. But health experts said border closures were futile. Not only would they come with huge costs but they would only delay the spread of the virus by weeks. By March, as it was becoming clear that the disease was widespread within its borders, the UK flirted with a policy of ‘herd immunity’ that would shield elderly members of society while others in less acute risk groups contracted the virus, in an attempt to build resilience.

Scroll forward almost one year, and the economists (unusually) continue to sing from the same hymn sheet. Despite $7.5 trillion in direct fiscal support already enacted across the G20, the IMF has warned against any premature fiscal withdrawal, as this would risk a fragile global recovery. So far, an unprecedented slump has failed to turn into a protracted depression. Meanwhile, the epidemiologists have changed tack on some key questions. Today, comparing COVID-19 to the flu is the preserve of ‘covidiots’, and herculean efforts are dedicated to stopping the spread of the virus. Herd immunity, via infection, is not mentioned in polite society. Meanwhile, Dr Fauci now recommends that people should wear not one but two masks, and mandatory hotel quarantines for foreign arrivals seem to be gaining favour, seen as a necessary price to pay in order to avoid mutant strains as vaccinations ramp up.

So have the economists had a better pandemic than the epidemiologists? Perhaps. It seems that the recent experience of the Great Financial Crisis, which was followed by a sluggish and protracted recovery, had left its mark. The lesson was that when it came to a crisis, there were risks in being too feeble as well as in being too bold. To be clear, the evolution in thinking was in scale, rather than substance. Meanwhile, the prescribed response (borrowing a lot of money to give to people) was not one that was ever going to garner much pushback amid potentially unprecedented joblessness.

By contrast, epidemiologists hadn’t faced a global pandemic for a century.[1] Their plans crumbled when met with reality. Allowing the virus to circulate among younger people while protecting the vulnerable made sense in theory, but politicians struggled to continue to justify the policy in the face of widespread public anger at high hospitalisations and deaths. Another issue was that many health advisors were not sure how far policies to prevent disease could be stretched with public consent. They can be forgiven for worrying about the feasibility of travel bans and the effective mandatory isolation of healthy individuals.

Looking forward, it seems that the crisis will have a lasting impact on both disciplines. Despite higher debt burdens, I reckon that future recessions are more likely to be met with more generous fiscal support than has historically been the norm. The cat is out of the bag when it comes to advanced economy government borrowing. It’s hard to see it being put it back in. Meanwhile, any future potential health crisis is likely to be met with a more immediate and stringent response. The available toolkit is wider than many health officials had previously assumed. Indeed, society’s relationship with disease may have undergone a permanent shift towards caution.

Whether these are positive developments remain to be seen. Though it may not be immediately obvious, there will be costs to increased government borrowing. Moreover, low interest rates today don’t guarantee low interest rates tomorrow. Likewise, there will be trade-offs when it comes to securing public health that may only become known once we are out of the teeth of the crisis; for example, closing schools may help to slow the spread today, but the negative impact from disruption to children’s education will only become fully clear over many years. As observers of the Kardashian clan’s love lives will know, going through a tough breakup can teach you lessons but doesn’t guarantee the success of your next relationship.

[1] The much more successful policy response among East Asian countries appears likely to be partly a consequence of their more recent experience with SARS