A sideways look at economics

One thing that many Remainers and Leavers have in common is that they want Britain to be more ‘global’, whatever that means. Naturally, they disagree about the path needed to get to this hallowed ground and indeed what a global Britain would look like, but both groups are sure they want it. But what does global Britain mean in an economic sense, how do we measure the UK’s openness, and how does it compare to its peers?

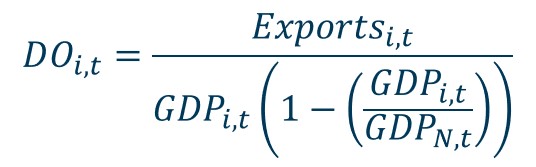

The answer to the first of these is somewhat subjective, since there are many ways to measure a country’s openness to trade. Many economists point to a country’s trade share — the sum of its exports and imports, divided by GDP — as a measure of its openness. However, as Arribas, Pérez and Tortosa-Ausina (2006)[1] point out, this method quickly runs into a large-country problem. The issue arises since large, resource-abundant economies typically produce more domestically and have less need to trade with the rest of the world. Instead, the authors propose scaling a country’s export share of GDP by its share of world output such that the degree of openness (DOi,t) of country i in time t is given by:

According to this metric, the UK is the EU country least open to trade, narrowly behind the likes of France and Italy. Accordingly, it’s hard to argue that EU membership is the limiting factor on the UK’s openness to trade, especially when compared to the likes of Ireland, a country for whom the total value of exports exceeds GDP. However, given the size of its economy, the UK is far more open to trade than countries such as China, India and the United States.

Roughly 200 years ago David Ricardo hypothesised that trade between economies works most efficiently when each country specialises in the goods and services that they are relatively better at producing — a theory subsequently known as Comparative Advantage. This implies that, all else equal, greater trade and specialisation should result in higher levels of productivity.

Based upon these ideas, Fathom’s proprietary RiCArdo tool[2] utilises detailed trade data to uncover an economy’s ‘revealed comparative advantage’ (i.e. which sectors an economy appears to be good at). The tool reveals (unsurprisingly) that the UK’s financial services, insurance and pension services sectors are among the strongest in the world. But, RiCArdo allows us to go further than that. By comparing each country’s revealed specialisms, we can see where the most efficient trading relationships could be struck. According to the tool, Asian economies such as China, South Korea and Indonesia should all be prime targets for trade deals since their specialities, as implied by their RCAs, are the least similar to the UK’s. By contrast, the similarities between the US and UK economies suggest that a transatlantic trade deal might be less beneficial than many believe. Interestingly, EU countries make up six of the top ten most suitable trading partners by RCA.

Of course, the ultimate benefits of trade deals don’t just depend on the differences in specialisms but also on factors such as the relative size of the target market and the distance between partner countries. This is one clear source of disagreement between how Remainers and Leavers view a global Britain — while Leavers highlight that EU economies only represent about 16% of global GDP, Remainers stress the importance of the trading bloc’s proximity. Of course, regardless of the outcome of Brexit, the problem that proponents of global Britain face is that the UK is highly specialised in services. While the proximity of trading partners is less concerning for this sector, many countries are reluctant to include services within trade deals. In or out, policymakers must find a way to convince trading partners to relax restrictions on services trade if they want to make global Britain a success.

[1] Ivan Arribas, Francisco Pérez & Emili Tortosa-Ausina, ‘Measuring International Economic Integration: Theory and Evidence of Globalization’ (2006).

[2] To find out more about Fathom’s RiCArdo tool and how it could help you, or to subscribe to the database, please contact us: enquiries@fathom-consulting.com.