A sideways look at economics

Investing by theme is in vogue these days and personally I think it’s great. Worried about climate change? Invest in a green fund. Think technology is the future? Go tech. There are a whole host of themes that investors can gain access to these days, via ETFs or fund managers. You can even get exposure to the marijuana industry if you think the prospects for the budding industry are good (or if you just like smoking pot). But despite the newfound abundance, there are some investment themes and demographic niches that are still underserved by the creators of these themed funds. In this blog post I consider one such demographic: people who enjoy bottomless brunches.

A key characteristic of this group is that they enjoy bottomless brunches. That’s right. But there’s a lot more to them than that. They could be from any age cohort, but overwhelmingly they are millennials, which by the way, has become a very popular investment theme in its own right. More and more funds that aim to benefit from the consumer spending patterns of this group are popping up. Millennials might all be living in their parents’ basement, but this is a growing demographic and their economic clout will continue to rise, which probably explains why some of these funds have been doing rather well recently. To give you a flavour of what this is all about, according to a recent article in the Financial Times, the largest holding in one particular millennial-focused fund is Adidas, due to its partnership with Yeezy, the clothing and sneaker line of Kanye West.

Think about that for a minute.

Companies actually want to be associated with Kanye West. And they are making money out of doing so! Fund managers take note. If I were to guess, I’d say that bottomless brunchers (henceforth called BBs) probably like Kanye West on balance; in fact, Kanye West could even be a BB himself.

As well as liking bottomless brunches, BBs are overwhelmingly urban. They typically have above-average income, and they like to spend it. They are aspirational, often irrational, particularly when it comes to their spending. They are loyal to particular brands, yet easily offended. They like to differentiate themselves from others, but quite often, because many so many others are trying to be different in the same way, they end up being the same. This is a powerful mix for companies: a large group of people who are willing to spend over the odds for things in the quest to be different, with large numbers of people flocking to their product if they get the marketing right.

Being a BB is nothing to be ashamed of. I like a bottomless brunch just as much as the next person and I exhibit some BB behaviour myself. I have a beard. I live and work in Shoreditch. And I pay £4 for a coffee on the way to work when I could make one for myself five minutes later in the office for one-tenth of the price. I am, basically, living the BB dream. So, I believe that qualifies me to introduce a list of concepts which could be included in a BB investment theme. If it were an index or an ETF, it would be the BBI (the Bottomless Brunchers Index), and it ought to include the following:

- Avocado: no item better summarises the BBs than avocado. Look at me I’m so cool with my smashed avocado on toast. Brunch wouldn’t be complete without it. Yes, eggs are needed too, but even my Mum eats eggs, so eggs aren’t original enough to go into the BBI.

- Pumpkin spice latte: main ingredient is pumpkins. But again, like eggs, this is in other stuff and on other occasions like during Halloween. Investing in pumpkins isn’t BB enough. Same thing for spice. Where better to get a latte and a pumpkin spice latte? Yes. Starbucks.

- Superdry: there are few things more BB than European people walking around wearing something with a name in English and Japanese, even though they don’t speak a word of Japanese and have probably never been to Japan.

- Uggs: quite useful if you’re herding reindeer, but I struggle to see their practical use for walking in the city. But BBs aren’t practical, remember. Brand owned by Decker.

- There’s no sweeter taste, the taste of success, than wearing a suit and standing in an overcrowded pub in the City after queuing for 20 minutes to buy a drink, than sipping on a Peroni. Owned by Asahi breweries.

- Nandos: the person who came up with the term ‘cheeky Nandos’ is a hero to all BBs. Unfortunately, the company isn’t publicly listed so cannot be included. OMG ☹

- Manchester United: the good people of Manchester, the true fans, would probably disagree. But Roy Keane knew that some of the fans that go to Old Trafford enjoy prawn sandwiches and bottomless brunches.

- Getting worked up by plastic straws. Yes, the environment is very important. And plastic straws are bad: they end up in the ocean and kill puppies. BBs might want to consider how their consumption patterns, and the resulting carbon emissions, are tipping the planet towards doom. But it’s more convenient to put all of the blame on plastic straws. Short plastic straw manufacturers, or long paper straw manufacturers. Couldn’t find any publicly listed straw manufacturers.

- While having a bottomless brunch, a BB will spend at least half his/her time using social media on their phones. Instagram is the platform of choice, but that’s owned by Facebook and my Dad even has an account. Not BB enough. He doesn’t have Snapchat.

- Michael Kors: if I was a woman I would love this. I’m not a woman.

- Anyone who doesn’t fantasise about cruising around on a jet ski while on holiday in Dubai is a loser. Two ways to trade this: buy the Dubai Financial Market General Index, or Yamaha, makers of jet skis.

- BBs need to have perfect abs. No better way to achieve that than by ordering something from My Protein, obvs. Owned by The Hut Group, which, sadly, is not publicly listed.

- Clapham: there are few things more BB than going to a good (but not top) university, getting a high 2:1, moving to London, getting a job as a consultant and living in Clapham for a few years as you prepare for a move to the suburbs. Buying property in this neighbourhood would be the instrument of choice.

- There are a whole host of health-related hobbies and activities that a BB can spend their money and time on: spinning, fishing and/or wearing a lot of lycra are good places to start.

- Nothing beats turning up for brunch with a yoga mat under your arm (and judging everybody else who doesn’t), wearing a pair of Lululemons (actually having been to yoga isn’t a prerequisite).

- Fevertree tonic: no point in having a gin and tonic with normal tonic.

- Wearing a smart watch: not necessary, but cool. Buy Fitbit.

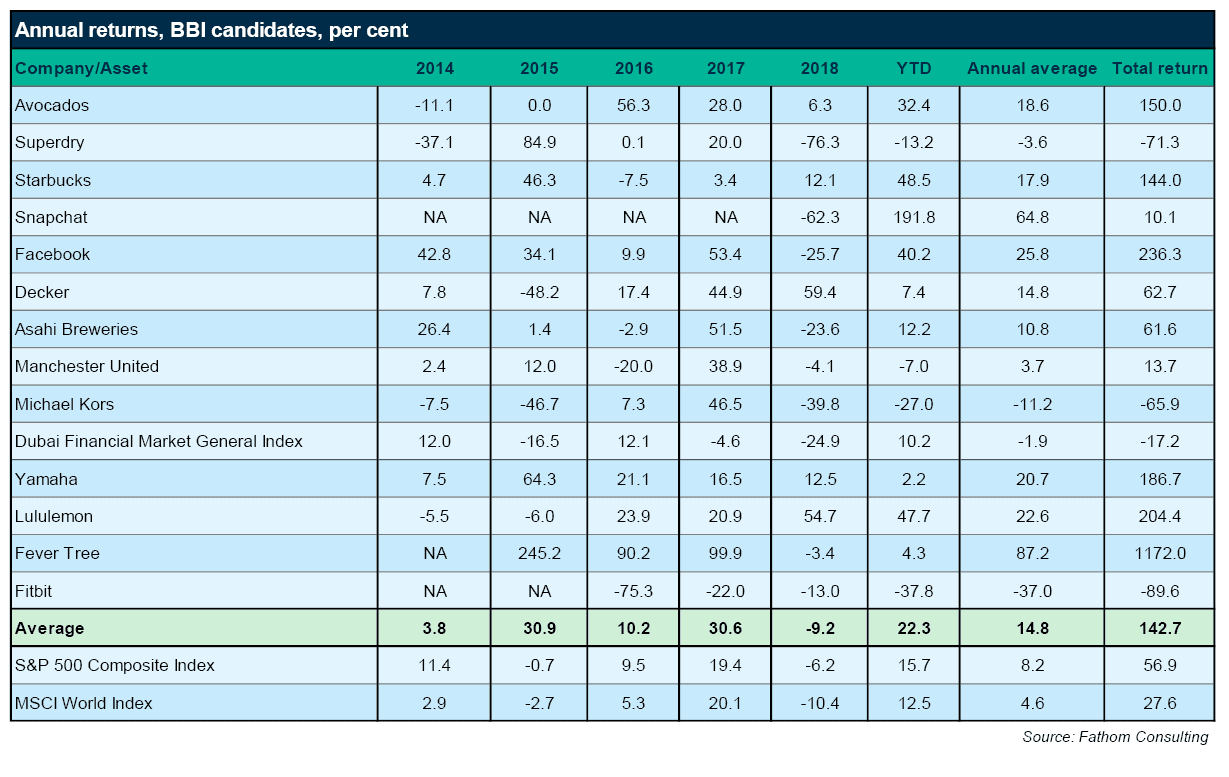

There are several other names that could be added to the list, but I have other things to do in my life (like check social media) so I’m going to leave this there. But to explore this idea, I’ve looked at the price returns on many of the various assets described above, over the last few years. As the table shows, returns on these assets have, on average outperformed the MSCI World Index by some distance. In fact, the average return of those assets is higher than the return on the MSCI World Index in each of the last six years.

To conclude, the return on things consumed by BBs is good, but there are risks involved with investing in this asset class. While BBs exhibit some brand loyalty, tastes can change quickly, and when things go out of fashion — like Superdry seems to have done — the outcome for investors can be disastrous. Other companies like Fitbit have struggled with competition, including Apple, who make smart watches themselves. The key to making money, really, is to identify the products and services that will become essential to the BB lifestyle. With the climate in peril, it won’t be long before BBs start expressing their concern about the environment in ways that go beyond getting angry at plastic straws. The bottomless brunch will probably increasingly include plant-based alternatives to meat; if that becomes widespread, firms producing meat alternatives might have to be added to the BBI.