A sideways look at economics

In this column last week my colleague Kevin wrote a strong argument in defence of doing nothing in certain situations. In that blog, he referenced a colleague who had told him, in jest, that his default position on many policy issues was dovish and to do nothing: for example, on climate change, Russia/Ukraine, and setting interest rates. That colleague, I admit, was me. In response, I’d like to make the case for doing something. Unfortunately for Kevin, he is currently on holiday and will not have a chance to comment on this column before it gets published, unlike I did on his last week. But anyway, here goes.

In his column Kevin made a pretty strong case for doing nothing in certain situations and cited examples where it could be argued that doing something made things worse (like him proactively investing in companies that he likes rather than just the S&P500). It is hard to disagree with that, although I would counter that the best examples of ‘doing something when doing nothing would have been better’ that come to my mind are examples of knee-jerk reactions. I think it is fair to say that knee-jerk reactions are bad. Of course there will be times when doing nothing is the best course of action. But too often people do nothing because a) they aren’t prepared to make a decision; or b) they are risk-averse because doing something involves a change, and since they don’t know for sure what effect that change will have, they prefer not to take the risk. Thinking about something ahead of time reduces this uncertainty, and increases the chances of an action being taken, all else equal. But even then, there is a tendency to stick to the status quo, even if change would rationally lead to a better outcome.

Holding losing stocks for too long:

There is a well-established literature which notes that investors, especially retail investors, tend to hold on to losing stocks for too long. In this example, doing something (i.e., selling) would have been better than doing nothing. The reasons for their reluctance to act are complex and relate to behavioural biases – these, and other ‘irrational’ behaviour are nicely explained in Daniel Kahneman’s Thinking Fast and Slow. To be fair, there is a flipside to this example: that investors also tend to sell winners too soon. In this case, they would be better doing nothing. The point I am highlighting is that supposedly rational people tend to make the same irrational mistakes, which can be explained by behavioural biases. Those mistakes often involve doing nothing.

The example of UK pension-saving decisions:

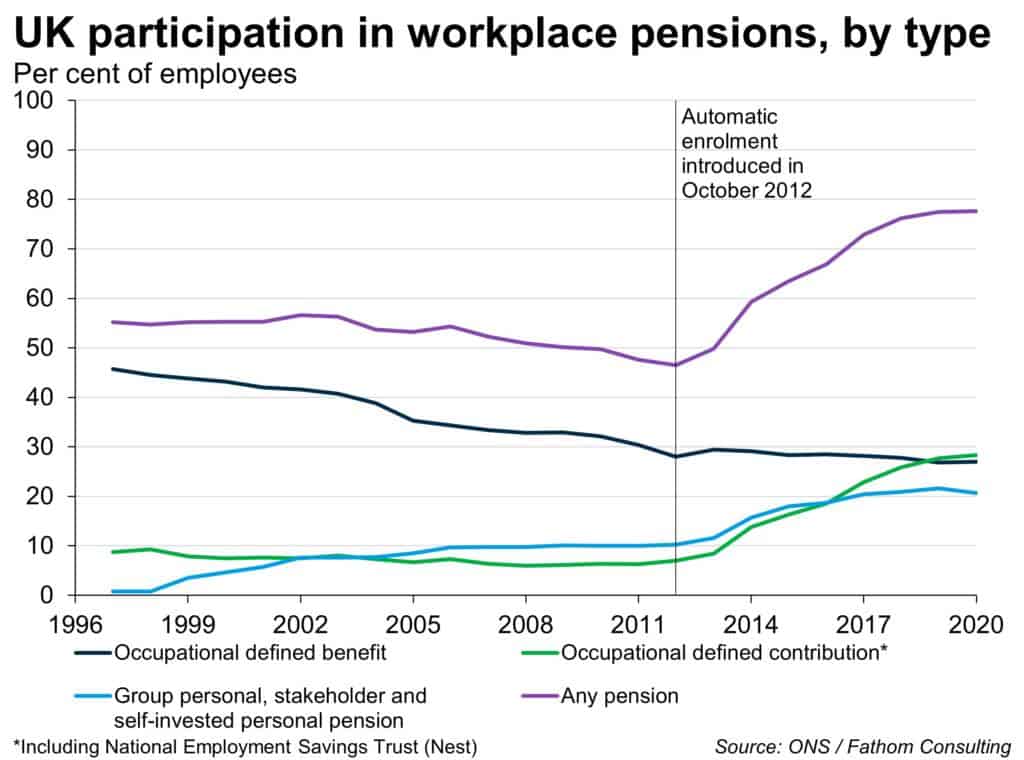

In 2012 the UK government introduced legislation whereby people would need to ‘opt out’ of contributing to their workplace pensions, rather than ‘opt in’. The government wanted people to contribute more to their pensions, and there is a significant benefit from doing so (employers match employees’ contributions up to 5% of their salary). Despite this benefit, and the importance of having a solid income in retirement, many people chose not to contribute to their pension when the default position was opted out and opting in required doing something. There may be a rational reason not to contribute today (e.g., if you associate a lot more value to having money today than having money in future). Nevertheless, the simple legislative change to a different default position has increased pension contributions significantly (see below). Whatever you think of this policy and whenever you prefer to make use of your money, this shows that people are far more likely to do nothing than to do something, regardless of what is right.

One theory why people tend to do nothing is the so-called status quo bias, in which a preference for the current state of affairs is displayed. Nobel prize-winning behavioural economists and psychologists such as Kahneman and Richard Thaler (whose nudge theory underpinned the UK government’s decision to switch pensions to ‘opt out’ schemes) have carried out experiments which illustrate this bias. They showed that people were consistently more likely to do nothing if doing nothing corresponded with the status quo.

My personal view is that this tendency helps to explain many of the world’s problems: climate change and inequality are the two biggest that come to mind. It fosters herd mentality among investors. It increases tribalism in politics. There are a few reasons we generally don’t like to change, and here is my take on why: the need to explain an action. We have busy lives, are subject to so much information, that we naturally cannot have fully formed reasons to explain every action. People, rightly, may be worried about being shown up in their arguments for making that change or proposing a change; to avoid such a scenario, most people do nothing. Consequently, if we are actually going to do something a much bigger effort is required, there is a much higher threshold to cross. The easiest course of action is to carry on with what we have been doing, to continue to follow the people we trust, and not to think about things too much. I do this myself, no doubt, but I am aware that this creates a bias towards doing nothing, even when that is not the right thing to do.

Donald Trump’s trade tariffs on China:

These are an interesting example. I remember the shock among the establishment (both left and right) when he introduced them. Part of that was probably due to an instinctive establishment pushback against anything that Trump proposed. But I also think that the opposition to those tariffs was explained by the status quo bias and preference for doing nothing. At the time I thought they were the right choice, and so did Fathom. This is one of the reasons I like working at Fathom: we are unafraid to make calls, to stick our necks out based on our analysis and convictions, even when this goes against the mainstream. Now, those tariffs have become the status quo and widely accepted. Removing them would require more effort, justification, than keeping them.

The response to Russia’s invasion of Ukraine:

It is also interesting how quickly the impossible can become possible. For me, this is an example of how often things should be done, but don’t get done. The swift and firm western policy response to Russia’s invasion of Ukraine is an example. It often takes a shock for people to take action, something that makes the new status quo intolerable. I have spent some time debating with myself what I would do if I were a Western military leader or politician: what sort of military assistance to provide Ukraine, whether to impose a no-fly zone, how to avoid confrontation with a nuclear-armed autocrat. Despite all my thought, the answer is that I simply do not know. I take solace in the fact that such decisions are beyond my pay grade and that I don’t have access to the information and resources to make a truly informed decision, unlike our policymakers. In this instance I do not say do nothing, or do something (although I did to Kevin to wind him up): I simply hold my hands up and say, “I don’t know what to do.”

That is not my usual response; there are many things, key policies, on which I do have an opinion. In fact, I get paid to have an opinion and, mostly, I feel I have the knowledge and have done the research to qualify me to make that opinion.

At the end of the day, I think Kevin and I agree on many policies – perhaps even as much as 90% of the time, even if we spend 90% of our time talking about the 10% of things we disagree on. And while we might not always agree on what we think should be done, our clients are often most interested in what will be done and what effect that will have. On this, we agree even more.

Other blogs by this author:

The cleaner wrasse, the economist and the ESG investor

A glimpse behind the scenes

If football comes home, will GDP come home too?

It’s time to talk about breastfeeding

The destination or the journey?