A sideways look at economics

Magic, according to the Collins Dictionary, is the power to use supernatural forces to make impossible things happen. Well-known authorities on the issue such as Hermione Granger,[1] assert that casting a magic spell successfully requires not only saying the right words in the right order but also enunciating them correctly, with the correct emphasis: “It’s not wingardiam leviosa, it’s wingardiam leviosa”. Others such as Ged, the principal character in the late Ursula le Guin’s Earthsea series, maintain that magic is the sparing and judicious use of true names for things and people, a form of language in which only dragons can lie: the rest of us are committed to truth when using that language, and it is truth that changes things. A wizard who states something in the true speech ensures, by doing so, that the thing stated must be true: by saying the words, you make it so.

A previous TFiF drew attention to the difference between real and nominal concepts, and to the supposed role of names in influencing real outcomes. This, if you like, is a kind of magic, for economists — by doing something in the world of names, the nominal world, you can affect outcomes in the world of things, the real world. That’s not supposed to happen, except in an illusory, transitory fashion. In the terminology of le Guin, there are many clever people adept with trickery and illusion, which can be brilliant and spectacular, but you see through it pretty quickly. David Copperfield (the illusionist, not the Dickens character) didn’t really make the Eiffel Tower disappear or whatever, he just made it seem to disappear. You can see it’s not the real thing, not deep magic but just an illusion.

Not the supply side, just the demand side.

I propose this: magic is the ability (conferred by supernatural powers or otherwise) to change the real world simply by using the right words at the right time in the right order.

If we accept that as a definition, then is this an example of magic, or illusion?

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Mario Draghi, 26 July 2012

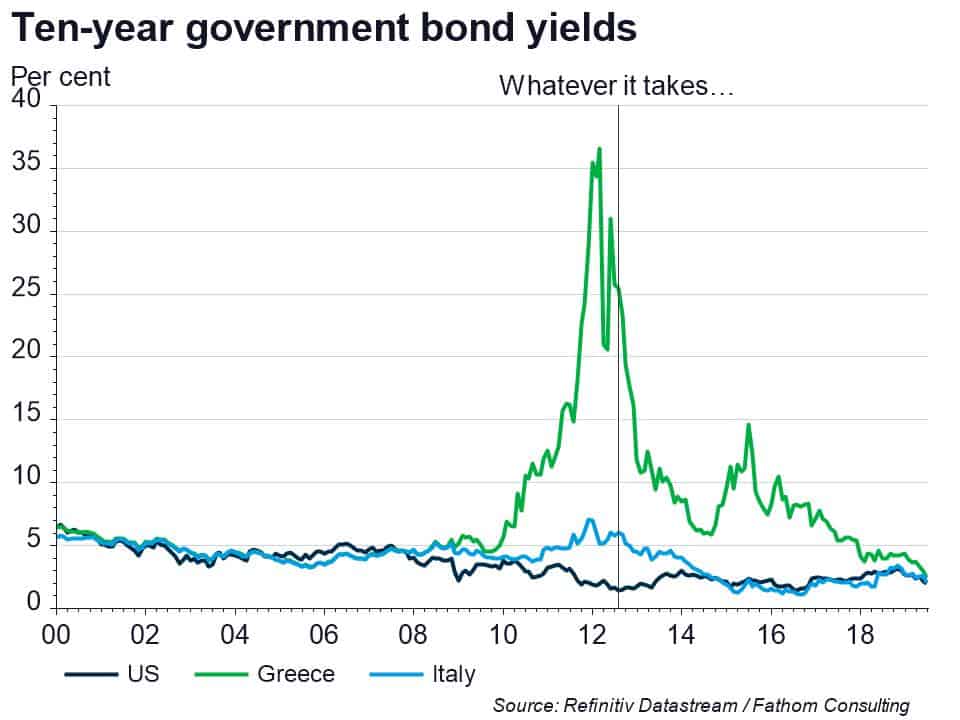

Those words, in that order, spoken by that person at that time appeared to change the world — and the illusion, if that’s what it is, has persisted until now. It has persisted for so long that it’s starting to look like the real thing. Is Draghi a magician, then, speaking a deep truth and changing the world? Or is he a very skilled illusionist, creating a beautiful illusion that has taken much longer than usual for us to see through? Or could Draghi be a dragon (that’s what his name means, after all: dragons), so to speak, capable of lying in the true speech?

By saying those words, Draghi was committing to something that was not in his or the ECB’s direct power to give. He was committing the politicians of the euro area to a contingent liability (subsequently partially honoured, with OMTs and other dips into the acronym soup of ECB policy instruments), a promise to buy the bulk of peripheral sovereign debt in the event that private investors declined to do so themselves. That promise was well beyond the purse that the ECB had at its disposal at the time (and, indeed, now), and the commitment it therefore implied for the finance ministries in countries like Germany and France went far beyond anything the politicians in charge of those ministries had ever previously agreed. Draghi committed them without their agreement and told us to believe him. It worked like magic: markets relaxed, and the contingent liability never fully materialised (at least not so far).

Because it was never fully honoured (as it wasn’t necessary), the commitment that Draghi made might have been illusory. Had they been truly tested, would the politicians have come through as Draghi promised they would? Who knows: the important thing is that investors believed Draghi, so the test never came. We still don’t know if it was real magic or just an illusion.

If it’s an illusion, it’s a strong one. Rewinding to the date of that speech, it seemed incredible in hindsight that the Greek government had for a time, ahead of the recession, been charged less to borrow than the US government. How could investors have been so stupid as to differentiate between Greece and the world’s largest economy and printer of the world’s principal reserve currency — in favour of Greece?

Scroll forward to today, and investors are within a hair’s breadth of doing the same thing again (the chart above shows local currency bonds, so that inference is not entirely safe, but the big picture holds). The Greek fiscal position has improved, and the Greek people have elected a government committed to economic reform, and the structure of the outstanding stock of government debt has improved. But, come on! Is it really plausible that lending to the Greek government is less risky than lending to the US government?

If markets really believe that the Eiffel Tower of Greek debt and historic fiscal profligacy has disappeared, then they are more stupid than even I would credit. No: the bet — at least in part — is that the ECB won’t allow a Greek default within the horizon of most investors, say around a year. That’s a more reasonable proposition. If it’s true, then the driver of the Greek government bond spread is really the relative outlook for growth and inflation in the euro area compared to the US. EA growth and inflation are both likely to be weaker over the coming year than in the US, so bond yields follow suit.

The key step is the assumption about the ECB, which is really at its heart an assumption about the behaviour of politicians in the euro area who are not directly controlled by the ECB. It’s an assumption that the magic spell cast by Draghi over those politicians (or the illusion cast over investors) will hold.

But will it? Will Lagarde have the same powers over markets and politicians as the wizardly Draghi? A great deal hangs on this question. It’s one thing to commit others to future actions in certain contingencies. But it’s quite another thing to have those words believed; those future actions credibly pre-committed. It’s one thing to say the words, another to make it so.

The famous dialogue between Hotspur and the Welsh wizard Owen Glendower in Henry IV, Part 1 makes this point much more eloquently:

GLENDOWER

I can call spirits from the vasty deep.

HOTSPUR

Why, so can I, or so can any man;

But will they come when you do call for them?

[1] Come on, you know who that is.