A sideways look at economics

I imagine most of us can think of a time when we delayed looking at our bank account, fearing what the sequence of digits might read compared to our last check. Maybe we have woken up feeling groggy, with a few gaps in our memory and the burgeoning effects of a night out. Or maybe we’ve enjoyed a day in town, paying cash for a haircut, tapping the debit card here and there in the shops and beeping the smartphone for a bite to eat too. And upon the eventual return home we probably felt fairly fulfilled and happy. However, reality sets in when the time comes to assess the damage to our finances and it’s clear that we’ve said our farewells to more than we expected. A revisit to the day is needed, to see where it all went wrong. So we begin working our way through each individual transaction until, inevitably, the penny drops and the ‘Ohh…that’s where it went’ moment occurs — I certainly have experienced that a few too many times!

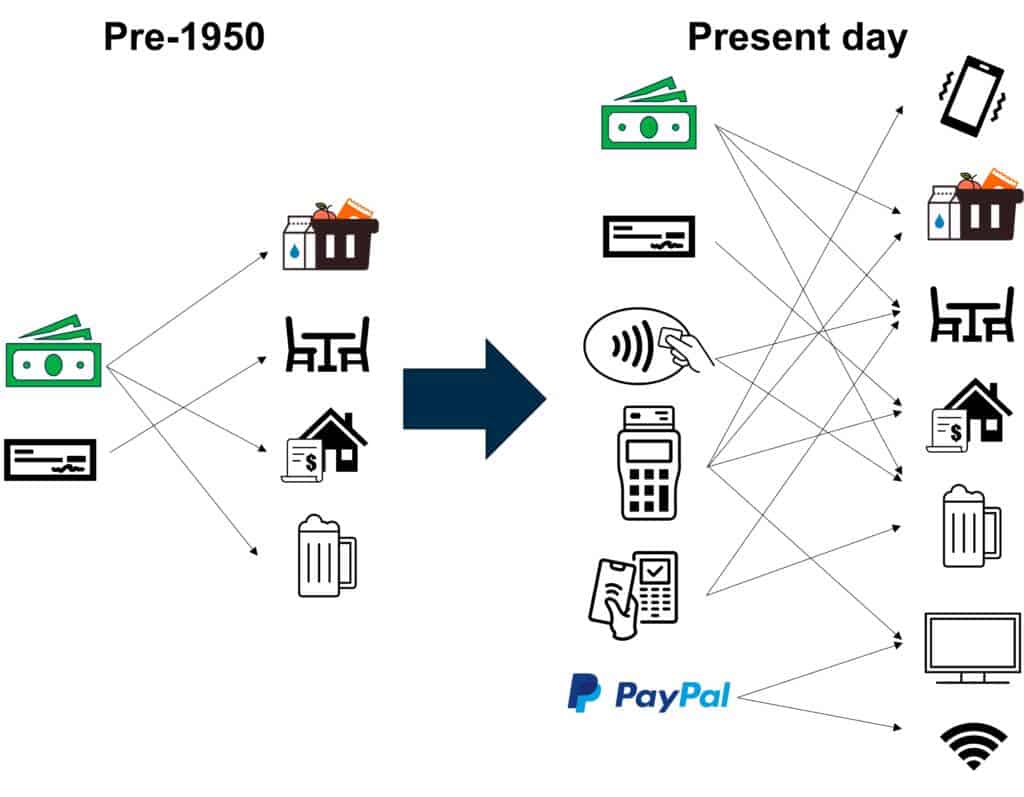

In an increasingly modernised and digitalised world we find a growing number of payment methods available, whether it be card, contactless, direct debit, electronic, or cold, hard cash, among others. Simultaneously, we are tempted by an ever broader variety of goods and services to consume. Naturally this makes it harder to track spending, as not only are we engaging in more transactions, but we’re also paying for things in an increasingly diverse number of ways — making our ‘mental consumption web’ transition to a more complex network, as in the simplification below.

Traditionally you would feel your money pouch getting lighter when you spent your coins, or your wallet would feel thinner as notes disappeared. Even before that, under the barter system goods would be exchanged based on subjective valuations, e.g., a cow for three magic beans. Recent evolutions in electronic and card payment methods represent a significant step forward, improving the accessibility of our savings and discretionary income. But there is a trade-off, as accompanying these advances is a loss in the physical element of an exchange.

Since the adoption of magnetic swipe cards in the late 20th century, and since chip-and-pin cards arrived in the UK in 2003, there has been a large shift to the use of card payments.[1] With this, the need to go to the bank, count out money or write cheques was largely removed and replaced by a system whereby all payments could be fulfilled by the same transaction process — insert card, check display, enter PIN and remove card. Nowadays, it’s just ‘tap and go!’ ― no PIN or need to concentrate at all. And, with the likes of Apple and Google Pay, we don’t even need to fish out a card from the multitude entombed in our wallets — we can pay with ease on our smartphones.

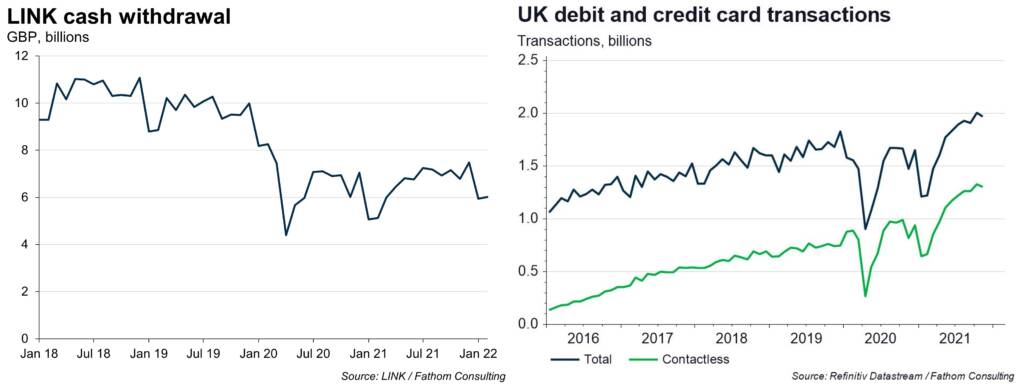

The pandemic has accelerated this move away from cash in the UK, as seen by the reduction of cash withdrawn from the UK’s largest ATM network, LINK. Meanwhile the number of debit and credit card transactions has only continued to rise. The integration of contactless payments has been accelerated by COVID, when cash was viewed as less hygienic, prompting contactless limits in the UK to rise to £100.

Contactless payment has made exchange less of a mental process, cutting out the physical action and ‘personal identity’ associated with a purchase.[2] Simultaneously, without a handover of cash, transactions have become less tangible. Now, the action of exchange is identical whether spending five pounds or a hundred, making the real size of a payment harder to visualise and conceive.

Most of the time our money does not physically come into our hands; salaries go straight to bank accounts: no cheque, no bundle of cash, no pay packet nor physical exchange, just a bit of code that records a transaction, digitally transferring money from one account to another. Then, as I’m sure you well know, we ourselves redistribute our respective earnings as we wish, with a couple of clicks and keypresses. With this detachment from our liquid assets and personal expenditure, if you neglect to regularly check your bank account and ‘guestimate’ how much you have left I’m sure you often find a surprise, and not normally a happy one. Combined, the loss of tangibility and the detachment from spending make keeping mental tabs on money flows harder. This can be even more demanding when trying to track changes to one’s week-to-week or month-to-month financial standing.

While the loss of money tangibility makes visualising a budget and transactions more difficult, electronic payment has facilitated a growing feature of today’s consumption — subscription payments. Limited leisure opportunities during the pandemic drew many to subscription services such as Netflix, Disney+, or others like Hello Fresh, Peloton and Craft Gin Club to fill previously occupied time. Just to give an idea of the scale of the change, last August, Barclays found that the average Brit spent £620 on sign-up services a year (£51.67 a month).[3] This represents a 12.3% increase in reported spending year on year and follows a massive 50.2% rise in spending on digital and subscription services between April 2019 and April 2020 — most likely as a direct response to lockdowns.[4]

Now, six to fourteen pounds a month for Netflix doesn’t seem like too much — not even two hours of minimum wage for a month of anytime consumption. However, adopting this approach can soon result in consumers being engulfed in a sea of subscriptions and their accompanying bills, which all add up. Consumers continue to pay for these subscriptions without any further action required to confirm the transactions — money is taken from our account with little or no knowledge of its departure. Thus, these payments can be all too easy to lose track of, amidst the cacophony of budgeting concerns bouncing around in our minds or within a lengthening bank statement ― even if you do look at it!

As we all know, people aren’t perfectly rational or always completely on the ball. In fact, in June 2021 Comparethemarket.com estimated that 21% of households were continuing to pay around £265 a year for subscriptions they had forgotten about or no longer used.[5] As such, many consumers have been drawn into the almost mindless spending habits a ‘subscription economy’ encourages. Another of Fathom’s recent blogs highlighted the significant opportunity cost these regular payments possess when we consider them across a longer time horizon, such that the famous Tesco slogan, ‘Every little helps’ really does carry some weight. Just think what you might do with an extra £265 in the bank account at the end of the year? This could be used to refresh a wardrobe, enjoy a day out, top up the rainy-day fund or just to help ease the pressure of higher gas bills.

And don’t even get me started on the increasingly common ‘Buy now, pay later’ schemes![6] With easy-to-access short-term borrowing, accompanied by a paucity of checks on credit worthiness and ability to pay, these schemes can only make it harder to track spending.

So, is it nigh impossible to keep a mental track of monetary flows, while bearing in mind existing wealth which may be spread across a multitude of assets and various saving schemes? Will budgeting apps such as Plum and Monzo, or a detailed Excel spreadsheet, become a near necessity for the average individual to maintain a handle on their wealth, and envision how far their finances can stretch?

All I know is that I will try to be more careful with those ‘little spends’ here and there, and to keep in mind all my other payments, whether it be electronic on Amazon, cash for the barbers, or card payments from the regular food shop to the ‘tap and go’ for the next pint.

[1] The history of payments in the UK http://news.bbc.co.uk/1/hi/business/7839823.stm

[2] By ‘personal identity’, in this context, I refer to the concept of a unique PIN number associated to your debit/credit card or the use of cash which you have directly earned or withdrawn from your bank.

[3] https://home.barclaycard/press-releases/2021/08/Subscription-Society-surges/

[4] https://home.barclaycard/press-releases/2020/8/Lockdown-fuels-Subscription-Society/

[5] https://www.comparethemarket.com/media-centre/news/unused-subscriptions/