A sideways look at economics

One of the many fallacies within our cognition is normalcy bias: refusing to plan for or react to a disaster that has never happened before. Sound familiar? There are some facets of the pandemic that could have been mitigated with prior planning and resistance to the forces of normalcy bias. But, with the benefit of hindsight, these have already been analysed to death. To me, the more worthwhile lessons from the pandemic come from the things that we forgot in the busyness of our normal lives. The most profound to me has been remembering the importance of connection. Connection with other people, friends, colleagues, the internet… Connections are fundamental to every aspect of our existence, from nature’s own communication network, the fungal networks that sit beneath our feet, to the man-made financial markets that consume my daily life. This blog post will try to convince you that when examining connected entities, it is difficult to examine the individual without reference to the whole.

Like many others, I have found solace during the last year in reading. But of the books I have read, none have shifted my perspective, blown my mind and made me think more deeply than ‘Entangled Life’ by Merlin Sheldrake. As a biologist, Sheldrake spends his time researching underground fungal networks. Yes, fungus…bear with me, because from these complex and vast networks emerge some phenomenally intelligent behaviours.

Before starting this book, my understanding of what constituted ‘fungi’ was limited to mushrooms and… er… mushrooms? But these are really just the tip of the fungal iceberg. Beneath the ground, fungi form a vast ecosystem referred to colloquially as the ‘wood-wide web’, connecting trees and plants in symbiotic relationships that resemble some of the advanced trading structures created by humans. Plants and trees specialise in capturing energy from the sun through photosynthesis, whilst fungi specialise in extracting mineral deposits from the soil. Intimate connections form between hyphae (the tips of the root-like structures in fungal networks) and the roots of plants and trees; and these connections act as a marketplace where exchange can occur.

What’s even more interesting is the way in which these interactions occur. It appears that there are ‘market prices’ for different nutrients and minerals, which fungal networks can control. In areas where certain nutrients and minerals are in abundance, the price the fungi charge for those minerals and nutrients falls. Even more phenomenal is that these fungi can transfer resources to the location in which they will receive the highest price, and arrange ‘buy now, pay later’ schemes. As both partners in the relationship have equal dependence on one another, and each can choose between partners rather like consumers can choose between suppliers, neither the plants nor the fungi can ‘enslave’ one another.[1]

The wisdom of fungi does not appear to be limited to roots beneath the ground but stretches to the insights they can pass on to humans though their fruits. Recent studies have found that psychedelic experiences can be effective in the treatment of a wide range of human problems.[2] Two of the most commonly-used psychedelics in these studies, LSD and psilocybin, are derived from fungi. Interestingly, researchers find that psychedelic experiences can connect regions of the brain that often do not communicate, disrupting negative thought patterns. Participants in the studies often report a movement from feelings of ‘separateness to interconnectedness’. In one study, almost 70% of participants rated their experiences as one of the top five most meaningful of their lives.[3]

In the same way that new connections in the brain can elicit some interesting outcomes, the recent surge in the price of GameStop has shown how connections between retail traders can have surprising impacts on the course of events. Two Oxford PhD students have attempted to quantify how the connections between individuals in the Wall Street Bets subreddit led to a social contagion in buying GameStop shares. They find that users who comment on one discussion involving a particular asset are around four times more likely to go on to start a new discussion about that asset in the future, showing a potential channel for social contagion. They also find that there are strong relationships between the sentiment expressed in submissions linked in this way, and that bearish sentiment appears to spread more than bullish sentiment[4].

Connections are not just important in social contagion, but also in the type of systemic contagion we can see in the global financial system. Contagion is undoubtedly a crucial aspect in understanding how shocks in one place can spread throughout the global financial system; the bursting of the sub-prime mortgage bubble in the US is a prime example of this. The difficulty with contagion is that these linkages can be difficult to measure accurately in real time and, in the words of Sheldrake “it is tempting to hide in small rooms built from quick answers”. The problem is complex because the important channels of transmission of shocks from one country to another can be more expectations than anything tangible like trade. Picking up how shocks in one country impact expectations in another country is not a trivial exercise. This is a question the team producing Fathom’s Financial Vulnerability Indicator (FVI) has wrestled with when considering how an increase in risk in one economy impacts the level of risk in another economy. Using some new statistical techniques, we arrange countries into a network based on their financial linkages. Countries at the centre of the financial network are those most exposed to any global shocks while those at the periphery are least exposed. This, together with a measure of global risk, quantifies how exposed an economy looks to risks in other countries.

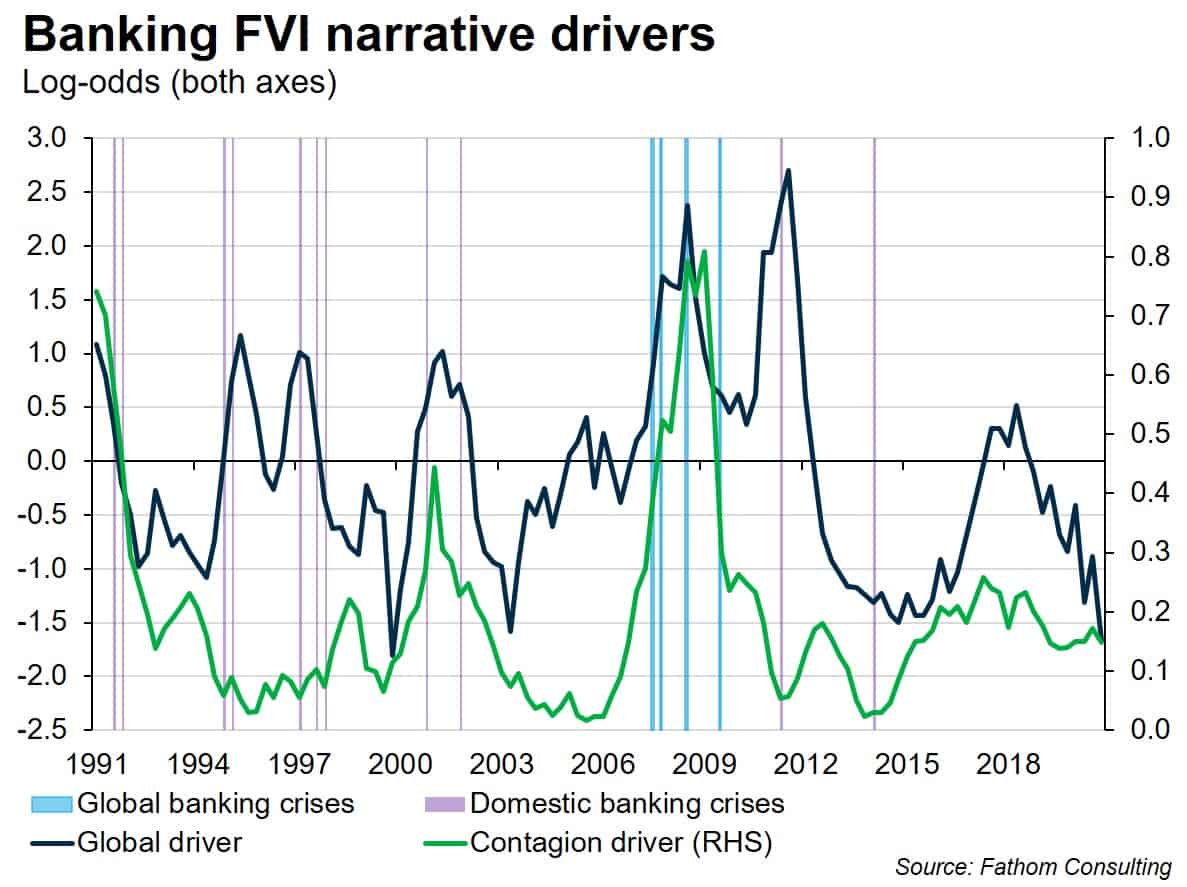

In our Banking FVI, we find that the banking crises that occur in periods when contagion is not elevated tend to be relatively domestic in nature. It is interesting to note that the Banking FVI’s global driver, representing the level of global risk, tends to peak around all of these crises[5]. By comparison, during the global banking crisis in 2007 and 2008, the level of global risk was also elevated but crucially that this was compounded by high levels of contagion. This supports the idea that to produce a global banking crisis, elevated global risk alone is not sufficient but must be compounded by propagation of an idiosyncratic shock by contagion, like the one seen in the US sub-prime mortgage market.

While some connections have weakened during the pandemic, others have strengthened. I personally have made the most of being able to work outside of London, living with my parents in the countryside. In big cities it is easy to become detached from the natural world and ungrounded. Some recent research[6] suggests that physical contact with the earth and its vast supply of electrons brings a range of health benefits. The one silver lining of the pandemic, amid all the pain and suffering it has caused, could be the way it makes us value our connections more and reconnect in some ways we have forgotten.

[1] https://science.sciencemag.org/content/333/6044/880

[2] https://www.frontiersin.org/articles/10.3389/fnins.2017.00539/full

[3] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5367557/

[4] https://www.inet.ox.ac.uk/files/Reddit_s_Self_Organised_Bull_Runs-11.pdf

[5] The only exception being Ukraine in 2014 which was related more to the war in Donbass

[6] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3265077/#:~:text=Earthing%20(or%20grounding)%20refers%20to,the%20ground%20into%20the%20body