- Banking crises typically result in L-shaped recessions with deflationary consequences, but can, on occasion, trigger currency crises that deliver high-inflation episodes

- Systemic banking crises (i.e., those occurring simultaneously across countries) typically result in more severe impacts on economic growth than idiosyncratic (i.e., isolated) episodes

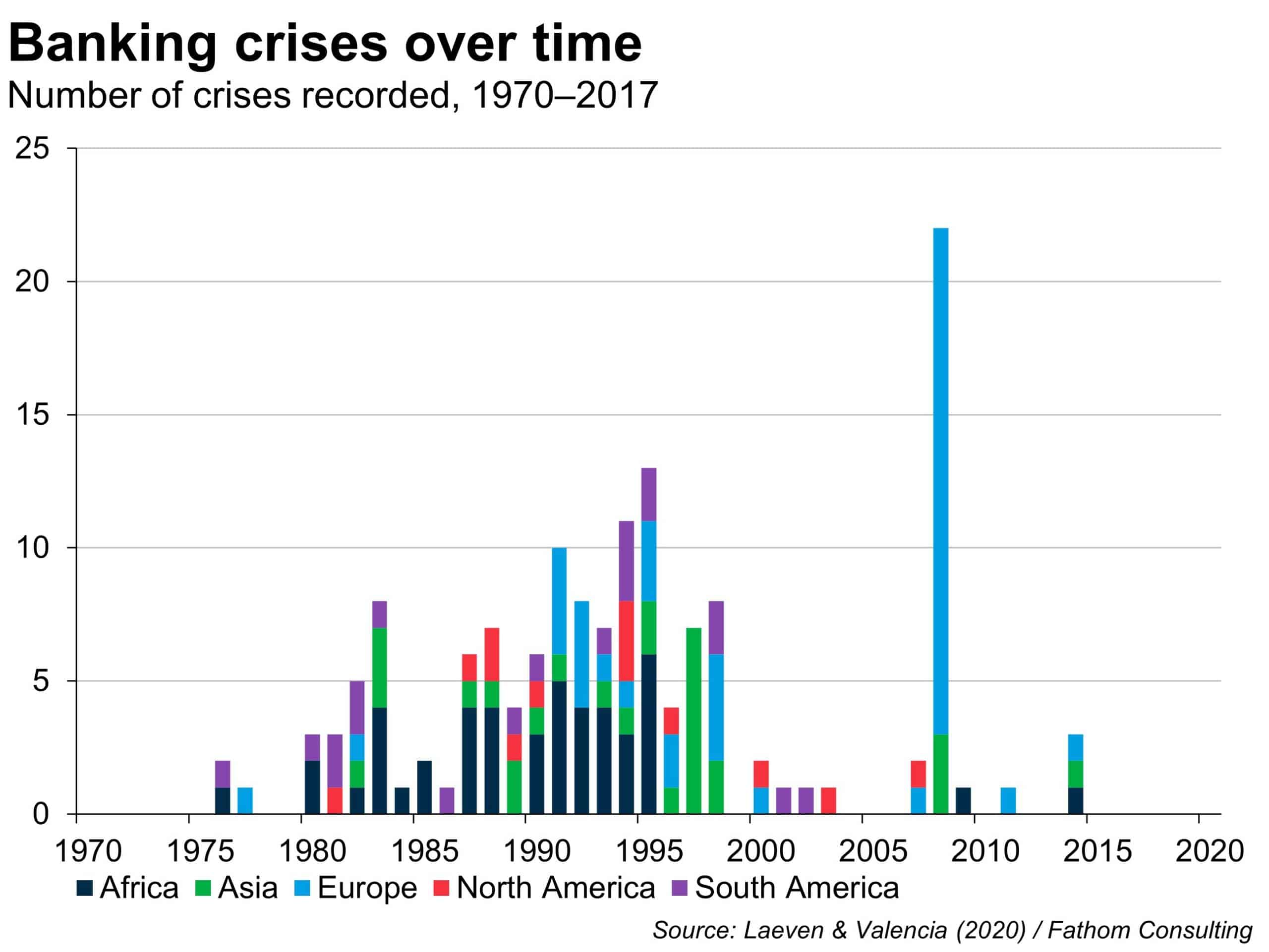

- Two systemic banking crises have occurred over the past 25 years — exposure to these explains a large proportion of why Europe and Asia appear to suffer more during banking crises

- Systemic risks are a product of excesses and contagion effects — on this basis, Europe and Oceania currently look concerning

[Please click below to read full note.]