High inflation and rising interest rates remained the leading topics in economic circles in the last three months, along with continued discourse about the growth of AI, the extent of China’s recovery, and an evident need for climate action ahead of COP28 this year. Fathom’s research has covered all these subjects in depth, and more. Here we’ve put together a recap of our Top 10 Fathom research pieces from 2023 Q2, based on the level of engagement from our clients.

Most read:

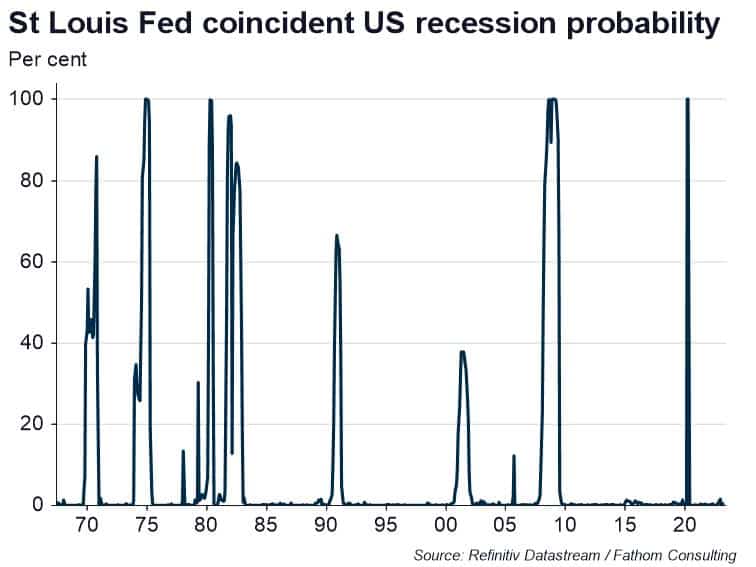

Recession Watch: sunny mood in markets

“The S&P 500 was more than 20% off its cyclical lows during trading on Monday, buoyed up by easing US recession fears and increasing expectation of a Fed ‘pause’, combined with technological optimism about the possible benefits from AI. Whether this is a bear market rally or a new bull market, it is too early to tell. The outlook for inflation and all its associated implications for Federal Reserve policy will continue to prove critical, as they have done for several quarters now.”

Kevin Loane, 7 June 2023

[Please click below to read the full note.]