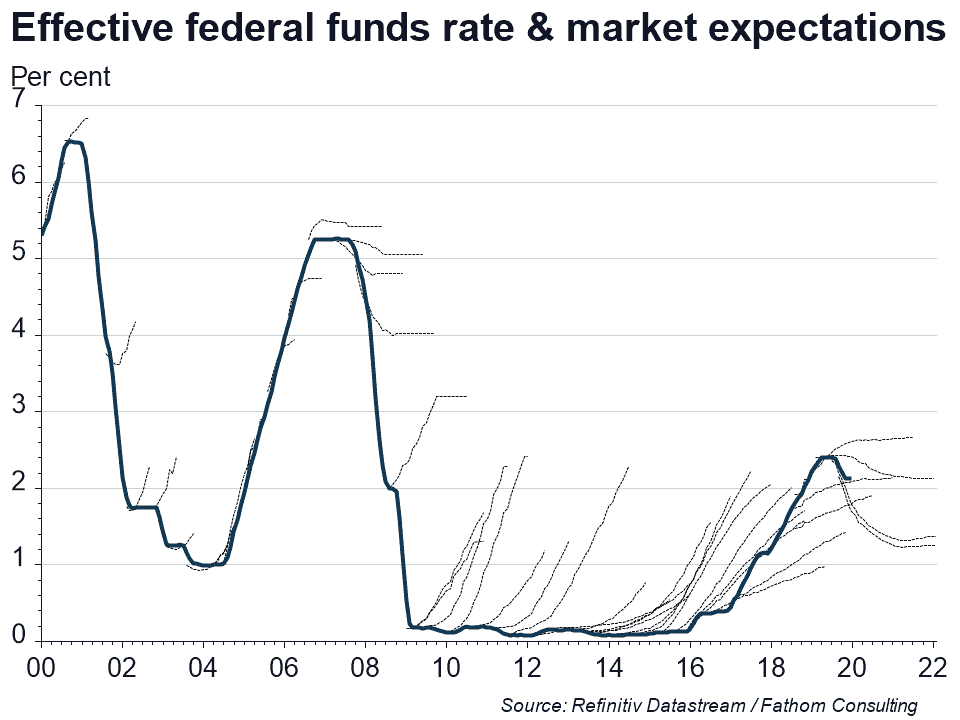

Over the last quarter, money markets, for once, correctly called the next move in the Fed funds rate: downwards. That bearish mood among investors reflected concerns about a trade-related global slowdown, and is itself reflected in sharply falling bond yields, surprising many including Fathom. But the bearishness in markets is probably overdone. In our central forecast, weak trade does not herald a global recession. Instead it echoes a pause in global growth, particularly pronounced in countries that are highly sensitive...

Please login to view this content

Lost your password?Not a research client? Click here to request access to notes.