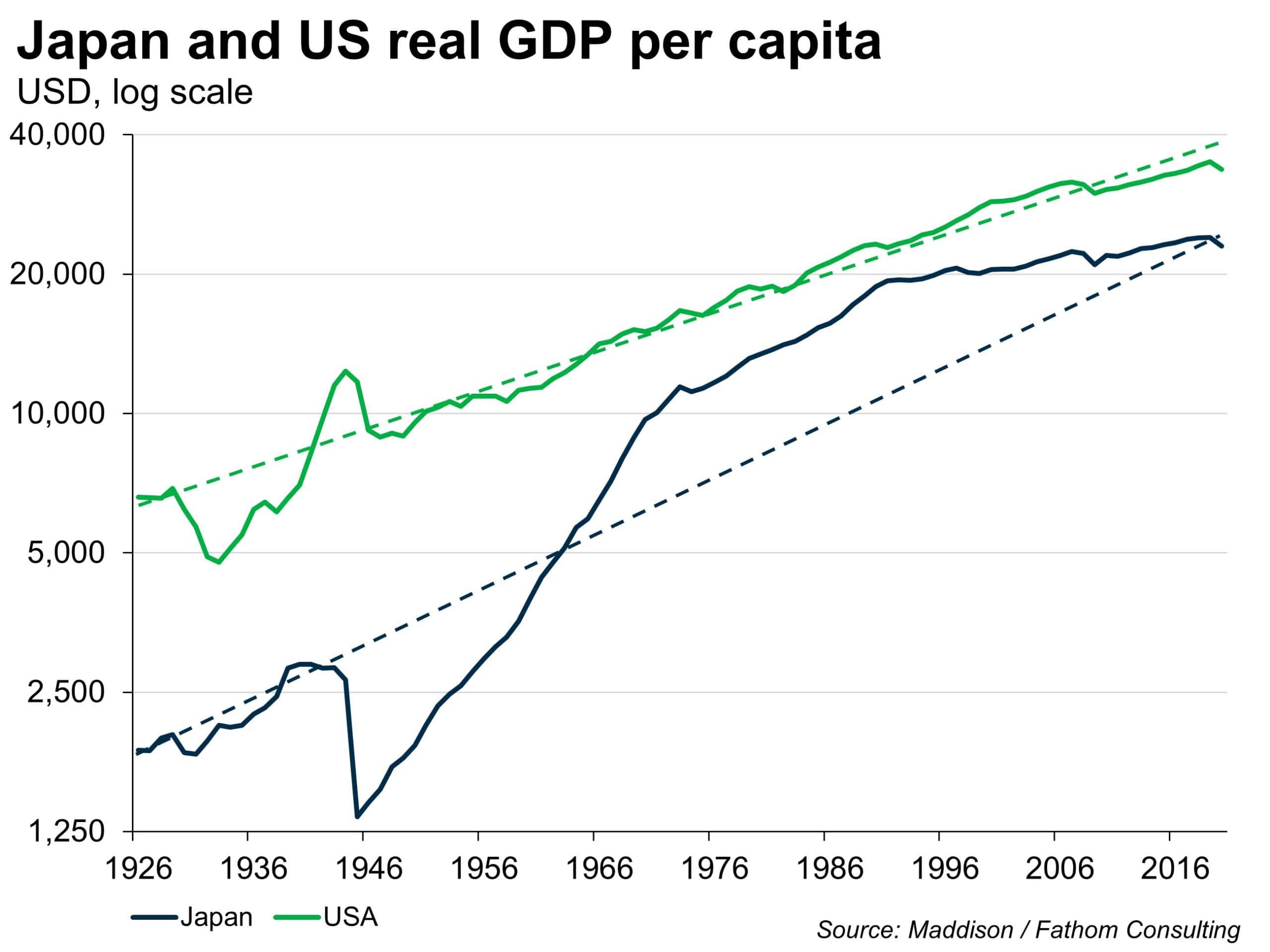

Japan’s post-war economic miracle was achieved by subsidising the cost of capital to keep it well below the returns that capital investment would generate. The result was to stimulate growth, led by exports and investment, with consumption bringing up the rear. That process had run its course by the early 1990s, and the elevated asset prices that had accompanied it, fuelled by low rates, collapsed as growth stalled. Since then, the Japanese economy has posted consistently low growth despite ultra-loose monetary policy. The returns to investment simply have not been there. Such growth as has been achieved has been driven by large and increasing government deficits and ballooning government debt, even as household saving ratios have shrunk.

[Please click below to read the full note]