Headlines

- Japan’s economy contracted in Q3; but given rising inflation, a weak currency and some signs of sustainably higher wage growth, the BoJ’s next step is likely to be a tightening

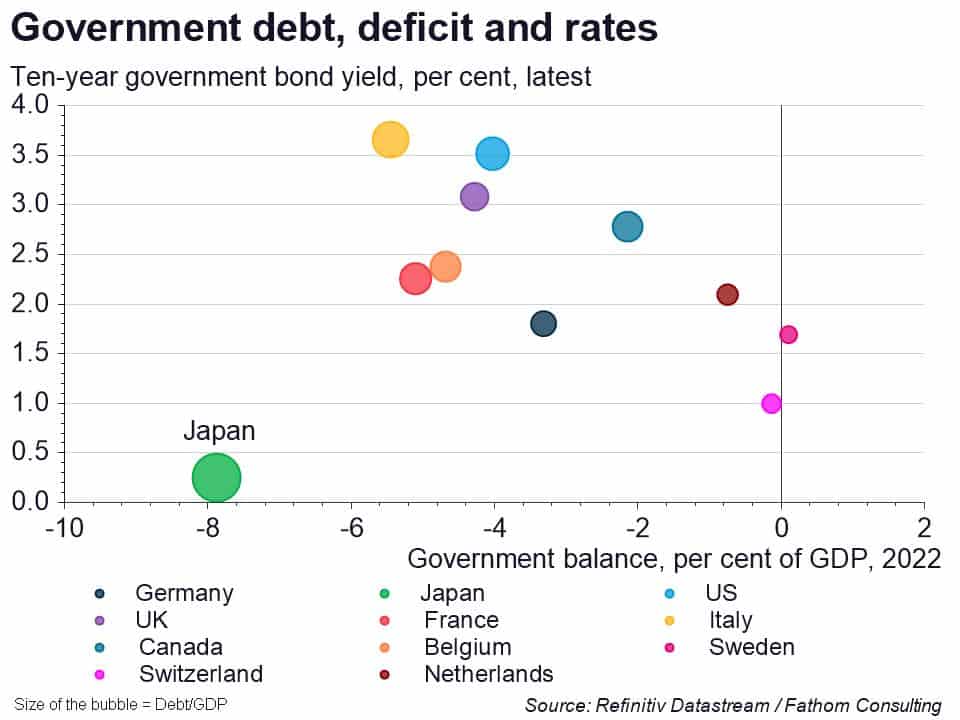

- Monetary tightening would have obvious consequences for a government with the highest sovereign debt burden in the world, and where the central bank is the main creditor. Fathom’s Financial Vulnerability Indicator (FVI) identifies rising risk of a sovereign crisis in Japan, partly driven by rising bond yields and widening budget deficits

- We foresee borrowing costs rising materially if the BoJ curtails its long-held policy of yield-curve control. If real yields rise by the level seen this year in the UK and Germany, that would take new borrowing costs above trend growth, meaning the Japanese government would probably need to run primary surpluses to stabilise the debt level. It hasn’t done that since the early ‘90s

- Recent developments in the UK are a reminder of how quickly market sentiment can sour, and the damage this creates

[Please click below to read the full note.]