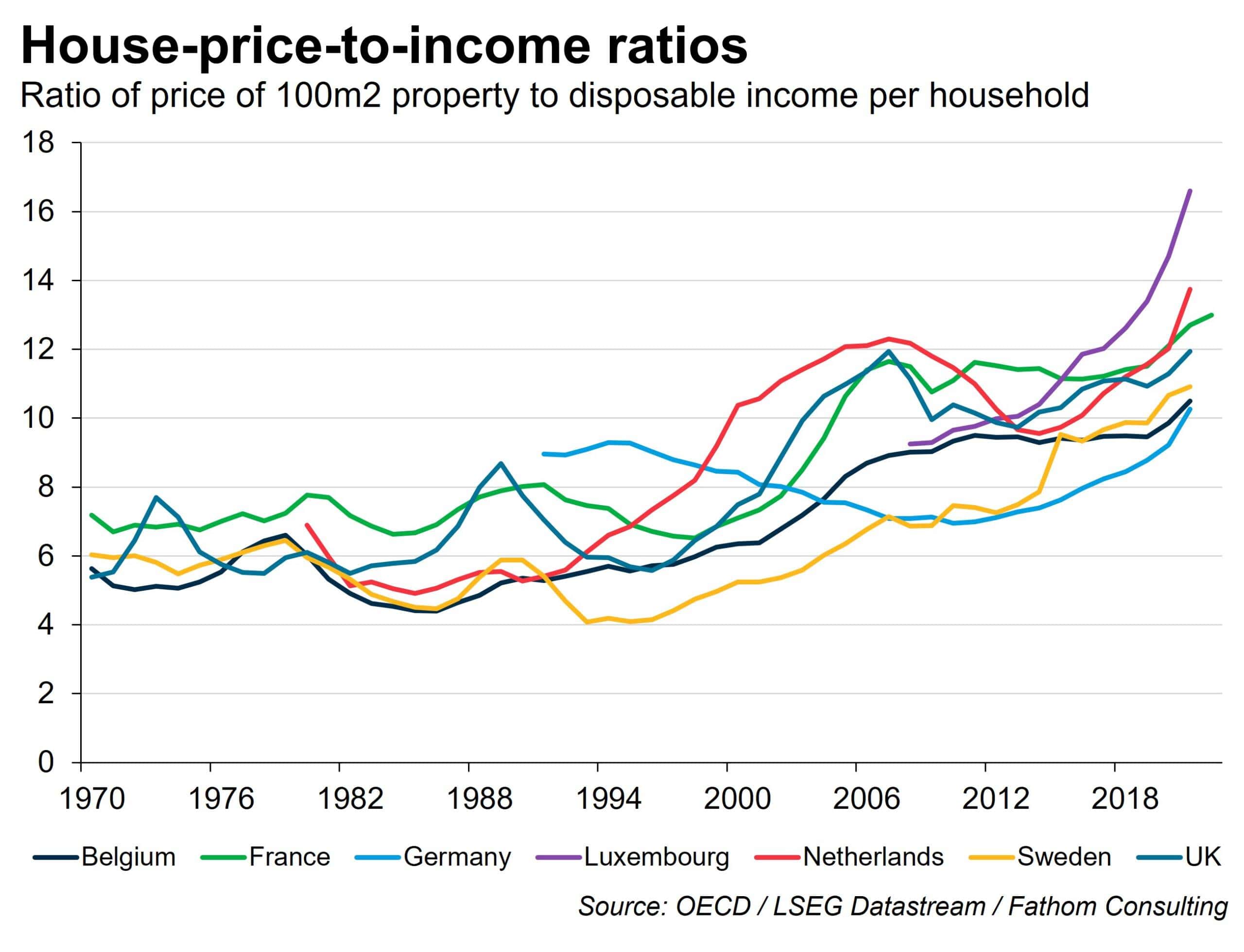

The house-price-to-income ratio used to be a popular yardstick for assessing whether UK residential property was ‘cheap’ or ‘expensive’.[1]

Over the period from 1970 to around the turn of the century there have been booms and busts in the UK housing market, but the house-price-to-income ratio always returned to the same, well-defined mean.

The chart below uses internationally comparable data from the OECD to show that this same pattern has been repeated across many European economies.

[Please click below to read the full note.]