A sideways look at economics

Spending money to flaunt one’s success is nothing new. Indeed, the phrase “conspicuous consumption” was coined over one hundred years ago by economist and sociologist Thorstein Veblen. Nowadays, these overt displays of wealth and exuberance tend to be referred to as ‘peacocking’. Although a term originally coined to describe the act of attracting a mate with tactics to distinguish oneself from the crowd, it’s now used more generally to describe overt, attention-grabbing behaviour. But the terminology isn’t the only aspect to have changed. With the advance of social media, these ‘displays’ now have a much larger potential audience than in Veblen’s time.

Indeed, whether showcasing a well chiselled set of abs or #livingyourbestlife on a once-in-a-lifetime holiday (every few weeks), the Instagram lifestyle is rife in every part of modern society. There are even websites which detect and advise on the most popular hashtags to use in your post in order to enhance exposure. And while that may massage the ego of the peacock, economic theory suggests that it may come at a cost.

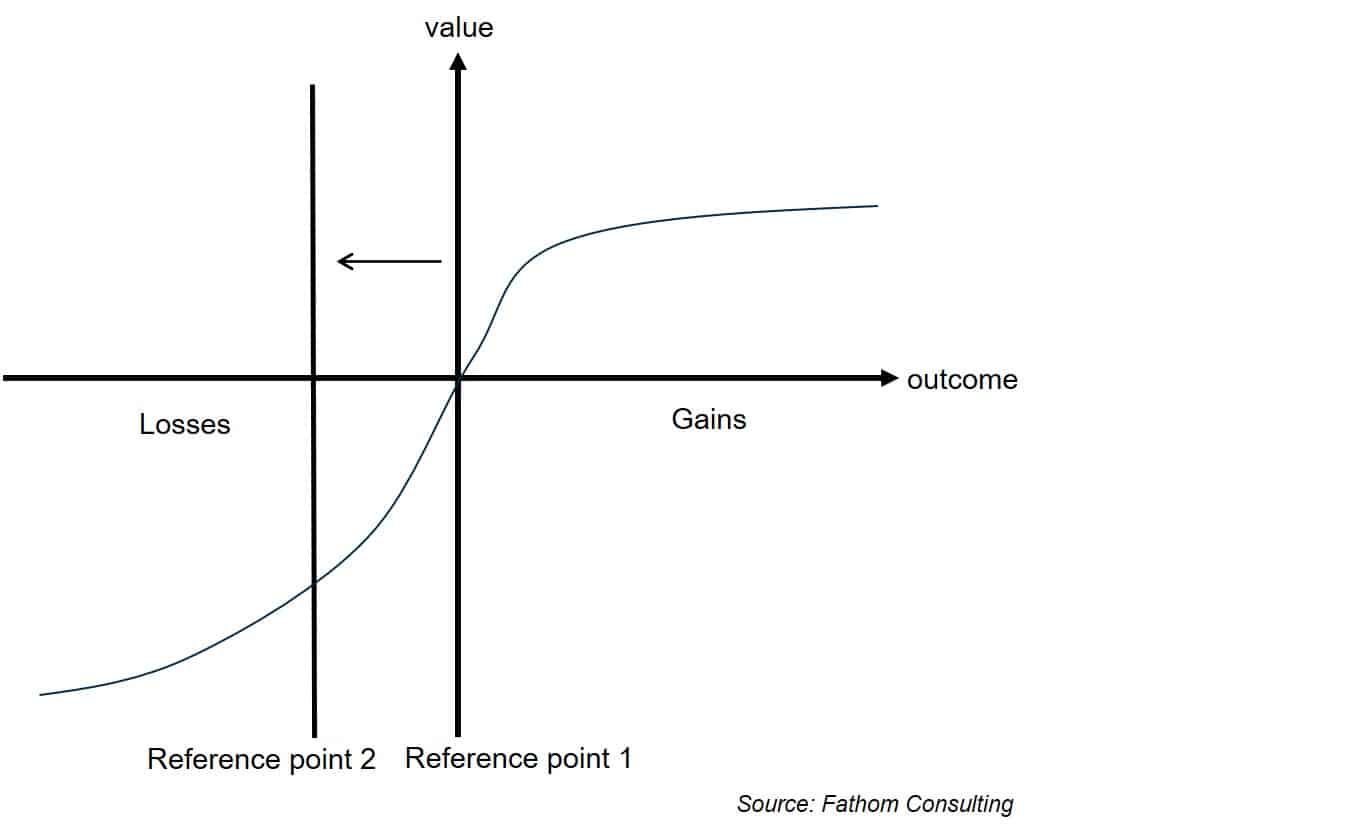

Indeed, according to prospect theory, devised in 1979 by psychologists Daniel Kahneman and Amos Tversky, people think in terms of expected utility, relative to a reference point. In other words, they form decisions based on the potential value of gains and losses, rather than the final outcome. But what if that reference point becomes distorted, with views about our own wealth and wellbeing relative to others undermined by the content of social media platforms? Amongst all the peacocking and ‘fake news’, determining what’s accurate and what isn’t, let alone where we stand within the spectrum, is undeniably difficult.

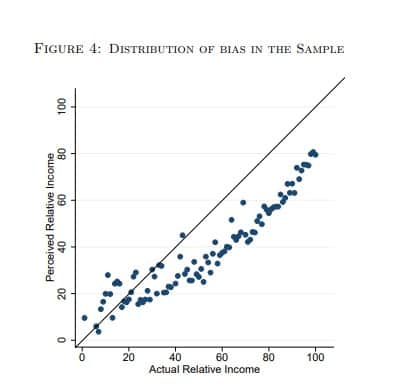

This modern-day challenge is reflected in a chart that is currently doing the rounds on Twitter. Courtesy of a paper authored by Mounir Karadja et al. and published in the Review of Economics and Statistics, the chart reveals that the vast majority of Swedes believe that they are poorer, relative to others, than they actually are. In other words, they underestimate where they sit on the income distribution, with almost 70% misjudging by more than ten percentage points. The study found that this was common across groups, although those that were younger, poorer and less educated proved to be more misinformed, with their expectations further from reality.

Sadly, the authors didn’t test for social media exposure, but they did conduct a second survey. This time, the aim was to ascertain whether those distorted views shape individual policy preferences. To this end, prior to testing, they randomly informed a subsample of the participants of their true relative income position. What they found was that in learning they were richer than they had originally thought, participants’ appetite for redistributive policy waned, bringing me back to where I left off… prospect theory.

According to this theory, people feel the loss of something more keenly than the gain of an equivalent amount, rendering them loss-averse. For example, winning £200 in a pub quiz would feel pretty good, not least because my general knowledge is poor. But if I were subsequently strong-armed into buying the entire pub a round of drinks, costing £100 of my winnings, it would feel like a net loss, even though in reality I remain £100 up. We don’t weight gains and losses linearly, and in that interim period my reference point shifted, just as it did for the Swedish survey participants when they were informed of their true income position.

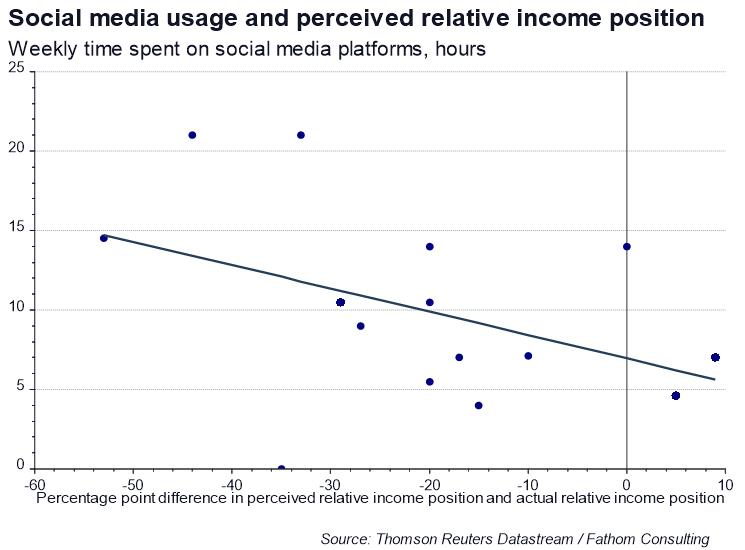

What does this mean in the context of social media? Theory implies that as we are typically loss-averse, fear of failing to ‘keep up with the Joneses’ may make us more willing to take on risk. To the extent that social media, through both giving ‘peacocking’ a global stage and making a lucrative industry out of it,[1] accentuates this sense of falling behind, it may be distorting our reference point.

My own, admittedly small, sample[2] certainly seems to confirm the link between increased time spent on social media and the underestimation of one’s position along the income distribution. This leftward shift as we underestimate our relative position, in this case in terms of wealth, but it could also apply to popularity, relationship success, career satisfaction etc., is illustrated in the chart above. Here, where theory suggests losses are felt more keenly and greater risk is taken, we might find the explanation for enigmas like the global credit binge and the negative impact of social media on mental health!

[1] Think the Kardashians and numerous other celebrity influencers on social media.

[2] If you want to test your own perception, try the OECD’s Compare your income tool.