A sideways look at economics

At Fathom, writing the TFiF blog is always greeted with a mixture of anticipation and dread. Picking a suitable topic tends to be half the struggle. I would obviously love to write exclusively, as I did last time, about exotic holidays, but I’ll leave this privilege to one of my colleagues returning from a one-year sabbatical trip around the world. Not that I’m jealous (I am!), but the hard-biting reality of middle agedness tends to steer me towards a choice between two broad categories: rants and genuine geeky interests. Indeed, I have a long list of rants saved on my computer that I would love to share with an audience other than my lucky wife. However, this time you’ll have to bear with me while I extol the virtues of getting to grips with the intricacies of coupling human behaviour and economic theory.

If you haven’t yet hit the delete button, I propose to you that the most fundamental question in life and economics is the same as picking a topic for this blog: choice. Choice almost by definition elicits a dithering “it depends” response, itself a fitting allegory for the famed inability of economists to provide a straight answer. Apparently, Harry Truman once asked for an economist with one arm because he was tired of hearing: “Well on one hand… But on the other hand…”. For someone who overanalyses choices of even the most basic kind, I’ve naturally been fascinated by the idea that while behaviours around preferences, choices and habit formation are often deeply different across people and countries, they might share a common strand of logic.

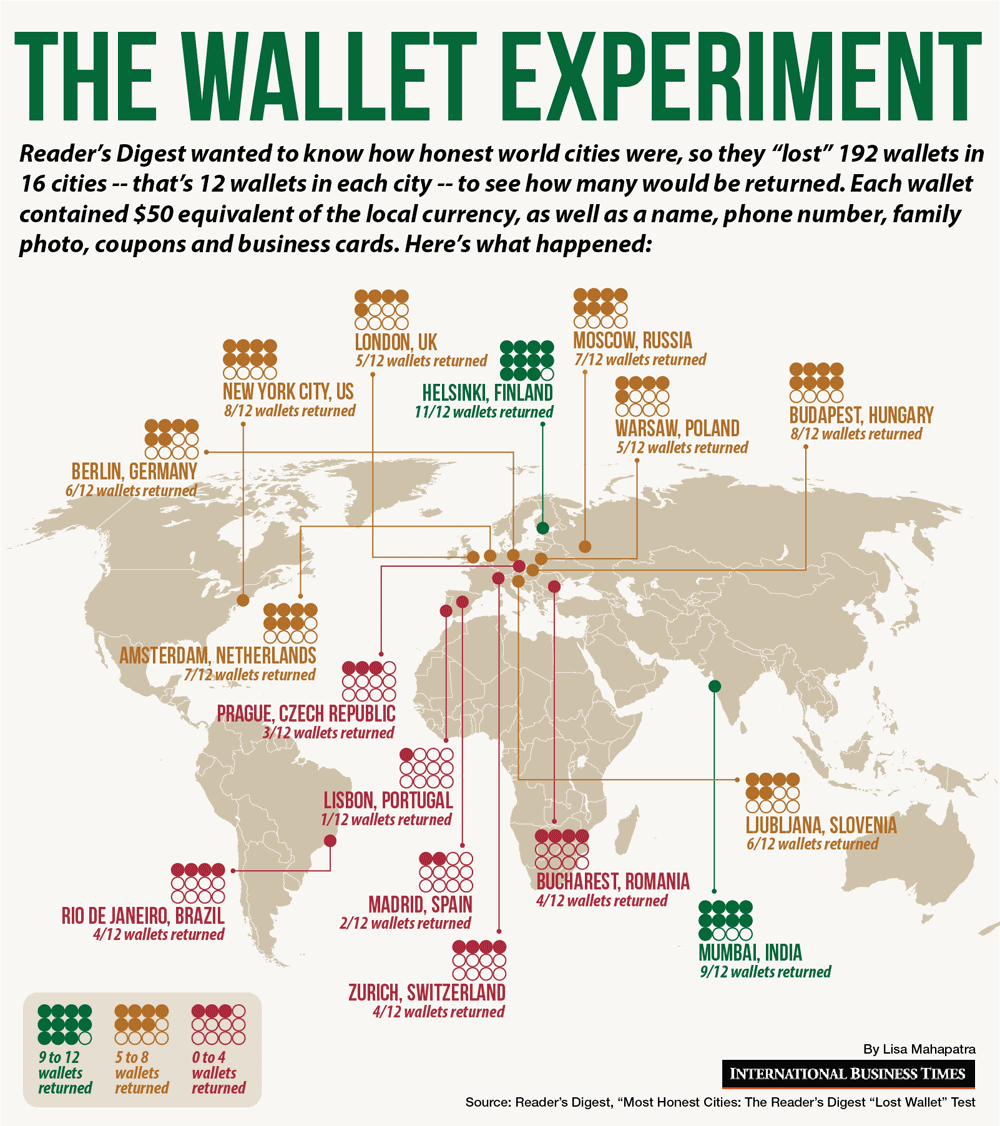

It’s certainly not a new concept. For example, Aristotle and Hippocrates alluded to the risqué concept that people from colder climates might be more trustworthy than inhabitants of warmer climates, as extending trust beyond the immediate family would increase the chances of surviving harsher temperatures.[1] There seems to be some truth in this if a casual experiment carried out by Reader’s Digest magazine is taken at face value. In this experiment, a wallet containing $50 or equivalent local currency was ‘lost’ across different cities around the world to test how many would be returned. The most honest city was Helsinki and the least Lisbon.

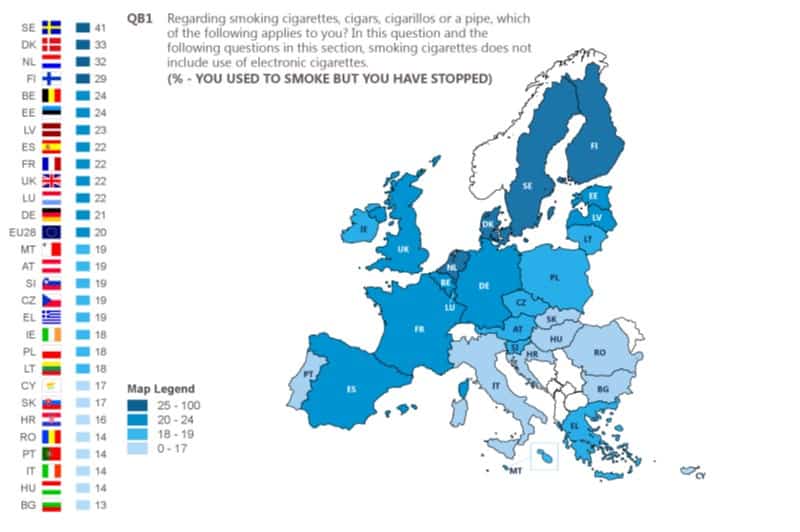

Smoking habits elicit more clues about differences in preferences across countries.[2] In Europe, southern countries seem to have a higher rate of smoking, but also a much higher rate of both non-quitters and non-starters than northern countries. In other words, we could speculate that Southern Europeans might have more addictive personalities: some people cave in to the addiction and never give it up, whilst others, conscious of their limits, never start. The latter incidentally describes me quite well.

In a more rigorous experiment,[3] a large number of people were asked about their willingness to swap a guaranteed salary for life for a riskier job that could lead to a much higher or lower salary. The authors found that most people tend to be rather risk averse while riskier preferences were associated with risky behaviours such as smoking, drinking, failing to have insurance and holding stocks rather than T-bills. Some interesting patterns emerged from more hard-wired socio-demographic trends too. Age mattered as the youngest category (under 50s) were generally less risk averse, but it was the over 70s who had the highest proportion of risk takers with a nothing-to-lose type of behaviour. Males were generally more comfortable with risk than females, with a greater share of males preferring the riskiest job offer. As expected, risk aversion fell with the number of years in education and it was high for people who came to the US as immigrants. Somewhat more controversially, religion and race were also found to be important drivers of risk behaviour with white or protestant individuals associated with lower preferences for risk.

Another fascinating experimental study[4] found that individuals were willing to forgo on average 4.5% of their consumption to have any future uncertainty resolved early, albeit with considerable heterogeneity. Incidentally, this is close to the price the Z-household pays for ‘help’ to resolve any uncertainty over the responsibility for some domestic chores.

Finally, a remarkably sweet study[5] revealed the paradox of choice by showing that people were about ten times less likely to make a purchase and had a much less satisfactory customer experience when faced by a large spread of different jams relative to a much smaller set (24 versus 6). This experiment has been subsequently proved many times and extended to financial choices such as retirement investment options.

The above examples are more than just versatile dinner party conversation starters or killers. Parameters about preferences and choices have tangible, large implications for our understanding of the modern economy. In the macro and finance literature, they influence anything from how quickly a country’s growth converges to its steady state, to the dynamics of labour supply, investment preferences, saving and consumption, trade dynamics, the effectiveness of monetary and fiscal policy, financial market behaviour, company behaviour, contract theory and redistributive policies. Entire new disciplines, such behavioural economics, have been created to study preferences and choices, and I would argue that no other single topic has produced more prizes in memory of Alfred Nobel.

Yet, the main conclusion from all the extraordinary brain power thrown at the problem is a lack of clear consensus. There’s no agreement on how preferences should be modelled, separated, calibrated or indeed formed. Paradoxically, the economics profession can be seen as a victim of the paradox of choice on the very constructs used to model individual choices and preferences. Confronted with such a large dispersion of parameters and modelling options, most mainstream macro models actually resort to simple and narrow modelling definitions and calibrations. Such a wide range of evidence, even if often contradictory, should instead clearly point to modelling preferences as being heterogeneous.[6] This isn’t another cheap joke about “economics being the painful elaboration of the obvious”, it has deep repercussions. Macroeconomists are on the perennial quest for a model that can explain as many as possible of the observed dynamics in any given economy. However, I would argue that too much of the quest is about the structure of the model and too little about its parameters and their calibration. Perhaps we might already have the perfect model, it has just been wrongly calibrated.

[1] Christian Bjørnskov and Pierre-Guillaume Méon make this point in their paper ‘The Productivity of Trust’, World Development, Vol. 70 (June 2015), pp. 317.331.

[2] See the Special Eurobarometer 458 report from where the subsequent picture has been taken.

[3] See Robert B. Barsky, F. Thomas Juster, Miles S. Kimball and Matthew D. Shapiro, ‘Preference Parameters and Behavioral Heterogeneity: An Experimental Approach in the Health and Retirement Study’, The Quarterly Journal of Economics, 112/2 (May 1997), pp. 537–579.

[4] See Thomas Meissner and Philipp Pfeiffer, ‘Measuring Preferences Over the Temporal Resolution of Consumption Uncertainty’ (2017).

[5] See Sheena S. Iyengar and Mark R. Lepper, ‘When Choice is Demotivating: Can One Desire Too Much of a Good Thing?’, Journal of Personality and Social Psychology, 79/6 (2000), pp. 995-1006.

[6] Heterogeneous preferences are sometimes assumed in macro models, but are often assumed to have a random component and much less often a micro funded, experimentally led calibration.