A sideways look at economics

Today sees two consequential events. One, the Conservative Party has won the general election with a landslide majority, making it more or less inevitable that the UK leaves the EU, as planned, on 31 January. And second, it’s Fathom’s Christmas party. While many believe the former will lead to a prolonged (economic) hangover, the headache caused by the latter will hopefully be limited to Saturday morning. But we don’t only indulge in delicious food and wine, we also have a long-standing Secret Santa tradition.[1]

As at our celebratory lunch, Christmas is associated with wholesomeness paired with good food and gift-giving. The latter has the added benefit that it’s a boon to the economy.

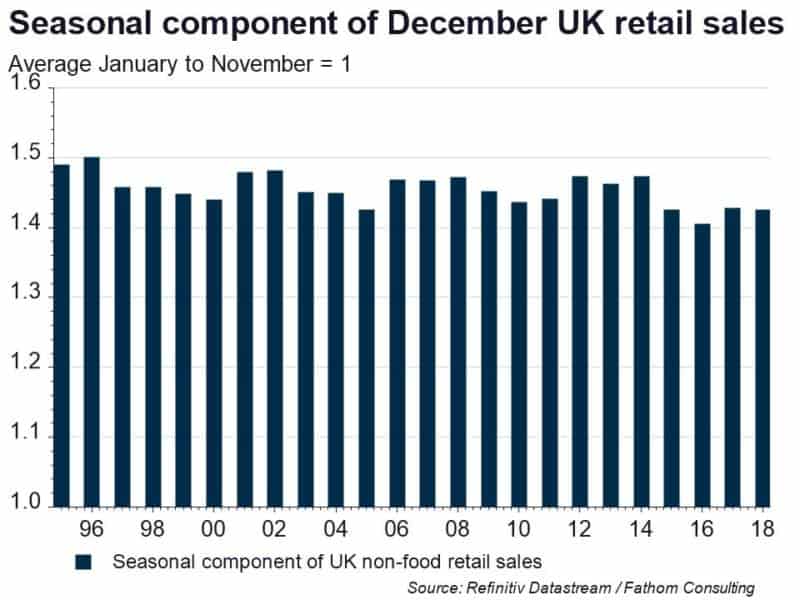

Seasonal patterns in economic data such as monthly retail sales are generally removed with seasonal-adjustment routines to allow meaningful comparison with the previous month. The difference between the unadjusted and adjusted series, represents the seasonal (as opposed to cyclical and irregular) component of the data. The following chart shows December’s seasonal component of UK non-food retail sales, rescaled so that it averages 1 over the period January to November. In December, the seasonal component suggests that expenditure is 40–50% higher on average than in other months. While some organised people will buy their Christmas presents in November, a substantial part of December’s seasonal component of non-food retail sales will be caused by spending on Christmas gifts. Assuming that all of it is attributable to Christmas gift buying would imply that £11.7 billion was spent on Christmas gifts last year.

However, economics is called the dismal science for a reason. Joel Waldfogel, in his famous 1993 paper ‘The Deadweight Loss of Christmas’ — which was published in The American Economic Review, one of the world’s top three economics journals — argued that gift-giving is causing a deadweight loss, i.e. a negative impact on welfare. Gift-giving implies that consumption choices are made by someone other than the final consumer. Therefore, gifts maybe be mismatched with the recipients’ preferences. From a purely economic point of view, the best the gift-giver can do is to duplicate the choice that the recipient would have made. But we all know from experience that the gift-giver is not always successful. Would you have spent £30 of your own money on that pair of socks that your grandparents gave you?

Waldfogel asked his students to estimate the amount paid by the givers on the Christmas gifts they received and how much they would be prepared to pay for the gift themselves. The difference between the two figures represents the deadweight loss. He concluded that “holiday gift-giving destroys between 10 percent and a third of the value of gifts.”

The size of the deadweight loss depends on the giver’s knowledge of the recipient’s preferences and the recipient’s knowledge of their own preferences. Waldfogel found that gifts from the extended family, such as aunt and uncles, and gifts from family members with a large age gap, such as grandparents, have the largest deadweight loss. Gifts from friends and significant others tend to entail the smallest losses. The only way to create, rather than destroy value is to know the recipient better than they know themselves. That is, gift a present the recipient doesn’t know they wanted. However, based on Waldfogel’s study, gifts by all groups of givers destroy value on average.

Arguably we know less about the preferences of some of our colleagues than our grandparents know about our preferences. Indeed, in a previous year one of Fathom’s more experienced analysts, who worked only one day a week, gifted a junior economist who doesn’t drink alcohol a drinking game — 100% deadweight loss! Of course, some people aim to maximise the deadweight loss — such as giving an Arsenal supporter a personalised Tottenham mug.

The deadweight loss of Christmas gifts is substantial. Using the above estimate of spending on Christmas gifts and Waldfogel’s estimate of the deadweight loss suggests that the shortfall caused by Christmas gift-giving amounted to between £1.2 and £3.5 billion in the UK in 2018.

And there are other types of economic cost associated with gift-giving. I’m sure we all can think of more enjoyable pastimes than the annual panic trip to Oxford Street on the weekend before Christmas with what feels like every other Londoner. In economics, this is called the opportunity cost. Then the annoyance you represent to others — negative externality in economic parlance — while forcing yourself onto the Central line armed with shopping bags full of the results of your anxiety-fuelled last-minute shopping spree, trying to minimise that deadweight loss. Then the environmental costs, etc… Ho, Ho, Ho…

The obvious solution would be to walk to the closest ATM and get out some cash to give as Christmas gifts. No deadweight loss, no environmental costs, minimal opportunity cost and negative externalities. Indeed, Waldfogel finds that grandparents, the group whose gifts tend to have the largest deadweight loss, give cash the most frequently.

Or, maybe, at least for Christmas, we shouldn’t think like economists. Waldfogel’s research explicitly excludes the sentimental value of the gift. That ugly pair of socks becomes invaluable if you associate putting it on with your grandparents. After all, it’s the thought that counts.

[1] You may remember last year’s blog on the subject: https://www.fathom-consulting.com/secret-santa-is-coming-to-fathom/.