A sideways look at economics

After having managed to pull off a very successful year at Fathom Consulting, I came to the conclusion that I deserved to treat myself to a nice watch that could complement my ‘out of consensus’ dress style. This experience has been much more interesting than I could possibly have imagined, and I feel an overwhelming urge to share it with you today. Are you ready?

If you had asked me around a year ago to list you the best watch brands in the world, I would have told you that the only one I know is Rolex. You see, I know Rolex as a long-standing sponsor of the Wimbledon tennis tournament, something which I have always followed passionately, as I have played and followed the sport since I was a kid. Besides that, I had no idea (and honestly no interest) about what was going on in the watch industry.

However, everything changed when I moved to London and started to pay attention to people’s watches amidst endless and boring rides on the Northern line to and from work. There, watches are unintentionally (or perhaps not!) exposed when commuters cling tight to the handrails of the underground, trying hard to avoid losing their balance when the train moves. Be that as it may, something ‘clicked’ in my head and I realised that it was time for me to also own a good timepiece.

I did not have any knowledge on the matter, but was determined to do the proper research and ‘fathom’ everything I needed to know to ensure I made a conscious purchase. The natural first step was to sketch in my head what kind of watch I was looking for. I came up with the following prototype: it needed to be a classic, timeless design, small (since my wrist is), manufactured by a highly recognised brand, have a leather strap and be made of gold (because, you know, gold is cool). This is clearly not the type of watch that the majority of people nowadays would opt for, preferring big size watches, smartwatches or, for those at the very top, flashy coloured and ridiculously expensive pieces such as the ones from Richard Mille. These watches may be very functional or fashionable, but they are the antithesis of elegance and refined taste. Definitely not my style…

The second step consisted of deciding how much I was willing to spend on the watch. Obviously, this is not a trivial decision and it depends greatly on a person’s income, as well as how much ‘utility’ (in economics jargon) or satisfaction it gives once you have it. There are people who own really expensive watches that do not correspond with their lifestyle, while billionaires such as Bill Gates are happy wearing a 50-euro Casio. I do not like extremes, so I decided to look online for some help. The most popular rule of thumb I found says that you should spend the equivalent of one month of your net monthly salary on a watch. I also found more aggressive rules, such as spending three times your monthly salary, as well as softer ones that recommend spending just 30% of your monthly salary on a watch as it belongs to the ‘wants’ category, with 50% ideally devoted to ‘needs’ and 20% to ‘savings’.

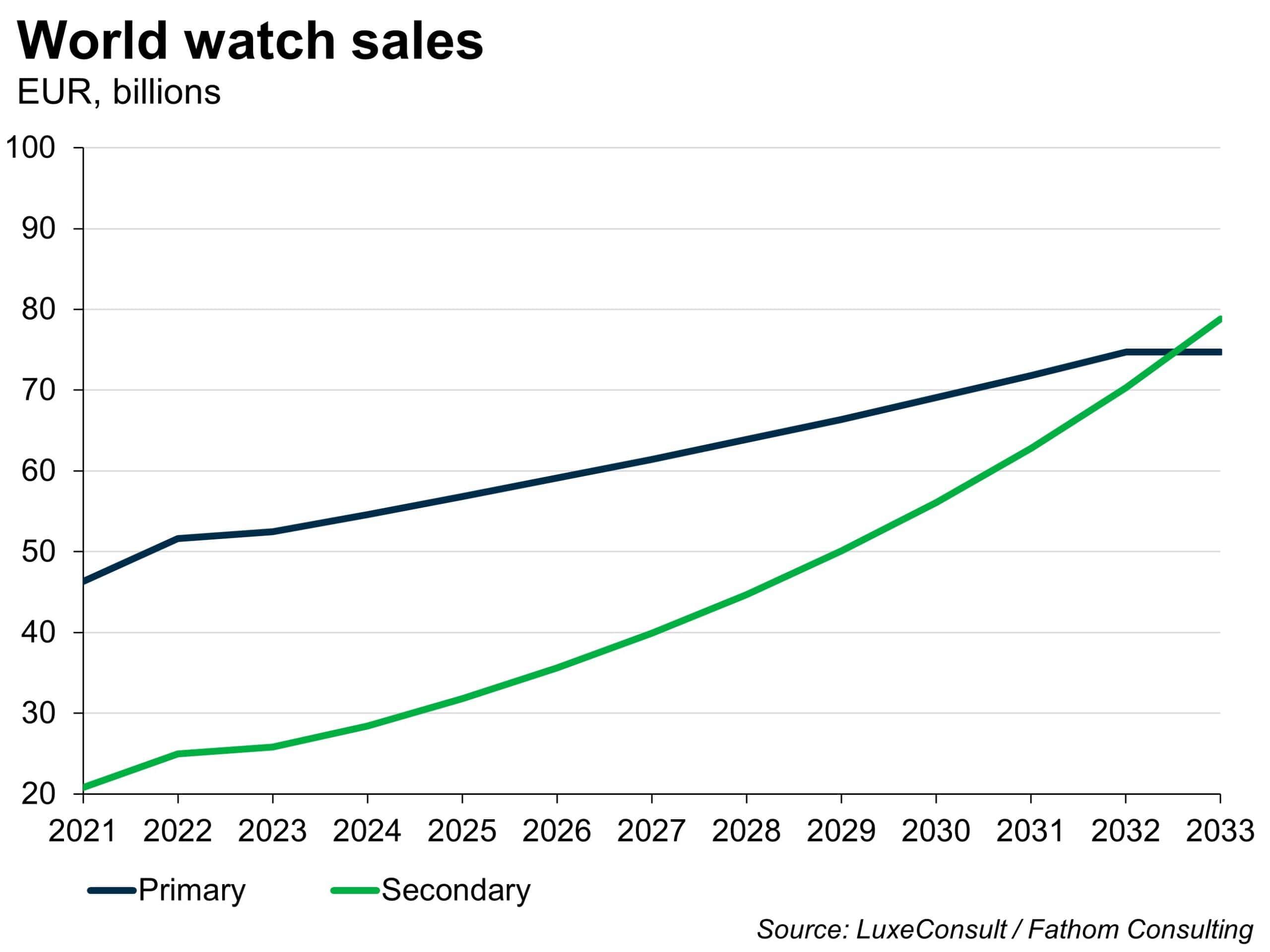

Once that was decided, I then went on and started my deep dive into the world of horology, soaking up information about the best brands out there, the models they offer and the different types of mechanisms that a watch can have. At first glance, my disappointment at discovering that the majority of watches that I was interested in were totally out of my budget was not lacking. However, I realised I was looking in the wrong place: I was not considering the vintage or ‘pre-owned’ market. This market has experienced astonishing growth in recent years and, although right now it is about half of the size of the primary one, a recent report by the consultancy LuxeConsult forecasts that in 2033 more people will be buying vintage watches than new.[1]

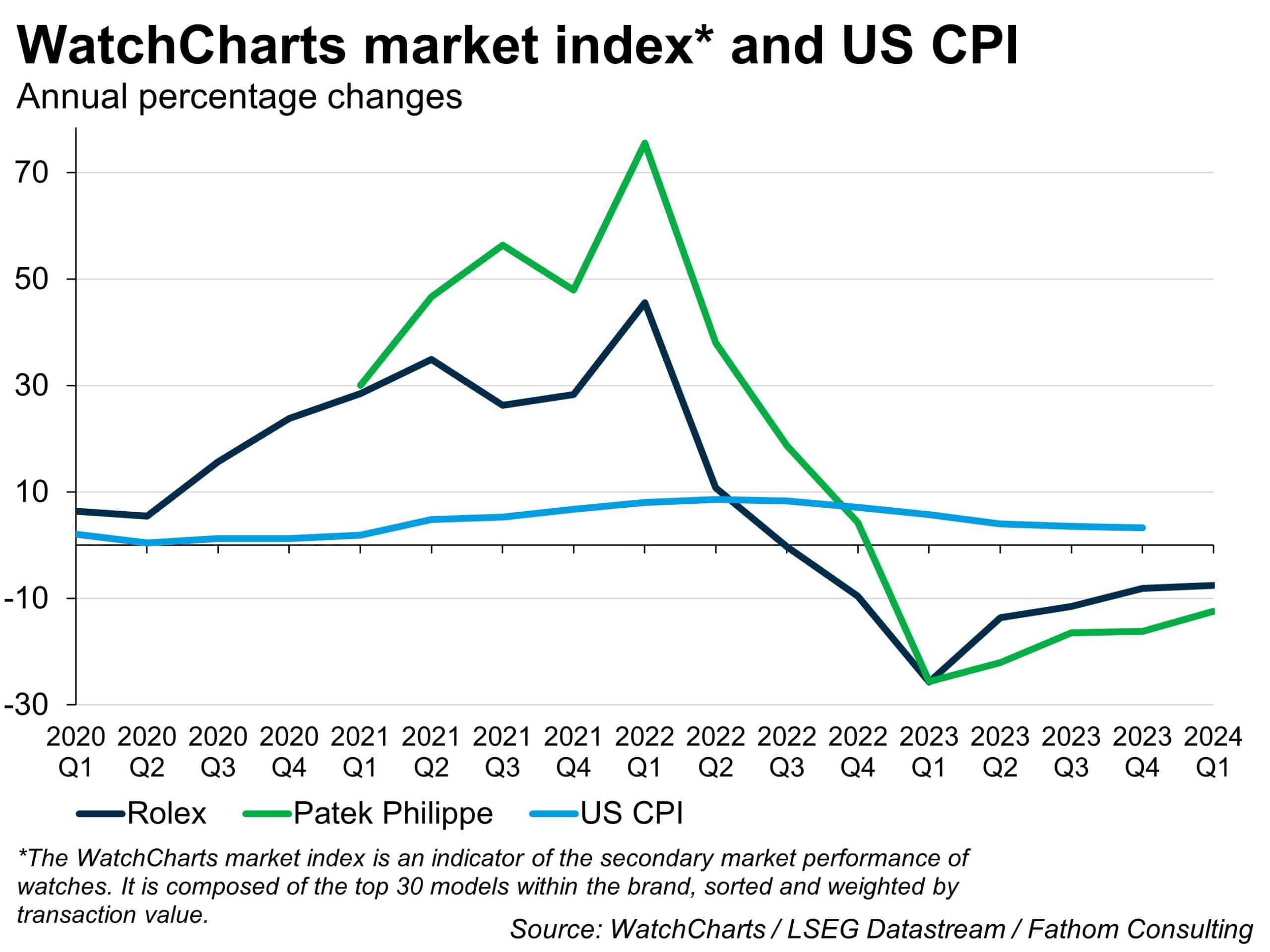

There are several reasons why this is happening, including the cost-of-living crisis, the rapid growth of the e-commerce market and increasing demand for sustainability. Furthermore, post-pandemic production slowdowns and rising demand has led some luxury watchmakers to instigate year-long waiting lists for certain models, with an increasing number of impatient buyers turning to the secondary market where availability is immediate, but at a premium cost. The inflationary surge has also led investors to look for non-traditional investment avenues to broaden their portfolios, and it turns out that buying a vintage Rolex or Patek Philippe watch would had been a magnificent protective shield during the worst of this episode.

It is important to note that in normal circumstances, vintage luxury watches do not appreciate in value over time (that’s why the vintage market is so appealing), with only a few specific models from certain brands managing to do so. Furthermore, some rare pieces could be considered highly illiquid assets, since it can be difficult to find a buyer who will want exactly the same watch and be willing to pay a premium price for it. Therefore, I would not consider vintage watches a good long-term investment, but rather something that holds intrinsic value for the owner (whether that is sentimental or pure aesthetic), who is consequently willing to hold the watch regardless of the financial return it generates.

Therefore, when I opened the door of the vintage market, a whole universe of possibilities appeared in front of me. Many of the luxury brands that were out of my league before became attainable and, not only that, I could also have access to several models that had been discontinued from production years ago. This was a particular advantage for me, since classic watches were a lot more popular in the past and therefore the range of options to choose from was a lot larger than if I would have been stuck with in the primary market. I am not exaggerating when I say that in the vintage watch market you can find truly authentic gems, pieces whose stories and history add to their charm, making them irresistibly attractive to those seeking a unique, one-of-a-kind piece.

After a year of deep investigation, having visited several boutiques and scrolled through endless websites, it is evident that you end up having a pretty good understanding of what you are looking for. And, all of a sudden, one day, you finally see it… and when that happens you know immediately that it’s the one for you. Then you experience that feeling of immense satisfaction that occurs when the one you have been looking for so long finds you and you finally find it. It is now yours, ready to be enjoyed for the rest of your life and, perhaps, if taken care of properly, be passed on to the next generation.

Audemars Piguet Calatrava, 18K solid yellow gold, Circa 1980’s

[1] https://www.bloomberg.com/news/articles/2023-01-12/secondary-watch-market-to-top-new-sales-by-2033-at-85-billion?leadSource=uverify%20wall&embedded-checkout=true

More by this author

Labour market’s impossible trinity