A sideways look at economics

After working in the Productivity & Structural Reform team at HM Treasury some years ago as a very junior economist, the fascinating subject of productivity has always remained dear to my heart. Back then under the Labour government, a key mission of the team was to close the UK’s yawning 45%[1] productivity gap with the US economy, and the smaller deficits with some of our European peers. After a period when UK productivity grew at a healthy pace of over 2% per annum during the 1990s, it was often stated that if this could be raised by just a few tenths of a percentage point, the future benefits would be significant. The initial omens were pretty good, with the UK outperforming many of its peers in the run up to the Great Financial Crisis (GFC) and broadly matching the performance of the US.

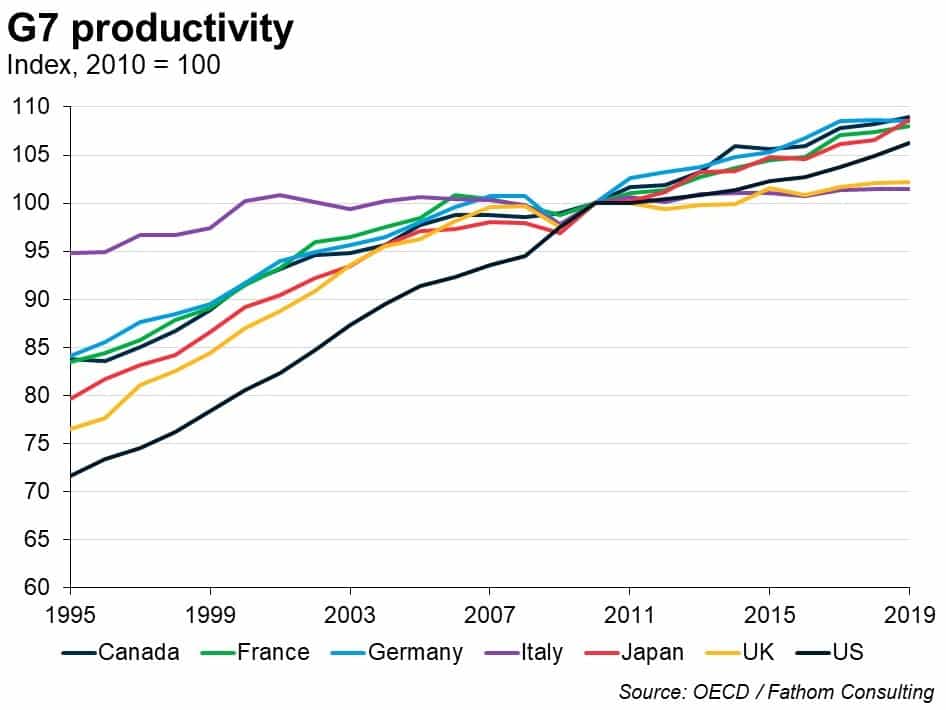

However, the GFC firmly put an end to the UK’s moment in the sun. While productivity growth has been extremely weak in most countries, the UK’s performance has been particularly abysmal. Productivity on an output-per-hour basis has increased by just 0.5% per annum over 2010-19, which compares with 0.9%, 1.2%, 1.1% and 0.9% in the US, Japan, Germany and France. Only Italy out of the G7 had a slightly weaker performance at 0.4% (chart below). Crafts and Mills[2] suggest that the slowdown in UK productivity compared with its prior trend is unprecedented in the last 250 years. Oh, how we could do with those extra few tenths of a percentage point right now! Future productivity performance is key for trend growth, and for the economy’s ability to handle its debt burden and provide for its ageing population. As Nobel Laureate Paul Krugman famously suggested, “productivity isn’t everything, but, in the long run, it is almost everything”.

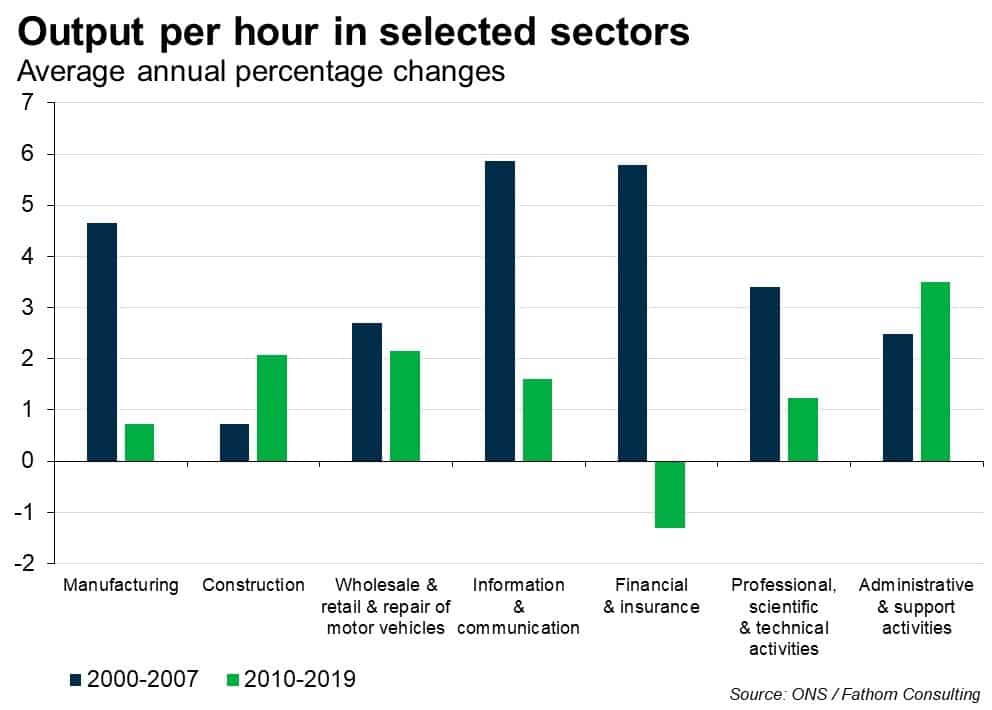

Many reasons are cited for the weakness in UK productivity, including cyclical economic weakness, soft investment, firms favouring low-skilled labour instead of capital, short-termism amongst managers, measurement error etc. A survey of leading UK economists found that the most agreed explanation, favoured by 40% of respondents, was weak demand.[3] Numerically speaking, the weakness in productivity was due to the fact that a 1.9% annual average increase in output was achieved by a 1.4% average increase in hours worked, whereas in the years before the GFC, average annual output growth of over 2.5% came about amid an average increase in hours worked of just 0.7%. The manufacturing, information & communication, financial & insurance and professional, scientific & technical activities sectors have been important drivers of the weakening productivity trend (chart below). Interestingly, however, some sectors have bucked the trend with stronger productivity growth post-GFC. These include construction and administrative & support activities, while wholesale & retail has maintained solid gains.

After personally being too optimistic about the eventual recovery in UK productivity as the economy recovered from the GFC, it is now tempting to become deeply pessimistic. Indeed, the UK has just exited the European single market and agreed a rather bare-bones trade pact with its largest trading partner, at the same time as being hit by the massive shock of the COVID-19 pandemic which has fuelled weakness in business investment and raised the risk of zombiefication in parts of the corporate sector. These factors alone suggest that the UK productivity trend could actually head further south over coming years.

And yet. Maybe it is because I am a ‘glass half full’ kind of person, but I still believe there are reasons not to completely throw in the towel. There is an inherent tendency in economics to excessively extrapolate trends both on the way up and the way down. Using econometric analysis, Crafts and Mills[4] and Brynjolfsson et al[5] find that historical productivity performance over a particular decade is not a good predictor of performance over the subsequent decade. Meanwhile, David[6] famously highlighted the fact that many of the productivity benefits from the electric dynamo took several decades to come through, with large boosts occurring when firms used the new technology to reorganise their methods of production. Whilst I would not stretch the analogy too far, my sense is that some of the IT-enabled changes adopted because of the pandemic may have begun to lay some of the groundwork for far-reaching impacts over time.

Indeed, there have been massive changes in the way many of us work, travel and shop, and many of these changes are likely to remain to some extent after the country has normalised again. From an individual perspective, more flexible work patterns are likely to allow employees to waste much less time and money on often stressful commutes or travelling to meetings that could be done equally effectively over a video call, and this may allow employees to maintain healthier lifestyles through extra sleep and better dietary and exercise habits (although, my colleagues are yet to convince me to be a regular at the Friday morning workout over Zoom!). Moreover, individuals who have got better acquainted with technology will save some time and money previously wasted on shopping and admin trips and by increasingly performing tasks online (I am finally beginning to make the transition to reading economics papers online rather than printing off hard copies!).

From a corporate perspective, there could be benefits from healthier and more motivated staff, and there are likely to be significant cost savings on real estate and employee travel costs. Also, one suspects the pandemic is likely to further accelerate the process of automation and digitisation, amid higher volumes of online sales, more self-checkouts in stores, less use of cash as a medium of exchange, fewer people going into bank branches and increased use of robots.

Meanwhile, the disruption from technological innovation is likely to continue to apply competitive pressure on firms across the economy to improve their productivity. These benefits are likely to be bolstered over time by further productivity gains through the use of artificial intelligence.[5] Sandbu[7] also suggests that remote working could help to reduce regional inequality, by allowing high value-added knowledge jobs to be done away from the largest cities.

Of course, changes to the structure of the economy post-COVID and technological changes create very difficult adjustments and pose great risks to employment in certain sectors. Hence, a supportive economic environment will be very important over coming years. This would aid the domestic process of reallocating workers and capital away from firms that may no longer be viable. The potential for a strong, US-led, global economic recovery is encouraging on this front, while maintaining supportive UK monetary and fiscal policy is also very important in this regard.

All in all, the data over 2020 were extremely noisy and will probably continue to be over 2021 as the economy recovers strongly. It may be difficult to get a good gauge of underlying trends anytime soon. Nevertheless, whilst a return to the sunlit uplands of pre-GFC productivity trends seems extremely unlikely, I still think the risks to the recent dire productivity trend are stacked more to the upside than the downside over the coming decade, assuming a decent economic recovery takes hold. That said, many of the technological innovations and trends that could help boost productivity are by no means UK-specific, so we are unlikely to close any of the productivity gap with the US.

Thinking back to my long-lost days in the Treasury’s productivity team, what would be my advice to the government now? Not to focus excessively on the productivity gap, but to focus instead on getting the basics right. The UK typically does well in international surveys of economic freedom (rule of law, government size, open markets etc) e.g., The Heritage Foundation’s Index of Economic Freedom, so there is probably less scope to improve in these areas. Instead, the priorities should be to sign good trade deals with important countries; remain open to the world’s best and brightest, and continue to encourage collaboration between universities and businesses; make housing more affordable – so that London and other cities are attractive places to live; invest in improvements in all forms of education (including in IT) and in infrastructure; and to continue to strive for a more regionally-balanced economy, so cities outside of London can punch their weight globally!

[1] This is on an output per worker basis. On an output per hour basis the gap was over 20%.

[2] Crafts, N. and T. Mills (2020), Is the UK Productivity Slowdown Unprecedented?, National Institute Economic Review, Volume 251.

[3] Ilzetzki, E. (2020), If the UK is high tech, why is productivity growth slow? Economists weigh in, LSE Business Review.

[4] Crafts, N. and T. Mills (2017), Economic models vs ‘techno-optimism’: Predicting medium-term total factor productivity rates in the US, http://voxeu.org.

[5] Brynjolfsson, E., Rock, D. and C. Syverson (2019), Artificial Intelligence and the Modern Productivity Paradox: A Clash of Expectations and Statistics in “The Economics of Artificial Intelligence: An Agenda”, edited by Ajay Agrawal, Joshua Gans, and Avi Goldfarb, National Bureau of Economic Research Conference Report, The University of Chicago Press. The Economics of Artificial Intelligence: An Agenda | NBER

[6] David, P.A. (1989), The Dynamo and the Computer: An Historical Perspective on the Modern Productivity Paradox, The American Economic Review, Vol. 80, No. 2, Papers and Proceedings of the 102nd Annual Meeting of the American Economic Association, May 1990

[7] Sandbu, M. (2021), Building back better must address regional inequality, Financial Times.