A sideways look at economics

I don’t know about you, and call me a curmudgeon if you like, but I do not like paying tax. It hurts. When I look at the tax bite out of my salary, I wince. When I think about the VAT I pay out of post-tax income, I grumble. When I reflect on the corporation tax my company pays out of its profits after it has paid gross salaries and employers’ NICs, I groan. When I pay the tax on dividends (if there are any) on top of that, I whine. And when I fill up my car or try to drown my sorrows in a couple of pints, and see the duty charged on those, well: what happens next is not fit to print.

It’s tax all the way down. It hurts all the way down.

And yet.

Fathom’s tax accountant once told me how, at the start of her career (an unspecified number of years ago), she could fit the entire UK tax code in one large briefcase. Nowadays it would not fit in eight of the same. The tax structure in this country is ridiculously complex: a massive Swiss cheese of loopholes and exceptions, navigable only by highly specialised experts.

That complexity alone is regressive: there is no way that people on low incomes can afford the kind of expertise that can navigate the tax structure efficiently. And it’s also profoundly undemocratic: if none but a very few experts (paid in proportion to the complexity of the system) can understand the tax structure, then no-one is properly democratically accountable for it either. But accountability for taxation is pretty much the number one prerequisite for democratic government, a lesson imparted to us by the American Revolution all that time ago. By the way, an interesting reflection on “No taxation without representation” was taught me when I overheard a Boston tour guide explaining that the prevailing rate of income tax that triggered the Revolution was… drumroll… 1%.

The complexity is also unnecessary. If I were World King (that day will come) then I would reduce the UK tax system to one side of A4. A bunch of duties on things we deem undesirable except in moderation (alcohol, tobacco, and stuff that generates significant negative externalities, like driving). And a single tax rate charged on all forms of income, no matter where or how they are generated. Salaries, dividends, capital gains, inheritance, the lot. Say 40%. Finally, a negative income tax below a certain threshold designed to ensure that everyone is in receipt of the “living wage” at the very least (which would have to be adapted for the number of dependents). So if you earn nothing at all you will receive the living wage as a transfer. And then every pound that you earn, from zero all the way up, will be taxed at 40%. No jumps, no distortions, no loopholes. The incentives to earn more are preserved all the way up and down the income scale. And before you complain that higher earners should pay a higher proportion of their income in tax, reflect that right now the opposite is true. In spite of higher marginal tax rates, higher earners (especially the very rich) tend to pay a smaller proportion of their income in tax, and in the end at the very top that rate reduces to almost zero. That’s because of all the holes in the Swiss cheese. First get rid of those holes, then (if you must) increase the marginal rate for high earners. I don’t think I would bother with the second bit if I could have the first.

If you don’t like it, give me your passport: that’s the deal.

And then left and right can argue about whether the tax wedge should be 30% or 50%, and the electorate can see clearly what’s at stake. If you want a large state vote for a higher tax wedge. If you want a small state vote for a lower tax wedge. Simples. It’s a nice dream; there’s absolutely no chance it will happen.

But other things might happen. The disastrous mini-budget announced by the new UK Chancellor Kwasi Kwarteng included a measure to scrap the top marginal rate of income tax (at 45%) alongside a bunch of other measures. The thinking here was that high earners need better incentives to earn more and, if furnished with those, growth will ensue that will trickle down and make everybody better off. Moreover, that extra growth will help pay for the tax revenues foregone as a result of cutting the tax rate on high earners.

Cutting taxes in and of itself is likely to result in higher growth. But cutting government spending will tend to result in lower growth. And unless lower taxes ‘pay for themselves’ through the large impact they have on growth, government spending will eventually have to be cut. The net effect on growth of lower taxes together with lower government spending is typically pretty close to zero.

Much rests, therefore, on the question of whether tax cuts pay for themselves. They don’t. I and many others have said this before, but it seems like it bears repeating.

The idea that they might was floated in 1974 by the economist Arthur Laffer, who noted that an average tax rate of zero would result in a tax take of zero (a truism) and that an average tax rate of 100% would also result in a tax take of zero because of the impact that would have on incentives. This second point is controversial – it is not clear that if people received no post-tax income themselves as a direct reward for work, but did enjoy the benefits of public provision of goods and services (a kind of communism), then the disincentive effects would be so large that work done would fall to zero. Nevertheless, work would pretty unambiguously fall.

Since the tax take at any arbitrary average tax rate between 0% and 100% is in fact positive, it follows that there must be a curve in place between the two supposed zeros at either end of the tax rate scale: the ‘Laffer curve’. Laffer argued that the US was well beyond the peak in that curve: in other words, that by cutting the tax rate, the overall tax take would increase. Politicians and the rich absolutely loved this conclusion and they still love it: it’s justification for what they feel anyway, that taxes should be lower. It’s having your cake and eating it. It’s like magic. Or, as George H W Bush put it later, it’s “voodoo economics”.

The Laffer curve exists. In some form it must be true. But the policy implication that Laffer drew from it back in 1974, well: you gotta Laff.

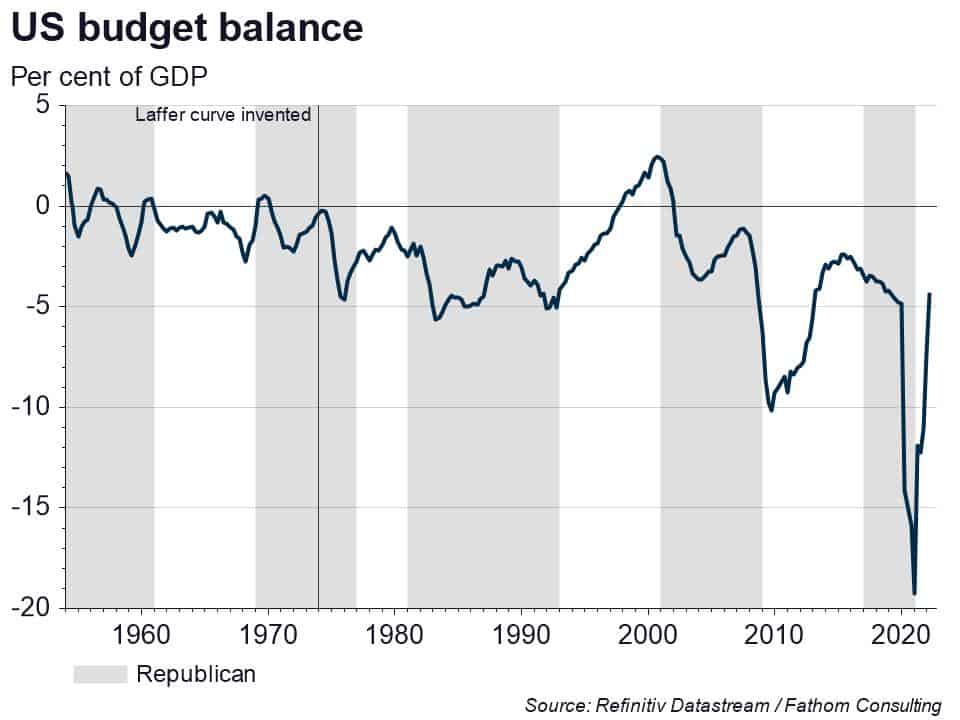

There is absolutely no evidence that cutting the average tax rate yields a higher overall tax take – rather, the reverse. It’s just not true for any advanced economy; and especially for the US, where it was originally floated. The chart below shows how Republican administrations in the US, informed by the Laffer curve, have repeatedly caused the fiscal position to worsen dramatically.

Lower taxes on their own will boost growth, that is true, but not by enough – and that effect will be wiped out when government spending eventually falls, as it must. The disincentive effects of higher taxes are just not that big at prevailing tax rates, as any fule kno.[1] The fact that the Chancellor of the Exchequer apparently does not know this has led to a loss of confidence in UK macro policy in the round: and correctly so. Remedial action is now needed.

Various studies have been done to identify the ‘peak’ tax rate (the average rate that will yield the highest possible tax take). The answer tends to be between 70% and 80%: much higher than the prevailing average tax wedge in almost all advanced economies.

To reiterate: I do not like paying taxes. Neither does anyone else, to my knowledge. So I am not — I repeat, not — advocating an increase in the average tax rate to the peak rate of 70% or more. But it is a mistake to invoke disincentive effects of higher taxes so extreme that cutting taxes would pay for itself, when the average tax take is generally far below that peak. Politicians should stop making that mistake. It’s tiresome in the extreme.

More by this author:

[1]. In the words of Nigel Molesworth, from Geoffrey Willans and Ronald Searle’s Down with Skool!