A sideways look at economics

“On victory, you deserve beer, in defeat, you need it”

Napoleon Bonaparte

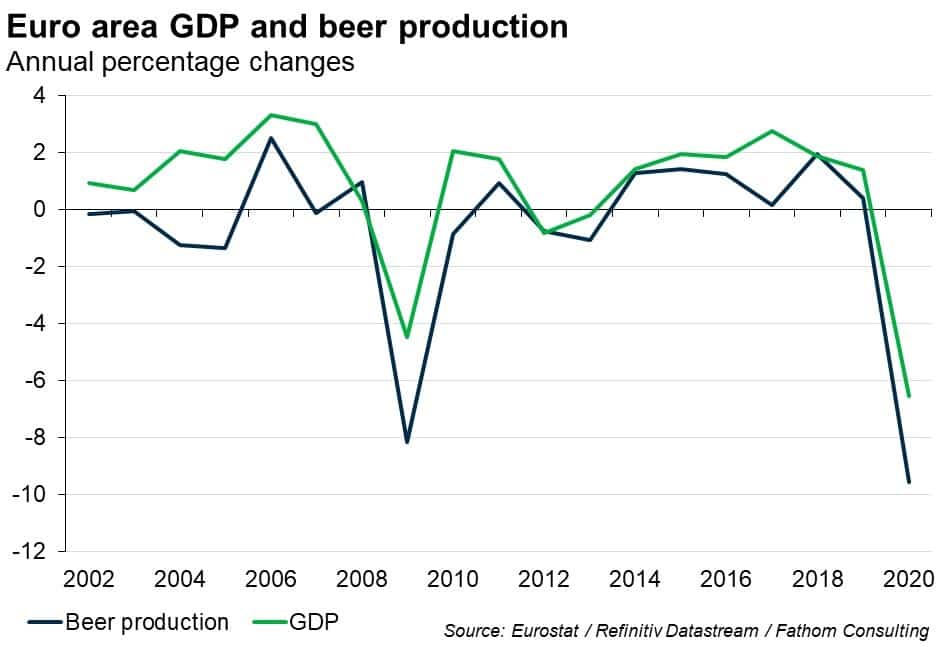

If I gave you £100, how much of it would you spend on beer? The answer you give is your marginal propensity to consume beer (MPCB). If you say “all of it”, your MPCB is 1. If you say “none of it”, your MPCB is 0. It’s that simple. Despite what some might say, previous work for this Friday blog uncovered some evidence that the MPCB is positive at the aggregate level while also introducing Fathom’s Beer IndicatoR of Real Activity (BIRRA). Now, more than a year into the global pandemic, we ask whether the BIRRA is still relevant.

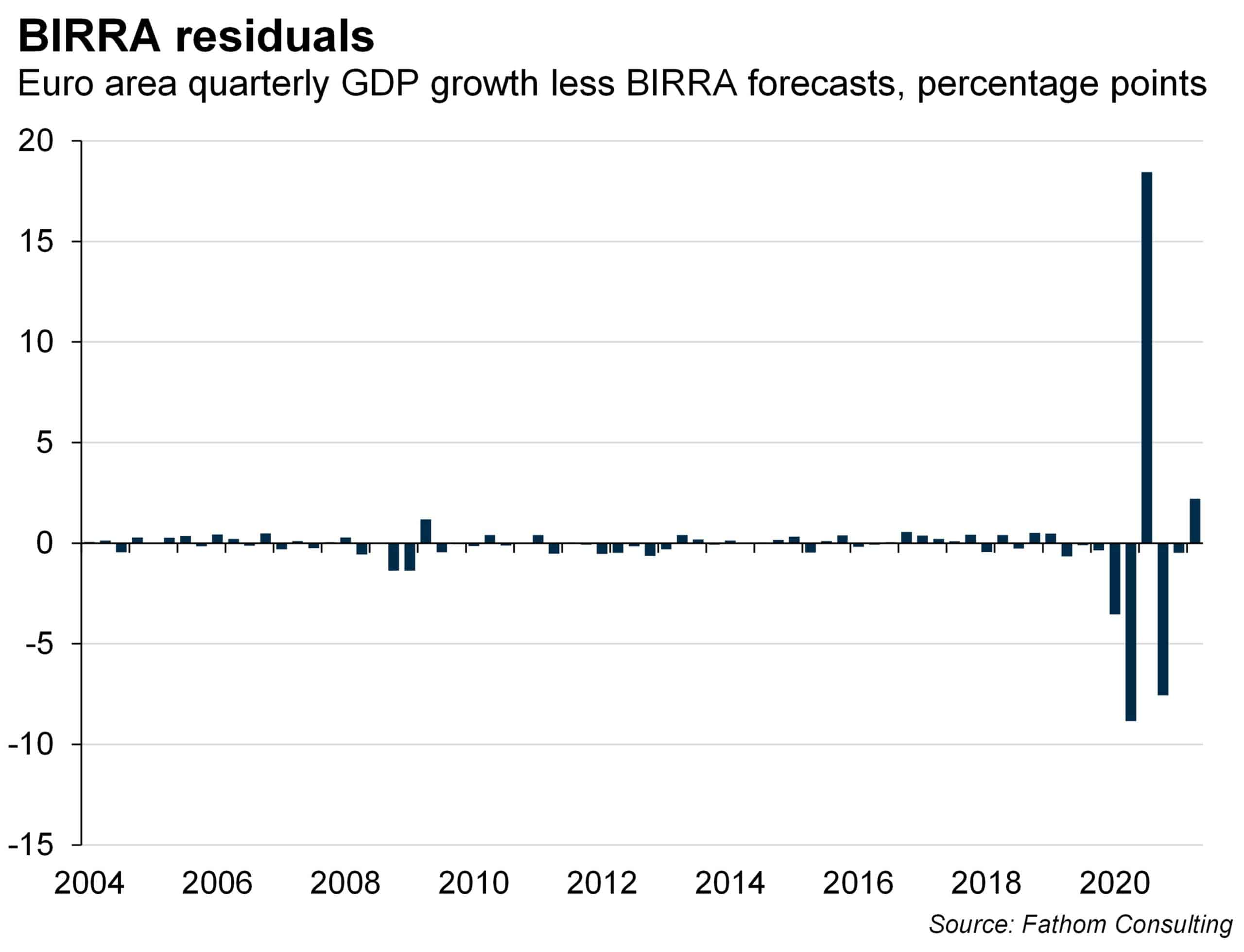

As we highlighted a year ago when we returned to the discussion of beer-onomics, while the BIRRA outperformed a simple PMI-based model in the first two quarters of 2020, it failed to fully grasp the magnitude of the contraction in GDP. Since then, the model’s performance has not improved much (see the forecast errors below). That’s a shame but it’s not entirely unexpected. Indeed, as we highlighted back then, there were several reasons why the apparent relationship might have broken down during the COVID-19 pandemic.

Some might contend that the reason for this breakdown is that the BIRRA was a fluke all long, but I won’t give that argument the benefit of any further discussion here. Rather, I believe we may have stumbled upon a great example of the ‘Lucas critique’. In a key contribution to the field of economic thinking, Robert Lucas argued that parameters estimated in reduced form (that is, relationships that can be observed but which don’t have a strong theoretical underpinning) are likely to vary with time, not least in response to changes in economic policy.[1] In short, if we want to build more robust macro models, we must micro-found them from first principles. This is now the standard for theoretical frameworks such as the New Keynesian model as well as being a guiding principle when Fathom first developed its Global Economic and Strategic Allocation Model (GESAM).

Let’s consider the BIRRA, the observed relationship between European beer stocks and GDP, in this context. Is it surprising that this broke down over the past year? Not really. We estimated a model between price of beer stocks and the level of output in an economy. That relationship could only really hold if: a) the relationship between the price of beer-related equities and the volume of production was constant; b) the relationship between that production and household disposable incomes was constant (i.e., that the MPCB did not vary over time); and c) if the relationship between incomes and GDP was also constant.[2] Clearly, none of these assumptions are likely to be true. For most people, their MPCB probably changed last year. (For some, it may have increased as the lack of alternative pastimes fell while for others, especially those who are purely social drinkers, it probably fell when the pubs closed.) And we know, empirically, that the relationship between disposable income and GDP changed last year. (The former rose in many advanced economies while the latter fell.) In short, COVID-19 should be thought of as a structural break (even if temporary), and models like the BIRRA, as traditionally specified, were always likely to fall foul of the Lucas critique and fail to fully gauge the impact of lockdowns.

So, what to do about it? Well, we could fix this by micro-founding the relationship between beer and total economic activity. It might be interesting but there are probably other, more important economic models falling foul of the Lucas critique (or suffering from other shortcomings) and we should probably fix those first.[3] Even so, it’s Friday afternoon and it’s also International Beer Day. Sounds like my time would be better spent with a pint!

[1] That’s not to say that these models have no use and no predictive power. Rather, as Lucas himself put it “the features which lead to success in short-term forecasting are unrelated to quantitative policy evaluation”. For more, see Lucas, R.E.J. (1976), ‘Econometric policy evaluation: a critique’.

[2] Strictly speaking, the relationship could also hold if brewers were the only producers in the economy — sounds like a fine world!

[3] Looking at you here, Bank of England. Though it is micro-founded, following the assumption that households will respond to the cash handouts of the past year by smoothing their spending over the duration of their remaining lifetimes looks exceptionally odd and not appropriate at the current juncture. Might wanna rethink that one!