An investor’s guide to net zero by 2050

Fathom Consulting and BNY Mellon Investment Management’s pioneering, in-depth report, An investor’s guide to net zero by 2050, sets out in detail for the first time the spending on fixed capital required to achieve net-zero carbon emissions by 2050.

Report at a glance

Achieving the goal of the Paris Climate Accord, and ‘greening’ the world’s capital stock, is arguably humanity’s greatest challenge. The transition could be just as, if not more, transformational than the Marshall Plan, or China’s rise in the 1990s/2000s. Get it right and the payoff to society, and far-sighted investors, can be enormous.

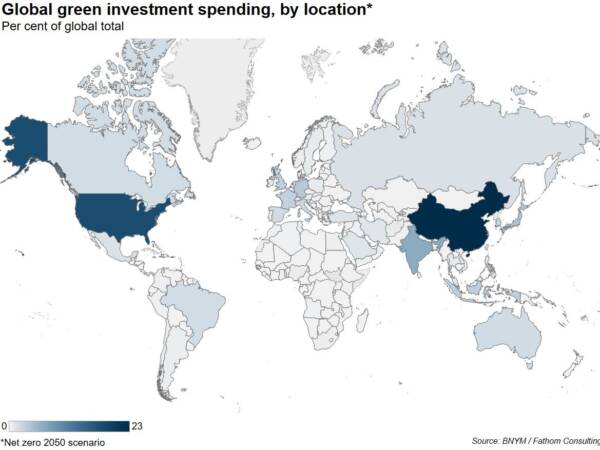

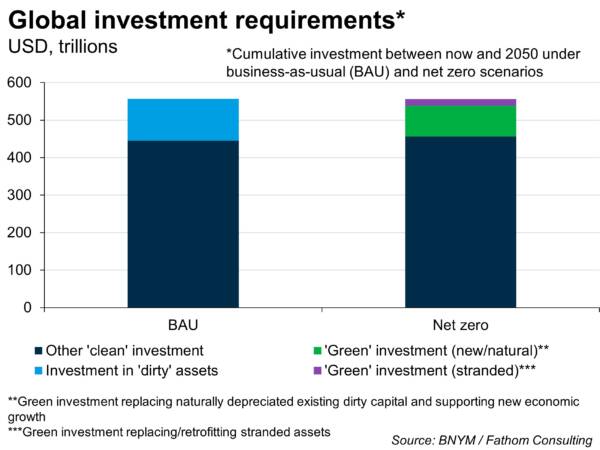

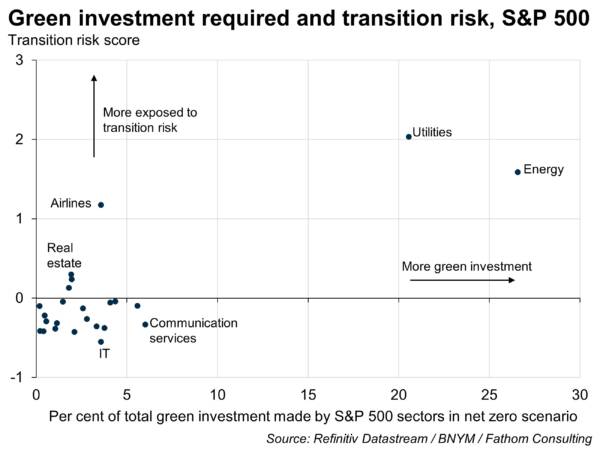

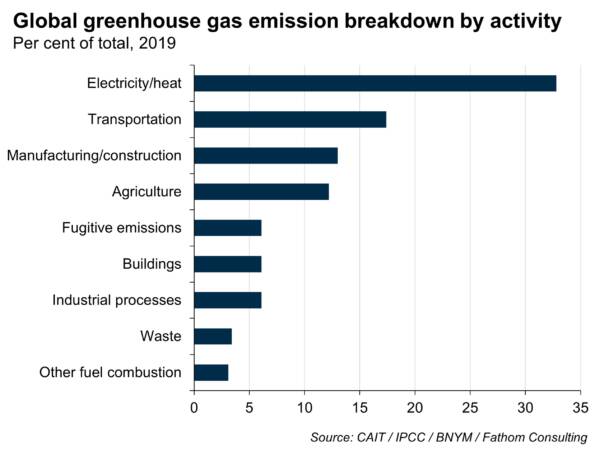

In this report BNY Mellon Investment Management and Fathom Consulting show that a capital investment of around $100 trillion in lower-carbon infrastructure will be required for the world to comply with the Paris climate goal of limiting warming well below 2.0 °C and achieve net zero emissions by 2050. We also show that this investment and, by extension, these targets are within reach. Analysis of investment needs by sector and by country shows that the net zero transition should offer significant opportunities to informed investors. However, despite this positive outlook, one primary obstacle to achieving net zero by 2050 is that around $20 trillion of polluting assets will need to be scrapped or retrofitted: these are referred to in the report as ‘stranded assets’.

“Not only is this investment essential to avoid the potentially catastrophic outcome of continued global warming, but it can also save money, spur economic growth and will create huge opportunities for investors.”

Brian Davidson

Head of Climate Economics, Fathom

“Achieving net zero by 2050 will require transformational investment, but it is attainable. Get it right and the payoff to society and investors can be substantial.”

Shamik Dhar

Chief Economist, BNY Mellon Investment Management

Insights from the report

- 25 October 2022

- 28 October 2022

- 1 November 2022

- 4 November 2022

- 8 November 2022

- 11 November 2022