A sideways look at economics

I’m an expat, or European immigrant, living here in London. Don’t worry, this post isn’t about Brexit. For my frequent visits home, though not as frequent as my Mum would like, I use an Irish low-cost airline (which is the only one which flies direct from London to my hometown). I have paid as little as £30 for a return flight to Germany. While this is good for my wallet, it’s really not great for my carbon footprint. £30 — or 5 pints in Bermondsey — definitely doesn’t represent the true, or social, cost of flying. Partly because of the implications for carbon dioxide emissions, I’m seriously considering taking the train next time. I’m not the only one. According to a recent poll, two-thirds of the members of the UK public surveyed favoured limiting air travel.

Awareness of climate change is growing. Greta Thunberg, a 16-year-old Swedish environmental activist who travels the world (by boat) to raise awareness of the risks posed by climate change, is now favourite to win the Nobel Peace Prize, according to betting odds.

The world of economics has also increasingly recognised potential risks that climate change might entail. For example, in the 2021 biennial exploratory scenario, the Bank of England will stress-test the UK financial system’s resilience to the physical and transition risks of climate change. Physical risks arise from increasing severity and frequency of climate- and weather-related events, such as heatwaves, floods, droughts and sea-level rise. Transition risks emerge from the adjustment towards a carbon-neutral economy. By directly impairing asset values, reducing income and creditworthiness both physical and transition risks can cause economic and financial stability risks.

To assess the potential economic and financial risks associated with climate change economists will have to rely on a well-established methodology: using models to conduct scenario analysis. This will pose dramatic challenges to economic models and modellers.

Fathom’s Global Economic and Strategic Allocation Model (GESAM) is one of five commercially available fully integrated macro models in the world. Every quarter we use this model as a framework to conduct scenario analysis. It’s difficult enough to construct baseline forecasts and risk scenarios projecting two years into the future. By the same token, as one of my all-time favourite TFiFs established (and I’m not only saying this because my boss wrote it and my annual review is coming up), economic forecasters have a poor track record when it comes to economic forecasting, even when making projections only a few quarters into the future. Assessing the risks from climate change implies looking several decades ahead.

Analysing the economic consequences of climate change will require a new generation of economic models. A comprehensive model would have to be able to account for the interaction between economic agents, the economy and the nature.

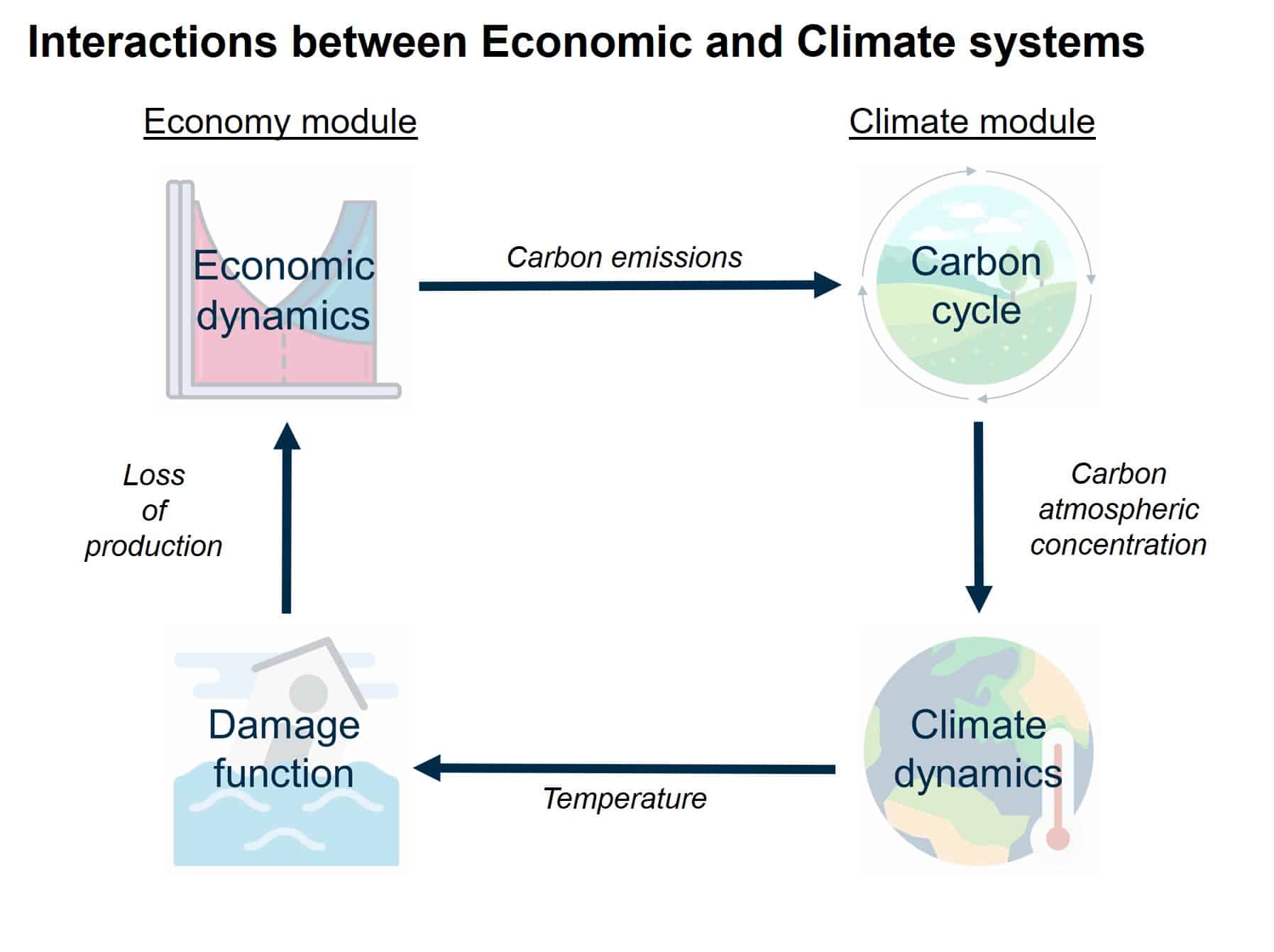

It would have to capture the interaction between economic activity and the amount of global carbon dioxide emissions, and how policy measures affect this relationship. Furthermore, it would have to be able to describe how global carbon dioxide emissions influence the concentration of carbon dioxide in the atmosphere. Then, a model would have to be able to measure how the carbon dioxide concentration in the atmosphere is related to the time path for global temperature, a key measure of climate change. Finally, to close the circle, a model would be required to link changes in global temperature to economic losses.

Source: Ortiz and Markandya (2009) [1] / Fathom Consulting

William Nordhaus won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (more commonly known as the Nobel Prize for Economics) in 2018 for developing a model that can just do that. Time for the economic profession to pat each other or Nordhaus on the back? Unfortunately, not. As Nordhaus himself argues in his book The Climate Casino, climate change models, like his own, have substantial drawbacks. Most crucially, the results are highly sensitive to underlying assumptions, such as the discount rate. Some would say it’s better to light a candle rather than to stay in complete darkness. Arguably, a better metaphor would be the following joke, also referred to as the streetlight effect:

A policeman sees a drunk man searching for something under a streetlight and asks what the drunk has lost. He says he lost his keys and they both look under the streetlight together. After a few minutes the policeman asks if he is sure he lost them here, and the drunk replies, no, and that he lost them in the park. The policeman asks why he is searching here, and the drunk replies, “this is where the light is”.

In light of such uncertainty, the Network for Greening the Financial System — a group of all major central banks and supervisors, less the Fed and the Central Bank of Brazil — advises that “Financial firms should not wait for central banks or supervisors (or others) to deliver some kind of universal, perfect model. Rather, they should initiate their own structured analytical work to identify risks and vulnerabilities, which, successively, can become more and more quantified and sophisticated.”[2]

I agree. Economists could adjust their existing models to capture how transitional and physical effects resulting from climate change would work through the economic and financial system. For example, the capital stock could be measured in such a way as to differentiate between geographical and sectorial allocation of its components, such as dwellings located in areas affected by adverse weather effects or the share of the capital stock of sectors with high carbon dioxide emissions.

Such modifications to existing models, such as GESAM, would allow the running of scenarios assessing the potential economic and financial risk of climate change, for example in the context of the Bank of England’s stress test. A step, albeit small, in the right direction.

I can’t think of a better way than to end this TFiF than with a forecast. Before the human race has either solved climate change or become extinct because of it, economists will earn a lot of money and will be awarded more Nobel Prizes for modelling the implications of climate change.

[1] Ortiz, R.A and Markandya, A. (2009), ‘Integrated Impact Assessment Models of Climate Change with an Emphasis on Damage Functions: a Literature Review’, bc3 Working Paper Series, 2009-06.

[2] https://www.banque-france.fr/sites/default/files/media/2019/04/17/ngfs_first_comprehensive_report_-_17042019_0.pdf