A sideways look at economics

Tired of paying extortionate exchange commission on foreign currency when you go on holiday? Annoyed that there is nothing you can do about it? Read on to understand how and why the Bureau de Change does it to us. It might help ease the pain.

Changing money is the ultimate holiday challenge. What currency do they use there? And how many of those can I get for £1? Where to change it? How much to change? What if I don’t spend it all and I need to change it back? And how much does all this cost?

Thankfully some of this headache has been reduced, owing to the increasing acceptance of bank cards around the world and the emergence of banks that allow you to withdraw cash overseas with minimal transaction costs.

But despite that progress, normally you still need to change at least a little money at a Bureau de Change before you go. Partly for this reason, but mainly because I’m a nerdy economist, I enjoy reading the electronic exchange rate board whenever I pass a Bureau de Change. Checking out the latest rates is interesting, but the most fascinating thing, in my opinion, are the differences in the spreads between the buy and sell rates for different currencies.

This brings me to two main observations. One, is that the breadth of the spreads varies according to the location of the Bureau de Change. And two, it varies on the currency in question. At times, the spread can be as high as 30% or more. This sounds outrageous. But is it? Are all Bureau de Changes evil and looking to shaft us at every opportunity?

Perhaps. Because the spread often reflects the supply and demand dynamics in the location of the Bureau de Change. Unsurprisingly, spreads are higher in airports: there is a limited supply of Bureaux de Change there, and the people that didn’t plan ahead and so are left trying to exchange money at the airport, really need to change their money at the airport (demand is inelastic).

But perhaps not. Because there is a cost involved with holding a currency and being willing to sell it. First, a Bureau de Change needs physical space in which to store the currency and keep it separate from other currencies. Second, by holding the physical currency on hand, the Bureau de Change foregoes the opportunity to place it in a bank and earn interest on it. In theory the higher the interest rate in the country of that currency, the more the Bureau de Change should charge, all else equal. Third, the value of that currency might depreciate, and by holding it, the Bureau de Change loses out. Volatile currencies should, in theory, be more costly to hold and therefore require higher commission from the Bureau de Change.

With this in mind, it occurred to me that Bureaux de Change must consider a range of things when deciding the commission they will charge and setting their spreads. For this TFIF, I investigate some candidates. Can I create a model which explains the spread differential of different currencies?

To do this, I grab the exchange rates of 44 currencies from a well-known Bureau de Change online. I compare these rates against the spot rate on financial markets; the difference tells me the commission charged by the Bureau. Then, I grab the data for ten variables which could explain the different spread for each of those currencies – mainly macroeconomic data about the country in question, but I also include the FIFA ranking of its men’s football team, its popularity as a tourist destination and its trade with Britain. Yes, you read that correctly: the FIFA ranking of its men’s football team.

Three things stood out. First, although included as a joke variable, it appears that the FIFA ranking of the men’s football team does indeed have some explanatory power for the spread charged by the Bureau de Change![1] Generally, the higher the ranking, the lower the spreads. Perhaps I am onto something. Are the quants employed by this Bureau de Change big football fans? Or is the rank of the men’s football team somewhat correlated to a country’s importance in the global economy, and other things that determine demand for its currency? Does this joke variable capture some of those more serious variables?

Second, the variables that we can have most confidence in, insofar as they do explain something about the spread, are GDP per capita and inflation. The Bureau de Change tended to set a lower commission for the currencies of richer countries, and a higher commission for countries that had higher inflation. For example, the commission charged on Turkish lira was nearly 18%. (Inflation in Turkey is currently around 80%.)

Third, I was not able to conclude that daily foreign exchange rate volatility had any explanatory power on the commission. That is strange, because the more volatile a currency is, the more costly it would be for a Bureau de Change to hold it. Perhaps the results would have been different had I measured volatility over a longer time horizon.

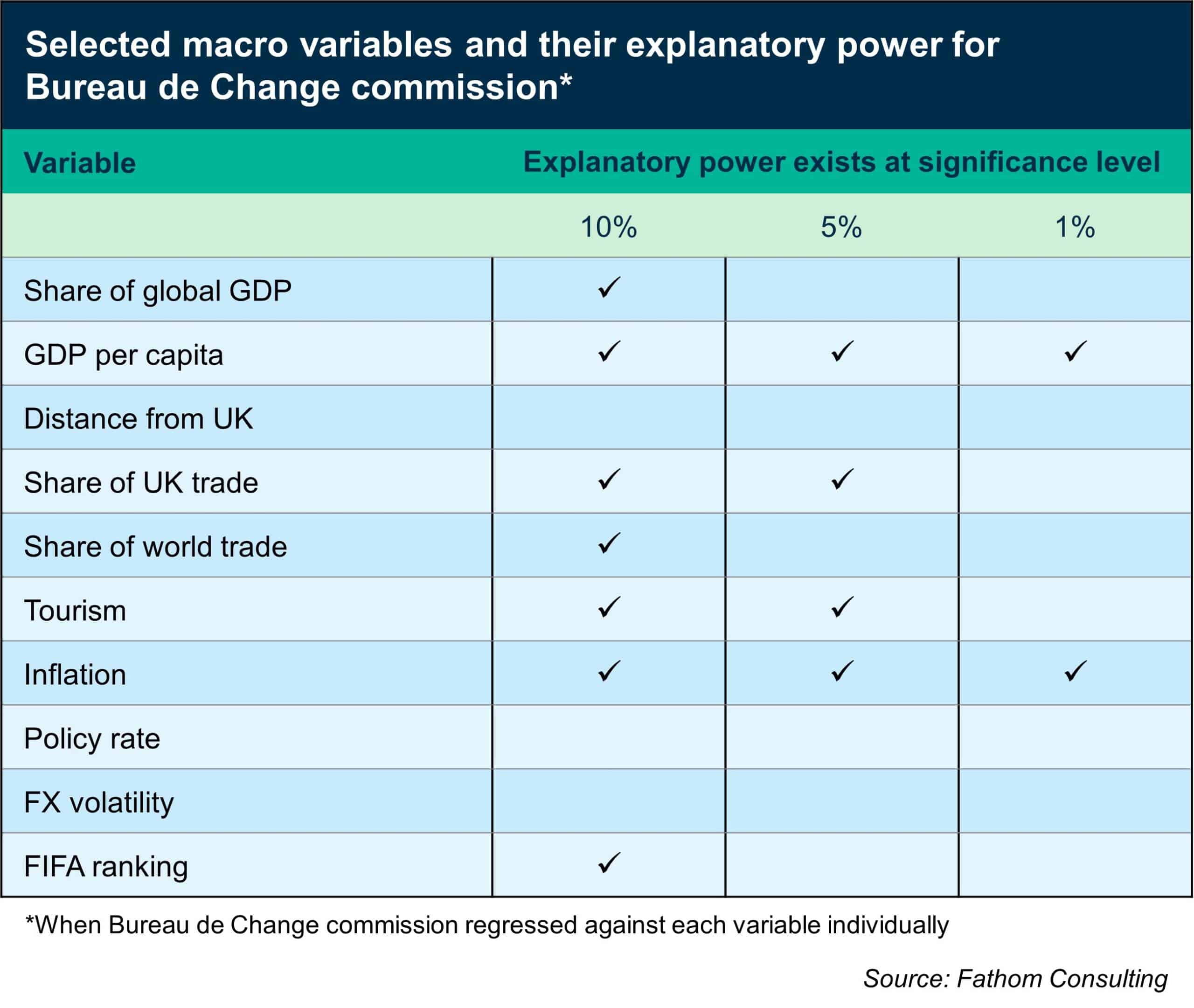

When tested individually (by regressing the 44 currency spreads against each variable), I found that other variables also had explanatory power: some at the 10% significance level (meaning that we can be at least 90% sure that the variable in question can explain something about the difference in spread). Some were at the 5% level, while others had no explanatory power at all. My full results are below.

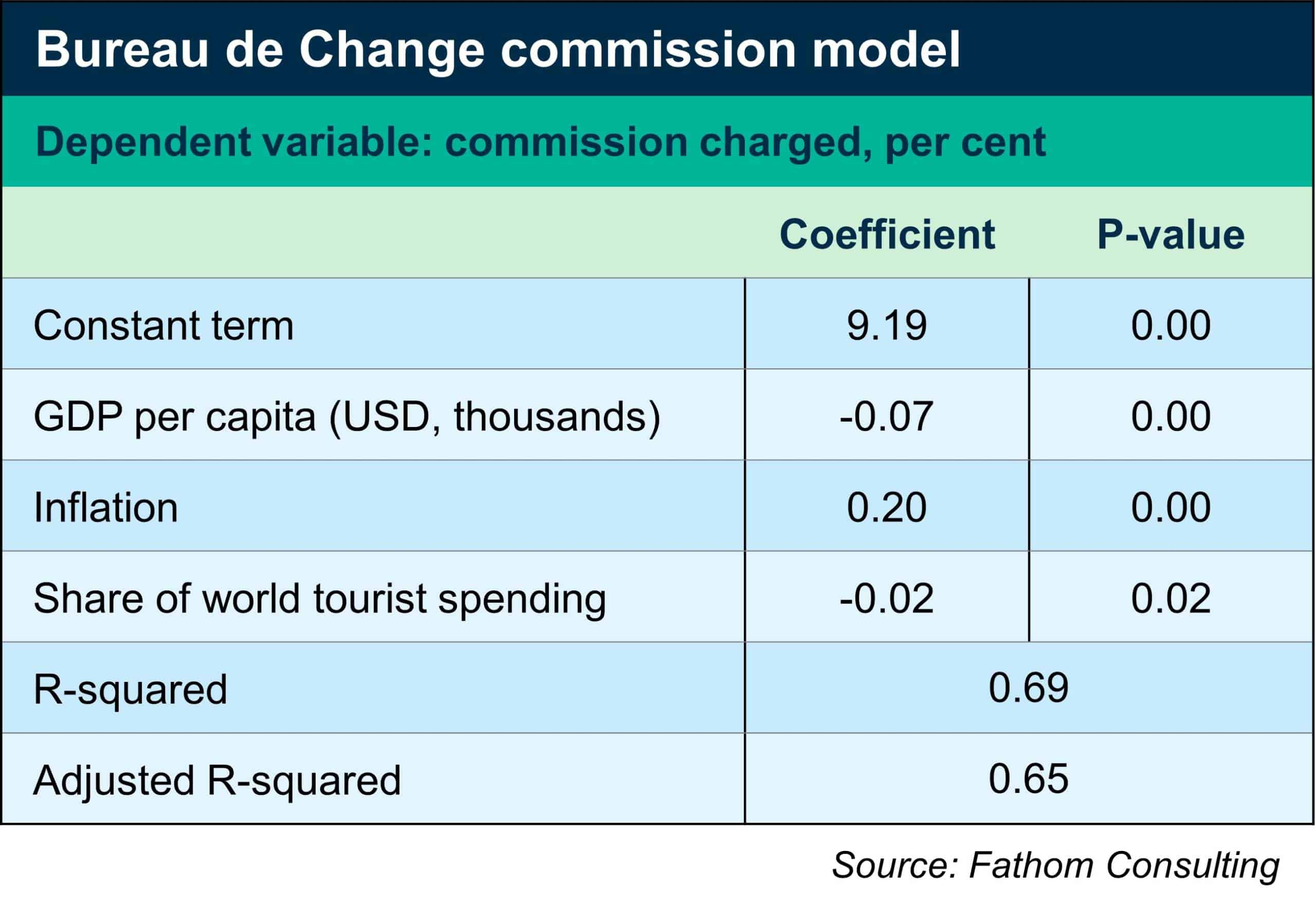

When all ten variables are considered together, the model has explanatory power (i.e. an adjusted R squared) of around 60%, even though only one of the individual components had a statistically significant coefficient in this model. In other words, together, these variables explain more than half of the observed spread. That is a decent number in any econometric equation, although I was hoping for and expecting a little more.

Dropping the FIFA variable didn’t change the explanatory power of the model. In fact, it turns out that dropping all variables except GDP per capita, inflation and tourism, resulted in a higher adjusted R squared. That model explains around 65% of the Bureau de Change commission. Not bad.

In conclusion, if you want to avoid an FX shafting altogether (and who am I to say what’s a good motivation for choosing your holiday destination), pick a rich country where lots of well-off tourists go, which has low inflation and regularly gets to the knockout stages of the FIFA World Cup. If, however, you prefer to holiday in an edgier destination off the beaten track and feel like you’re getting shafted at the Bureau de Change, you can console yourself with the knowledge that three macro variables can explain 65% of the hefty commission you pay. After all, running a high-class Bureau de Change is no easy task, as proved by the video below, and I’m sure their quants have good reasons which can explain the remaining 35%.

[1] It did at the 10% significance level

More by this author