A sideways look at economics

It may be a coincidence that the results of the EU banking stress tests are scheduled for publication as soon as the closing bell sounds at the New York Stock Exchange later today. Whether this timing was planned or not, at least it will give investors and EU decision makers ample time to decide how to react, or panic, before financial markets open on Monday morning.

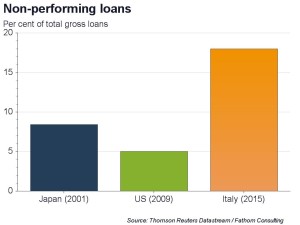

It may be too late to avert an Italian banking crisis whatever the results. Alas, non-performing loans (NPLs) make up nearly 20% of total gross loans at Italian banks, which is much higher than the share of NPLs reported in Japan or the United States at their respective peaks in 2001 and 2009.

The IMF reckon that around €360 billion are needed to clean up the Italian banking system. But who will pick up the tab? New EU rules require a ‘bail-in’ of creditors before state funds can be used. Around a third of those creditors are ordinary Italian citizens. Forcing losses on them would risk their wrath at the ballot box at an important referendum later this year.

Protecting ordinary Italians, and making institutional creditors take the hit, would be politically more convenient but risk the wrath of investors and potentially starve the economy of badly needed capital. If the Italian government foots the bill, its precarious credit profile will weaken even further. This, in turn, would weaken the credit quality of Italian commercial banks since they hold Italian sovereign debt. The Atlante fund is a step in the right direction, but is insufficient. The words ‘rock’, ‘hard’ and ‘place’ come to mind.

The good news is that EU and Italian policymakers know the risks. Better news still, they have some scope to kick the can further down the road. The bad news is that the day of reckoning will eventually come.