A sideways look at economics

In my eleven years in the UK, every hot, sunny spell has increased my appreciation of the links between the weather and human behaviour. On these days: supermarkets will sell out of disposable barbecues before I manage to get hold of one; a surprisingly large proportion of men will remove their shirts and turn a painful red as the day progresses; ice cream vans will be nowhere to be found; usually calm drivers will be doing their best to boost government revenues from speeding tickets; the government will use the fine weather as an opportunity to bury bad news, and sneak out unpopular announcements; road rage incidents will proliferate and fights will erupt between neighbours, making work for lawyers. Last week’s heatwave made me appreciate another behavioural phenomenon which I had previously overlooked: the tendency for stock prices to be higher on sunny days.

While working on charts last week, I noticed that the FTSE All-Share index was higher week-on-week without any notable corporate or macroeconomic reason. The only major, underlying difference my brain was able to conceive of in the greenhouse-like temperatures of my house was, in fact, the sun itself! I realised that this was arguably a biased thought, and so went in search of some academic literature that might support such a connection between the sun and the stock markets.

I didn’t have far to look. At least one academic study has observed that even when one controls for possible confounds, stock market returns are slightly higher in warm weather. Hirshleifer and Shumway (2003) noted that sunshine was positively correlated with returns from 26 stock markets over 15 years. The authors cite evidence from psychologists that sunshine tends to lead to increased tipping (Rind 1996) and lack of sunshine to depression (Eagles 1994). Therefore, Hirshleifer and Shumway argue, people feel good when the sun shines, and when they feel good, they are more optimistic and may be more inclined to buy stocks — thus leading to higher stock prices. In other words, it appears that sunshine raises mood and increases optimism that the conditions in the world are good. And if the world is in a good place, it makes sense to take some risks to grasp higher rewards by investing in stocks.

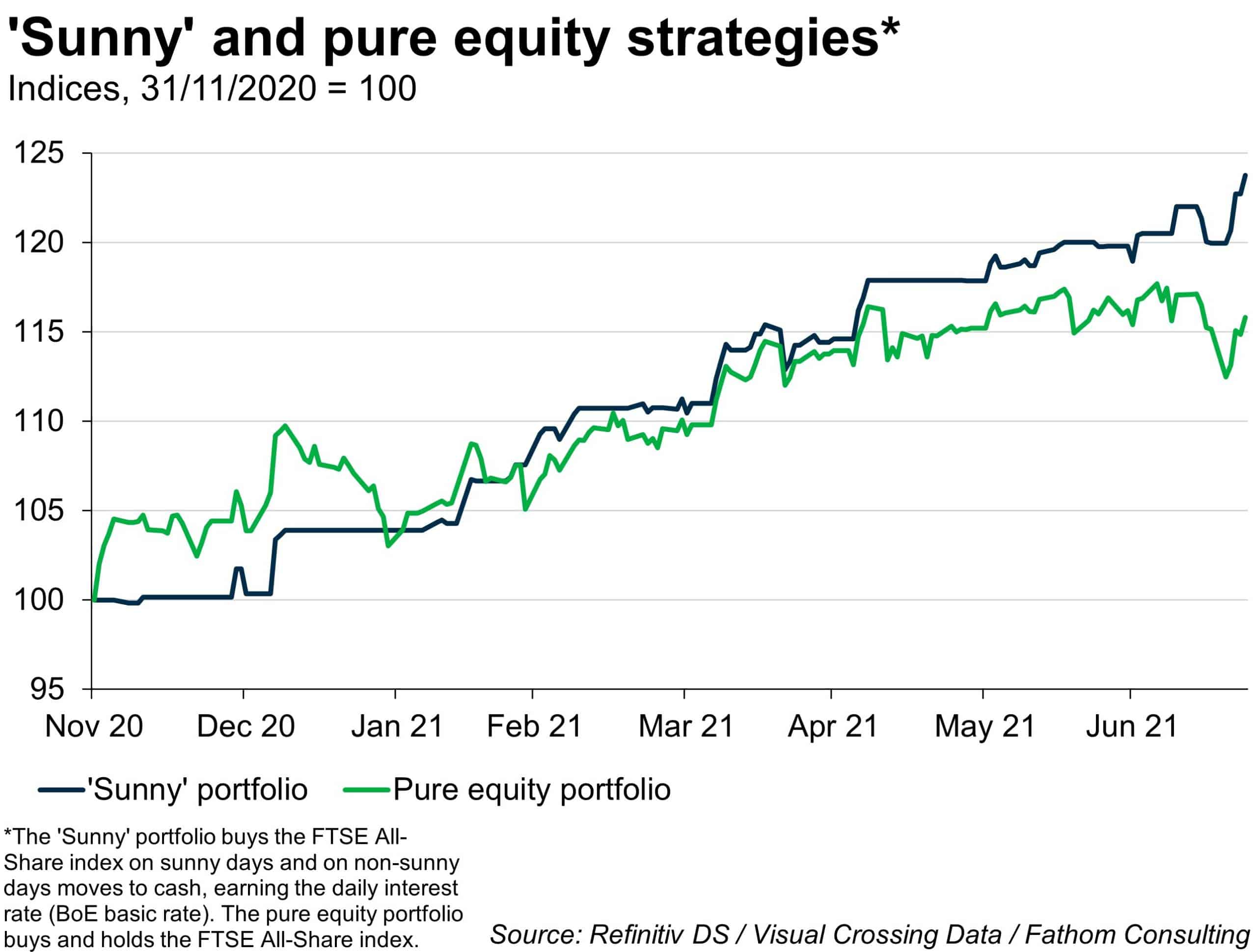

So far, my hunch was being borne out. But this research used data that were more than 20 years old. I therefore thought it prudent to corroborate them with some analysis of my own. Following Hirshleifer and Shumway and employing daily weather data for London from 30 November 2020 to 23 July 2021, I classified days as sunny or not based on cloud cover (less than 25%), controlling for rainy conditions and visibility. Then, I created a trading strategy (‘sunny’ portfolio) which bought stocks (FTSE All-Share index) on sunny days, and on non-sunny days moved to cash and earned the daily Bank policy base rate. My strategy effectively acted on the proposition that people feel more optimistic on sunny days and become risk-takers, buying stocks and thus pushing stock prices higher. On cloudy days people become risk-averse, moving into the safety of cash.[1] The benchmark against this strategy was a pure equity portfolio that bought and held the FTSE index.

Plotting the prices of these competing portfolios showed that investing 100 GBP in the ‘sunny’ portfolio on 30 November 2020 would have paid 124 GBP on 23 July 2021, eight GBP more than the pure equity portfolio over the same period. There were several other statistics worth mentioning. 41% of the sampled days were sunny, and 66% of those exhibited positive returns, which the sunny portfolio capitalised on thanks to the sunshine-related trading signal. For the remaining 59% of the sample, the sunny portfolio moved into cash, avoiding negative returns which occurred with 50% frequency during those (non-sunny) days. The bottom line is, there did indeed seem to be a relation between sunny days and higher returns. Contrasting the sunny portfolio with its counterfactual on non-sunny days, i.e., the pure equity portfolio, seems to suggest a relationship between cloudy days and lower returns.

I enjoyed this potential eureka moment, and then tried to organise the (possibly spurious) insights I had gained. The chart results were consistent with the view that optimism about better stock performance is widespread on sunny days, and that hope on these days tends to be self-fulfilling. The results also suggested that ‘bad’ returns tend to happen on cloudy days — but I decided to take that with a grain of salt, as related research has yet to back this up. In general, the results of my analysis might be circumstantial (due to the small sample period), full of caveats (e.g., high transaction costs) and subject to different explanations (e.g., day of the week effect, Sell-in-May-and-Go-Away effect). If anything, however, they prompted me to contemplate the following: any upward or downward equity market movement may have been exacerbated by the influence of sunshine, or the lack of it, on investors. That can be the case even if the direction of the move is justified by changes in fundamentals and the macroeconomic outlook.

What is the “so what” for you, dear reader? What have you learned from this experiment? You certainly have not learned that you should invest in stocks, or any risky asset for that matter, based on a sunny/non-sunny dummy. However, I think it is safe to conclude that whenever you feel that it’s time to raise the stakes, and the weather outside happens to be glorious, it is worth double-checking the rationality of your analysis, and considering whether the sunshine has made you jot down quantities on the order sheet that are possibly rather high. The same applies in the opposite case: check whether you are feeling unduly risk-averse on a gloomy day. Overall, the main thing I learned from this exercise, and hope that you did too upon reading this piece, is how irrational we can be when making complex decisions; and how we tend not to notice when we are being irrational, but instead attribute our beliefs to something more plausible — like the idea that stock prices are rising because the world is in a good place.

[1]This is a simplification and conservative, as people can equally move to the less risky fixed income or gold that can additionally offer higher returns than the base rate. Nevertheless, moving into cash and earning a minimum deposit rate is not a novel idea. The same strategy was employed by academic literature investigating whether selling stocks at the start of May and moving into cash, and then buying again stocks towards the end of October (the so-called Sell-in-May-and-Go-Away trading strategy) was profitable compared to a buy-and-hold equity strategy. For more details, see Dzhabarov C. and Ziemba W. (2011), Chapter 9: Seasonal anomalies in L. Zacks (ed.) (2011), The Handbook of Equity Market Anomalies: Translating Market Inefficiencies into Effective Investment Strategies, John Wiley & Sons, Hoboken, NJ, pp. 205-264.