A sideways look at economics

How might an individual react if, at the end of some arbitrary accounting period, they find themselves with more cash in the bank than they had hoped for? A happy position to be in, right?

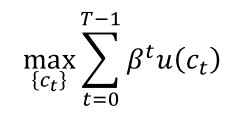

When trying to answer these sorts of questions, economists tend to wheel out the tried and tested ‘lifecycle consumption model’ (or LCM). This says that an individual will use their expected lifetime resources to consume goods and services, period by period, in a way that maximises their expected lifetime happiness. In algebraic terms, they will solve the following problem:

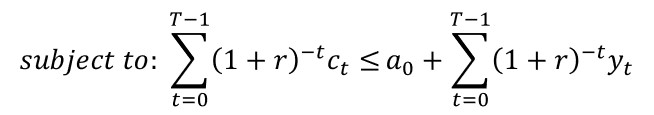

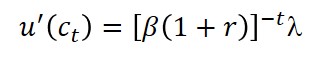

They choose a path for consumption through time, ct, to maximise the discounted value of future utility, which in turn is a function of future consumption. This is carried out subject to a lifetime budget constraint, which says that the present value of future consumption cannot exceed the sum of initial assets (a0) and the present value of future labour income (yt). β tells us about an individual’s rate of time preference, the extent to which they discount future happiness. It is usually assumed to be less than one, as humans are typically impatient, tending to prefer ‘jam today’. r is the common rate of interest, earned on savings and paid out on loans. By setting up an equation known as the Lagrangean, it can be shown that the solution to this problem requires:

This tells us that the marginal utility from an extra unit of consumption at time t will be a function of the product of β and (1+r), and the Lagrange multiplier, λ, which measures the value of an additional unit of lifecycle wealth.

One rather neat result is that if the interest rate precisely matches the rate at which an individual discounts their own future happiness, their consumption should be constant over time[1]. Equally, and to return to my opening question, if that individual is fortunate enough to win the lottery, say, and ends up with far more cash in the bank than they had imagined when they last sat down and mapped out their finances, the LCM tells us that they will not spend it all at once. Instead, they will smooth the benefits over the remainder of their lifetime. If they expect to live for another 30 years, say, they will spend precisely one thirtieth of their new-found wealth each year.

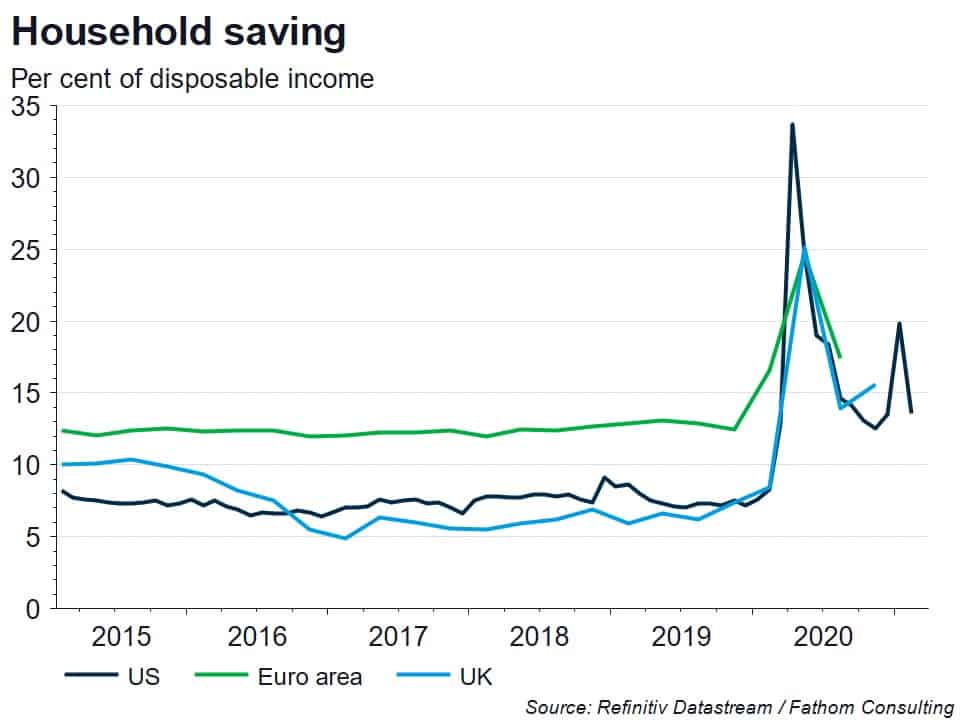

“What is the relevance of all this?” you may (or may not) be asking. Thanks to the pandemic, many UK households, in common with many households elsewhere in the world, got to the end of 2020 to find they had managed to save substantially more of their incomes than they might have imagined at the start of the year. To put some figures on it, we estimate that, by 2021 Q1, UK households had excess savings pots – by which we mean savings that they would not have planned to hold had it not been for the pandemic – of more than £150 billion. What will they do with all this money? Well, the view of the Bank of England’s Monetary Policy Committee, based very much on the kind of analysis set out above, is that they will spend only the annuity value of what policymakers are treating implicitly as a windfall gain. More specifically, they will consume the extra savings gradually, spreading them out over the remainder of their lifetimes, and spending just 5% over the next three years.

This just feels wrong to me. It doesn’t pass the smell test. The LCM is elegant enough, but it’s an economic model. And as with all economic models it’s a case of horses for courses. The savings balances built up during the pandemic, in the UK and elsewhere, were not ‘manna from heaven’. They were not windfall gains, in the way that the proceeds from the demutualisation of several UK building societies in the late 1990s might have been viewed as windfall gains[2]. These excess savings pots were acquired steadily through the year as households made the best of a very difficult situation. They were an endogenous response to a dire set of circumstances. Effectively prohibited from consuming their typical basket of goods and services, households chose to sit it out, to wait until the pandemic was over. They could have bought other things instead. They could have substituted the money they couldn’t spend on eating out, on holidays, on what the Bank of England has described as ‘social consumption’, for expenditure on things that were allowed, such as goods. But they did not, because they are not close substitutes.

Casting aside economic models, I decided to survey my colleagues at Fathom. Had they managed to save more than usual through last year? And if so, what did they intend to do with the proceeds? Most felt they had saved 10%-20% more of their post-tax incomes than usual, with a few saving more than that. Around a third planned to keep most of their newly acquired wealth in the form of savings indefinitely, in some cases to put towards the deposit on a house. This is broadly consistent with the textbook LCM. But a further third of respondents planned to spend most of their savings on things they were unable to enjoy during the pandemic, with the remaining third planning to do a mixture of the two.

Time will tell whether the Bank of England’s textbook approach to these excess savings pots is right. But as we have been telling our clients during an ongoing series of forecast presentations, the risks to their rather cautious projections for consumption surely lie in one direction. My sense is that 2021 will be a bumper year for purveyors of UK holiday accommodation, and other indulgences previously forbidden, that are in relatively fixed supply.

[1] The maths is made much easier if we assume that the interest rate precisely matches the discount rate, and that an individual knows with certainty how long they have left in this world. If we relax these two assumptions the most important result, namely that an individual will attempt to smooth the benefits of any unexpected increase in their assets over what they believe is left of their lives, still holds.

[2] And indeed were viewed in just this way by the then MPC – see box on page 22 of the February 1997 Inflation Report.