A sideways look at economics

Spearheaded by huge youth movements such as the global climate strikes led by Greta Thunberg, the climate change debate looks set to be one of the big issues of this decade. And, as with most promising trends set by young people, baby boomers and large institutions are scrambling to catch up. So too the financial sector; ‘ESG’ (Environmental-Social-Governance) is the new buzzword for investors and managers alike, with ESG-related data offerings, seminars, conferences and news articles springing up like mushrooms. On the face of it, sating investors’, policymakers’ and consumers’ appetite for sustainable and ethical solutions with a deluge of data appears to be an important step in the right direction to provide the tools needed to tackle the severe risks posed by climate change. Just re-route capital to highly ESG-compliant firms, buy ‘green’ products and the problem will solve itself! However, as is almost inevitable when offering straightforward, neatly packaged solutions to complex issues, the ongoing flood of environmental initiatives risks masking uncomfortable choices.

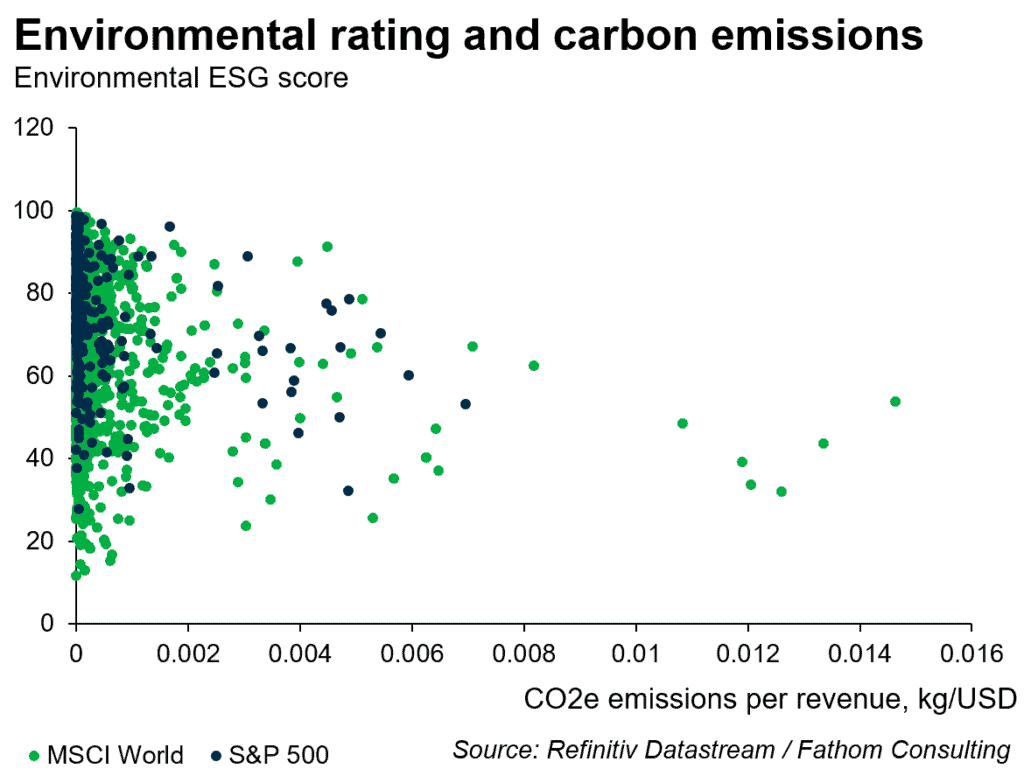

Numerous platforms claim to condense a bewildering array of often qualitative indicators into a single quantitative ‘environmental’ (or combined ESG) score. However, doing so discards very important nuances that emerge from the underlying data. For example, Exxon Mobil, one of the world’s largest oil companies and major carbon emitter, is given an environmental score nearly twice as high as Tesla, a pioneering manufacturer of emissions-free electric cars on one ESG database. Can that be right? In fact, it turns out that aggregate ESG ratings do a fairly poor job at conveying specific, albeit important details. Take CO2 (and equivalent greenhouse gas) emissions. Not only do they contribute significantly to climate change, they also attract the ire of consumers and are squarely in the crosshairs of regulation in the form of carbon taxes. Nevertheless, CO2e emissions don’t correlate very highly with ESG rankings.

While there is a vague negative correlation discernible, the fit is unimpressive. In fact, chemicals manufacturer Linde is one of the 5% most polluting companies in developed nations, but also manages to place in the top 5% of most sustainable companies according to this ESG rating. Picking investments blindly according to these oft-touted ESG tools could easily be counter-productive in trying to achieve environmental excellence.

How are such wild discrepancies between a relatively foolproof indicator of environmental impact and an ostensibly objective ESG indicator possible? Is ESG doomed to be a rightfully short-lived trend that succumbs to its inaccuracies? Perhaps the biggest reason for the unsuitability of ESG indicators is a troubling lack of clarity, both on the part of users and perhaps even on the part of creators, about the objectives of ESG indices. On the one hand, environmental scores are seen as a way to quantify companies’ environmental impacts. As such, they are used by impact investors looking to fund companies with the largest potential for turning the tide on climate change. However, many ESG tools are calibrated as risk management tools that evaluate a company’s ability to mitigate and manage company-specific environmental and often publicity- or regulatory-related risks. To an investor seeking to maximise returns and avoid the volatility of sharp sell-offs, ESG scores are a useful tool. However, as a way of addressing the wider issues created by environmental damage or corporate misconduct, most existing ESG tools are likely to be inadequate.

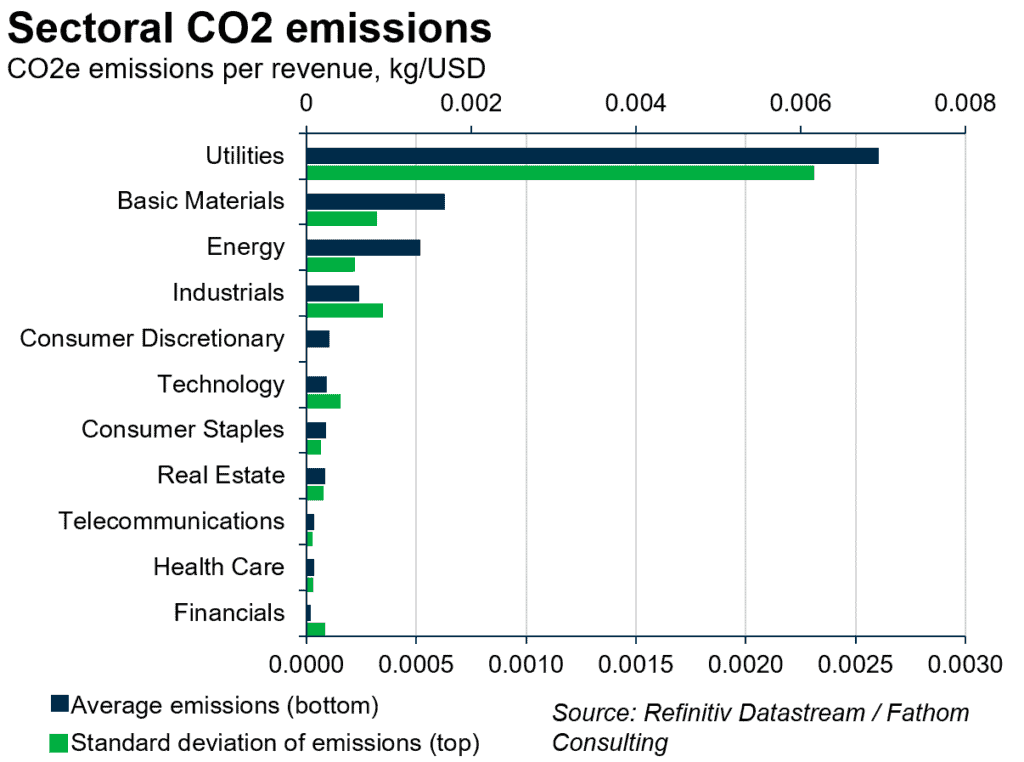

Even an accurate indicator won’t necessarily address how to solve the problem. For example, it matters how ESG scores are benchmarked. While certain sectors fare significantly worse on objective measures of environmental impact than others, there’s also a significant intra-sector variation of sustainable practices. An ESG-based negative screening investment strategy focusing on absolute environmental impact would probably shun entire sectors such as oil and gas. On the other hand, a compelling argument could be made for incentivising genuine best-practice relative to industry peers. An oil driller investing 20% of its revenues into renewables might be emitting far more CO2 than an online services company but could also have a much more potential to abate climate change. A single ESG rating will unequivocally fail to capture this.

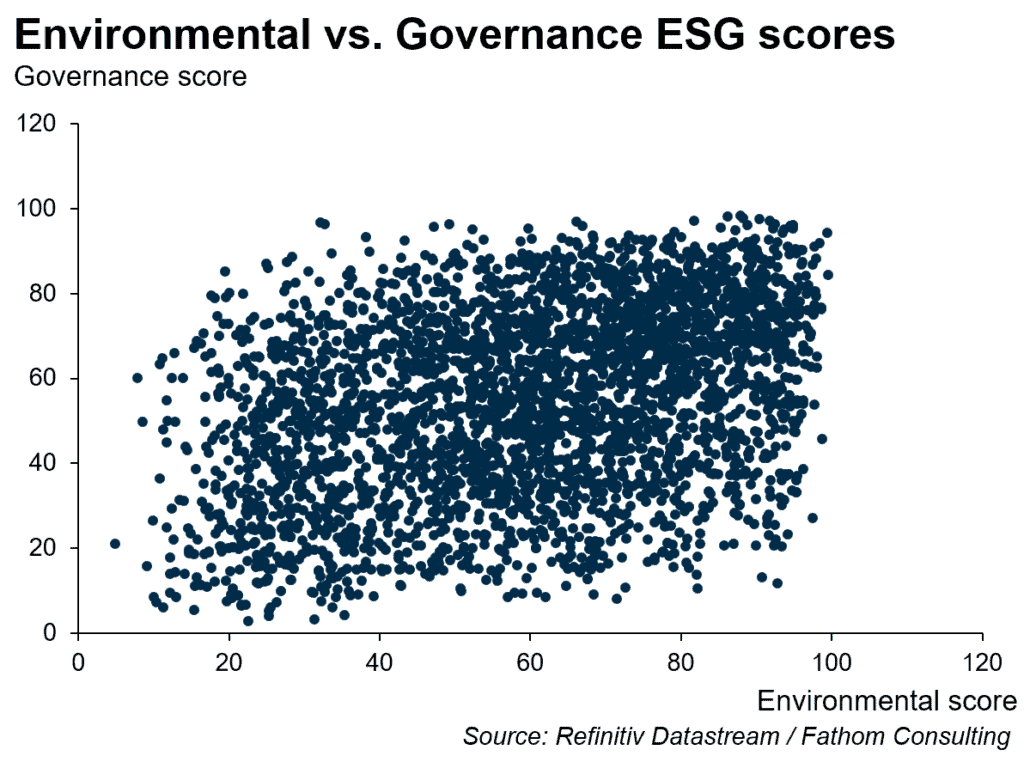

Another choice inherent in ESG is hiding in plain sight, in the name. ESG combines three related yet distinct concepts: environmental sustainability, social responsibility and robust governance. While far from mutually exclusive, the three don’t necessarily have a strong relationship with one another. To the extent that prevailing ESG scores reflect an ability to manage risks, all three ESG scores might reflect an ability for ‘box-ticking’. However, besides a heightened level of concern for non-monetary performance, there are no intuitive reasons why strong performance in one category should be related to the others. Existing ESG reports confirm this. The chart below shows the relationship (or lack thereof) between the ‘governance’ and ‘environment’ scores across all countries.

Only 1% of MSCI World companies fall into the top 10% percent of each of the E, S and G categories. And one-fifth of the top quartile of ‘governance’ companies are in the worst quartile of either ‘environment’ or ‘social’. While it’s theoretically possible to select that 1% of stocks that is ethical across the board, such a portfolio is likely to be undiversified and risky. The implication isn’t that capturing ethical business practices is doomed to failure; but instead that it’s important to pick one’s battles carefully and using broad composite indicators to conduct clumsy screening processes is unlikely to be very successful.

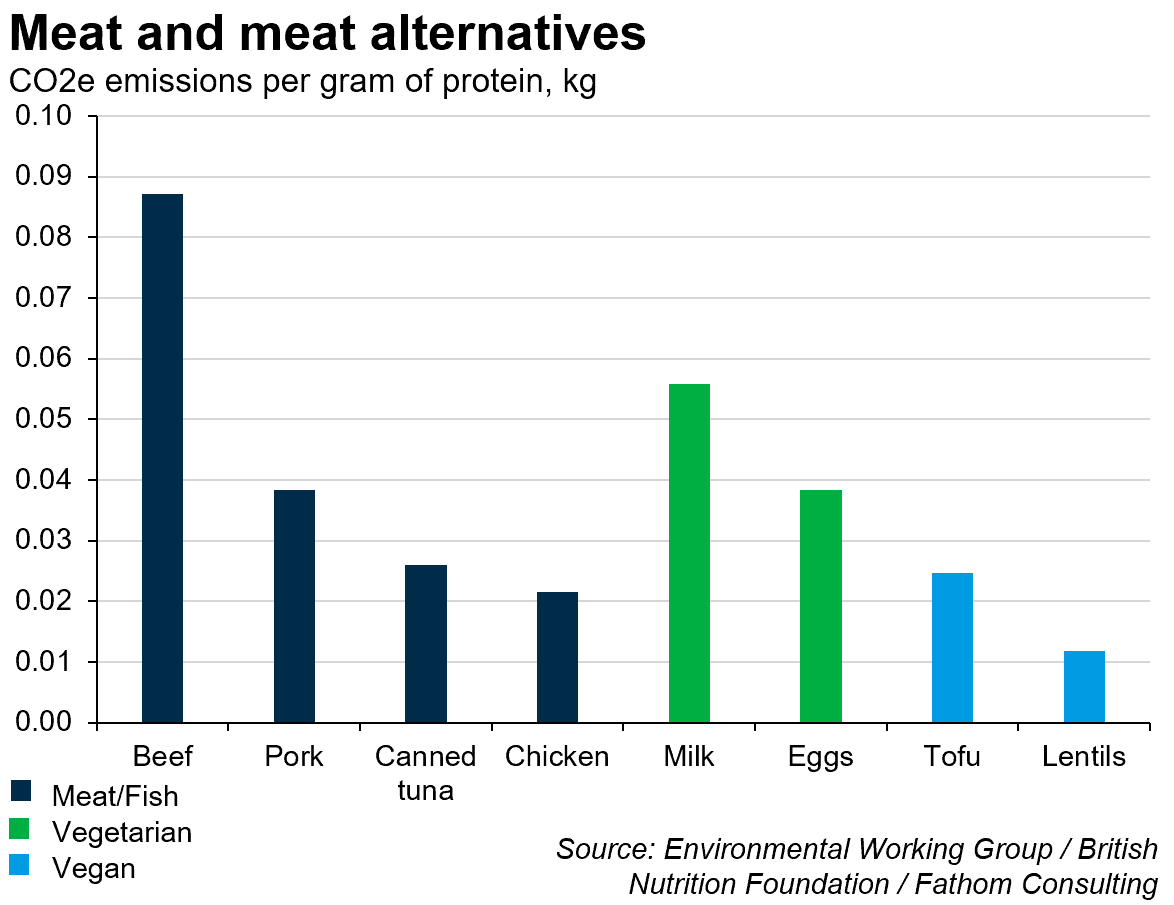

Difficult choices on how to make an impact exist not only for investors on a corporate level, but also for consumers in our everyday lives. Having well-meaning intentions to help save the environment is admirable; going a step further and doing something towards that goal even more so. However, the challenge doesn’t end there; the bigger difficulty may lie in deciding how to act. Among the plentiful advice on how to ‘go green’ with which consumers are bombarded lurk complicated details and unexpected trade-offs. An increasingly popular lifestyle choice especially in the wake of New Year’s resolutions and ‘Veganuary’ is reducing meat consumption, under the premise that meat-free diets are generally kinder to the planet. Due to far inferior resource utilisation (including land, water and energy), research has found that the production of commonly eaten meats such as beef emits nearly 50 times as much greenhouse gases per calorie of energy consumed than plant-based alternatives such as tofu.[1] However, part of a balanced diet is a varied intake of macronutrients (protein, carbohydrates and fats); and as a source of protein, some animal products are surprisingly efficient.

Chicken emits less CO2 per gram of protein than some vegetarian food and even some vegan alternatives, suggesting that meat products needn’t become entirely obsolete in a balanced yet environmentally friendly diet.

We face other dilemmas around the dining table, too. Once touted as the benchmark for ecowarriors everywhere, organic produce greatly reduces pollution from pesticides and encourages biodiversity. However, due to less efficient land usage, organic foods also tend to have a larger carbon footprint. In a world that’s still plagued by famine and food shortages (albeit largely due to distributional rather than capacity issues), insisting on less efficient production in the name of ecosystem welfare could create tensions between the social and environmental pillars of the ESG framework. The trade-off between various aspects of environmental stewardship isn’t limited to the food chain. As awareness around the impacts of plastic pollution, especially on marine wildlife, continues to grow, consumers and in response businesses are finding innovative ways reduce plastic in daily usage. However, these laudable efforts in championing eco-diversity may come with unintended consequences. Studies have shown that alternatives to single-use carrier bags need to be reused hundreds to thousands of times to have a lower environmental impact (depending on the metric used, such as emissions or pollution), due to more resource-intensive processes used to produce a more durable bag. An organic cotton tote bag might look trendy and impress your woke friends, but could also have contributed more to climate change than if you had taken a 5p carrier bag and re-used it as a bin liner. The same issue applies to alternatives to the plastic bottles which often end up as litter in the world’s oceans. Glass bottles can be recycled but require more fuel to transport due to their heavier weight. Recyclable aluminium cans are also more energy- and emissions-intensive in their production. The extraction of bauxite, the primary input to the production of aluminium, takes place in developing countries with lax human rights enforcement and can result in the exploitation of the local population. Human suffering surely can’t be a price worth paying just to find an easy fix to the pollution problem.

The corollary of the complex decisions that face all sectors of society must not be inaction. The mantra that ‘the worst thing to do is nothing’ holds as true as ever; just because consumers, businesses and policymakers are faced with difficult choices should not lead them to fear making them. Just because ESG offerings as they stand don’t provide us with the optimal tools to mitigate environmental risks in the aggregate doesn’t mean those problems can’t be solved, although just buying the latest ESG tracker fund and hoping for the best won’t get us far. Recognising that using blunt tools to approach complex problems doesn’t work is the first step to sharpening those tools. In fact, recognising the difficult trade-offs inherent to these problems should spur us to put even more effort into setting informed priorities and then make decisions based on relevant information. That’s why climate change is one of the central themes of our upcoming 2020 Q1 GEMO, where we’ll aim to look through the noise surrounding this crucial issue and provide some insight into how it matters.

[1] See for example https://static.ewg.org/reports/2011/meateaters/pdf/methodology_ewg_meat_eaters_guide_to_health_and_climate_2011.pdf. It should be noted that this report is based on large-scale farming in the US.