A sideways look at economics

Visiting Whistler Blackcomb ski resort in Canada this year, I was introduced to the concept of a multi-resort pass: a whole-season ski pass you can use at many resorts across different continents, as opposed to one that would only cover a specific resort or area. Having previously only ever skied in Europe, it got me thinking: would these multi-resort passes end up getting replicated over here?

Vail Resorts, an American ski resort company, revolutionised the ski industry in 2008 with the launch of its Epic pass, the first major multi-resort pass to allow a skier to use the same pass to access the ski lifts and runs at multiple ski areas over a whole season without having to buy a new one. Anyone familiar with skiing will know the ski pass is a major expense for each holiday, so while the launch was not an overnight phenomenon, subsequent fine-tuning and the addition of more ski areas led to its eventual success.

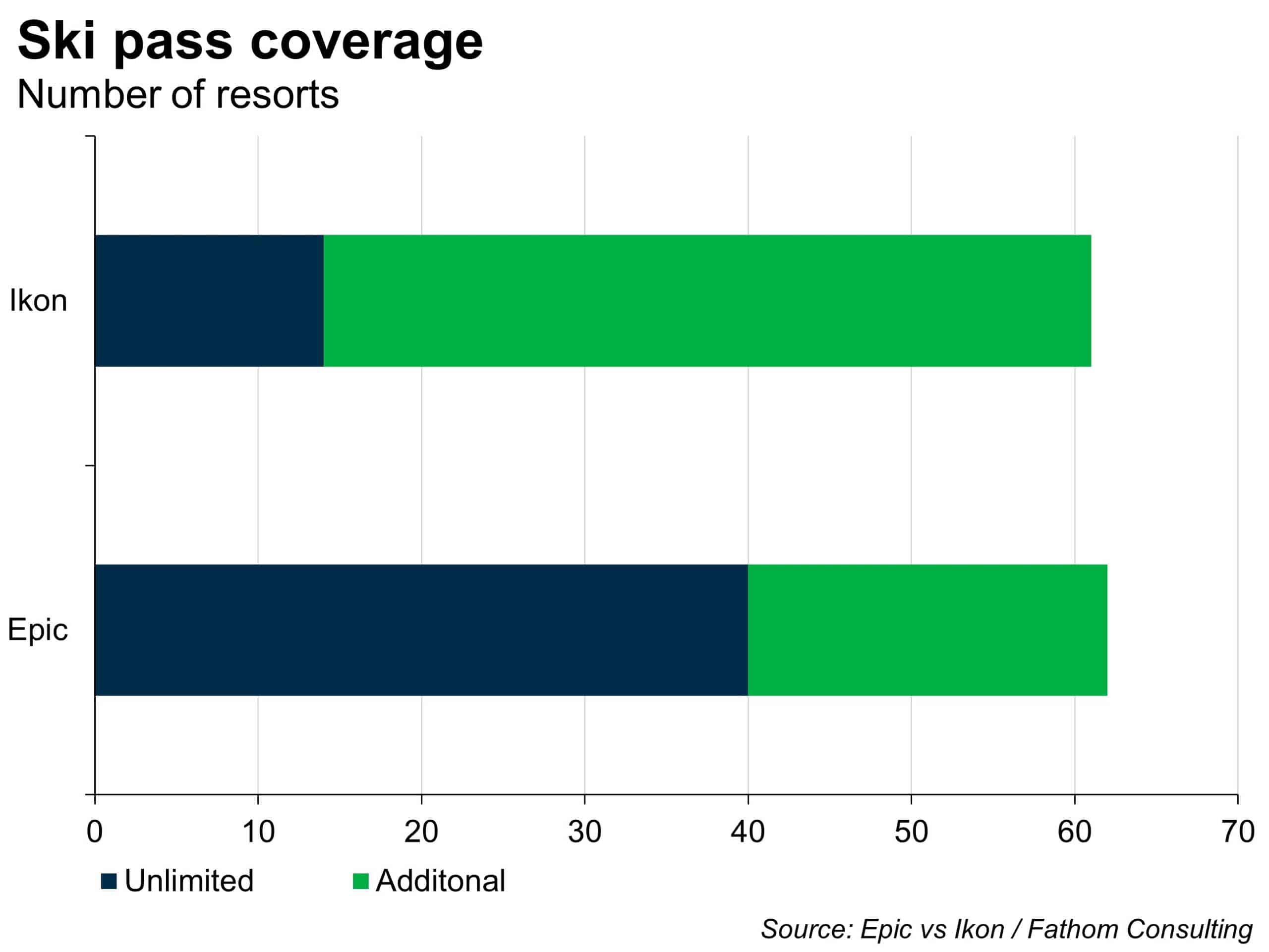

When originally launched in 2008, the Epic pass consisted of six resorts — five in Colorado and one in California. Now it has grown to encompass 62 resorts spanning four continents, making the pass ever more enticing to the consumer as the list of resorts expands. Of the 62 resorts, 40 are unlimited access resorts owned directly by Vail, while the remainder are partner resorts which allow pass-holders to spend a maximum of seven days at each destination.

After the Epic pass started to become popular, Alterra Mountain Company, Vail’s major competitor, launched its own multi-resort pass in 2018, the Ikon pass, which now covers 61 resorts across five continents.

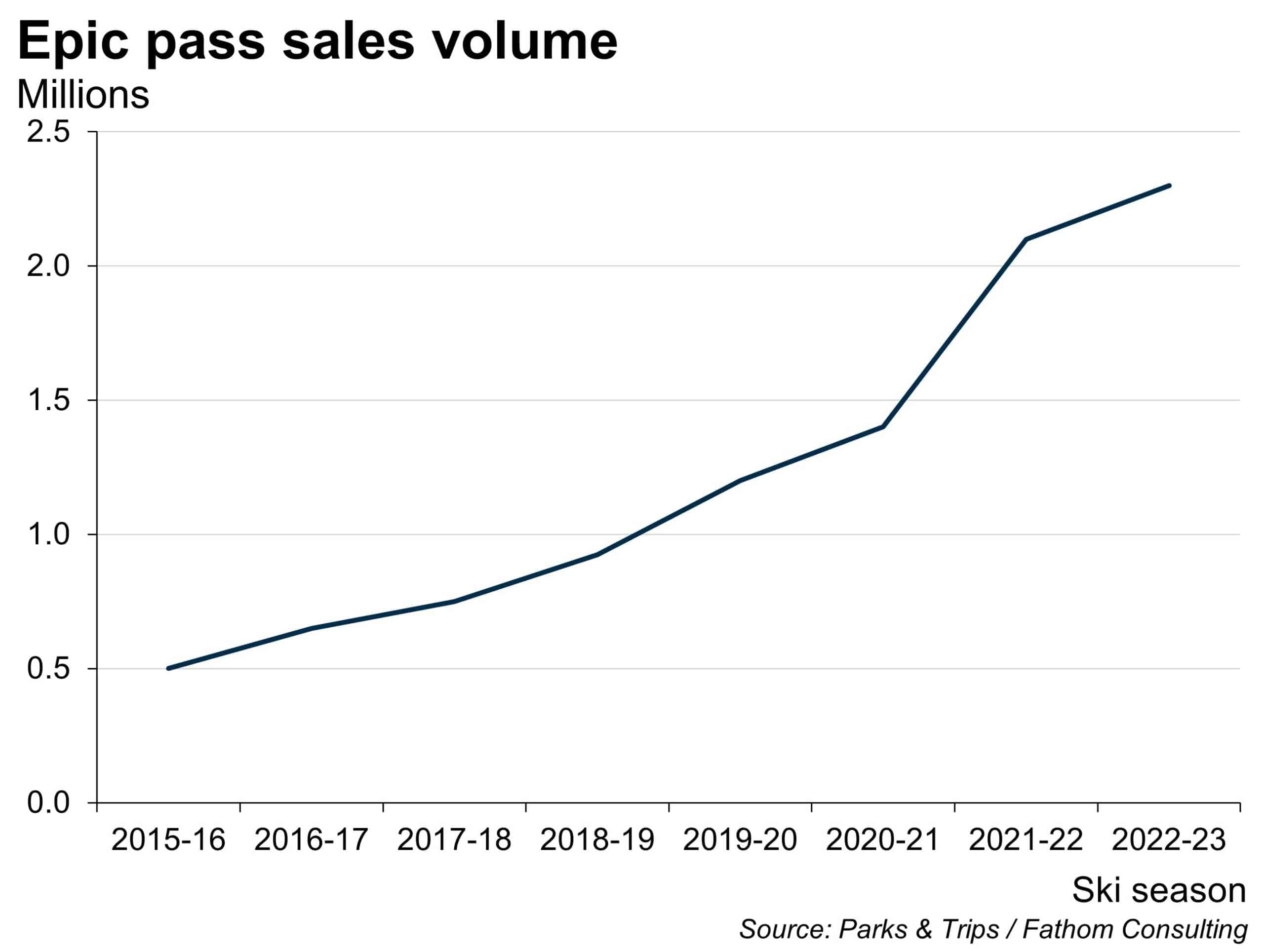

Vail’s Epic pass has snowballed in popularity, with sales increasing more than four-fold since 2015. The increasing number of resorts included has partially fuelled the increase in sales, expanding to Australia with Perisher in 2015 and Canada with Whistler Blackcomb (North America’s largest ski resort) in 2016. At first glance the economics of these relatively cheap multi-resort season passes may seem puzzling; at a cost of $909 in advance for the 2023-2024 season compared to $153 for a single day window ticket, buying a multi-resort pass for the whole season is cheaper than six day passes. However, the sunk cost (a cost which has already been incurred but cannot be recovered) of the pass increases visitations to Vail-owned resorts, both by increasing the amount of visits a skier makes as they try to ‘get their money’s worth’, and by making the pass-holder more brand-loyal, as it makes economic sense with two identical options to go to the resort where you don’t have to buy a new pass but can use the one you already own. Vertical integration in the resort allows Vail to offset the lower pass revenue per skier with increased in-resort spending on equipment rentals, parking and hotels, many owned partially or outright by Vail. The whole-season pass also provides resorts with more reliable capital upfront, reducing the negative impact of poor seasons by encouraging people to buy early by gradually hiking the price as the season nears, a practice known as dynamic pricing.

The 2022-23 season was the first where Vail Resorts has owned a resort in Europe, after purchasing Andermatt-Sedrun in Switzerland. This season has been one of Europe’s worst for snowfall, with many resorts forced either to temporarily close or to fall back on the costly (both environmentally and economically) expedient of making artificial snow. Seasonal variations like this help to make the case for expansion by the titans of the skiing industry, as geographical diversification can help protect them from the localised impacts of climate change, which has made snowfall less reliable and shortened seasons. The whole-season, multi-resort passes also benefit consumers, allowing them to choose resorts enjoying better snowfall.

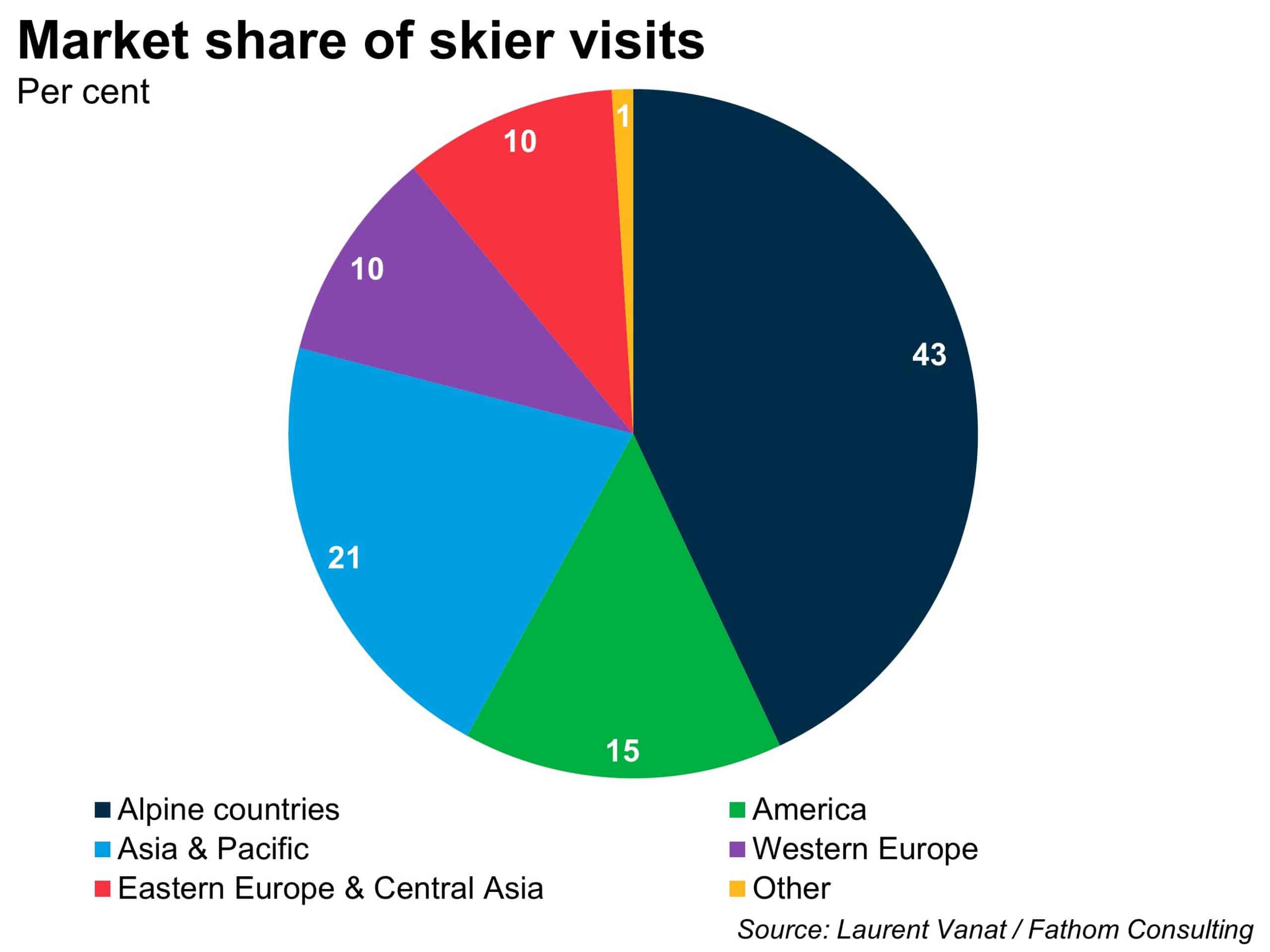

The sheer size of the European market, destination of nearly two thirds of all ski resort visits, makes it a prime target for further expansion by Vail and Alterra; or maybe for the birth of a completely new European-based competitor. The European market is likely to see a rise in mergers and acquisitions as companies compete to replicate the success of the multi-resort model across the pond. This would result in a small number of companies gaining an increasing share in the largest ski market in the world, cutting out competition as the market consolidates. Meanwhile lower altitude European resorts continue to permanently close, at a rate of more than two per year in France alone,[1] further reducing competition and restricting the options available to the consumer.

All these circumstances point to the likelihood of the multi-resort pass becoming an increasingly common sight in Europe. For a keen skier this is not necessarily a bad thing, however, as it may open access to more varied destinations each season.

[1] Typically these resorts are smaller and at a lower altitude (https://www.forbes.com/sites/alexledsom/2023/01/04/europe-ski-resorts-close-due-to-lack-of-snow-forcing-more-sustainable-approach/?sh=2fa7322d3955),

More from Thank Fathom It’s Friday

Premier League vs productivity