A sideways look at economics

Think there’s a recession coming? Go out for a slap-up dinner. Buy yourself some bling. And when you’ve done that, post pictures on Insta (or your social network of choice) of yourself wearing the bling, and ordering your second bottle at dinner.

Worried that your neighbours are facing hard times? Upgrade your car. Get that extension built. And what’s more, kindly talk about it: bang on about how much it’s costing, whenever you are out with your friends and neighbours. Make it obvious. Enjoy it: and do so in public.

Why? Well, all that bragging might sound boorish but it’s for everyone’s good. Last week’s TFIF was about altruism. This week’s is also about that: but with a different slant. Altruism is not always the same as empathy. Sometimes the best thing you can do is what feels like the worst thing, or the least sensitive thing.

Talking ourselves out of recession

The household is not a good model for the economy, we’re often told, in at least two respects. First, because households must observe their budget constraints or go bankrupt, while the same does not necessarily apply to the whole economy. Second, because while each individual household can (and sometimes must) change its own consumption patterns, it can generally do that without having to worry about the macro implications of that change: as a rule there are none, unless you are Jeff Bezos, for example. Each household on its own is a price taker.

However, all or many households moving together in unison can be price makers. This is where it gets gnarly: when the independent choices of many households all go in the same direction. This is what Keynes called ‘animal spirits’, though that term applies to firms as well as households. When many people feel the same way about something, the choices they make can influence macro outcomes.

The classic case here is recession: if everyone thinks there’s a recession coming and builds up their precautionary savings as a result, then a recession will come. It’s a self-fulfilling prophecy. That’s the role of government, according to Keynes: to step in and break the chain that links fear to the thing one is afraid of. That’s the thought that led FDR to declare that the only thing we had to fear was fear itself.

For example, it might be that a large number of households simultaneously worry about taking a hit to their future standard of living, for clear reasons: such as a recent shock to the cost of something to which they are highly exposed, like energy. That alone might be sufficient to drive the economy into recession, without government intervention.

Contagious narratives

But there is a second question about the severity and length of any recession. And here, you can imagine a second group of households – the neighbours, perhaps – who are not directly affected by the energy price shock, but have decided to save more nevertheless. That’s the classic Keynesian route to a lengthy recession or depression. We all get scared, whether we’re directly affected or not. And we all save more, ensuring the recession drags on for longer, and perhaps indefinitely. Fear is contagious. And contagious fear is self-fulfilling – if it goes on for long enough, even the neighbours who weren’t directly affected in the first instance will see their income and wealth hit. Then they will say to themselves: see? I was right to save more. In fact, I wish I’d gone even further.

What are the mechanisms that drive these animal spirits – what are the vectors of contagion? In his excellent book Narrative Economics, Robert Shiller develops the role that popular narratives can play in that process. It’s all good (and will be reviewed in a forthcoming Fathom book club), but I want to pick up one thread here.

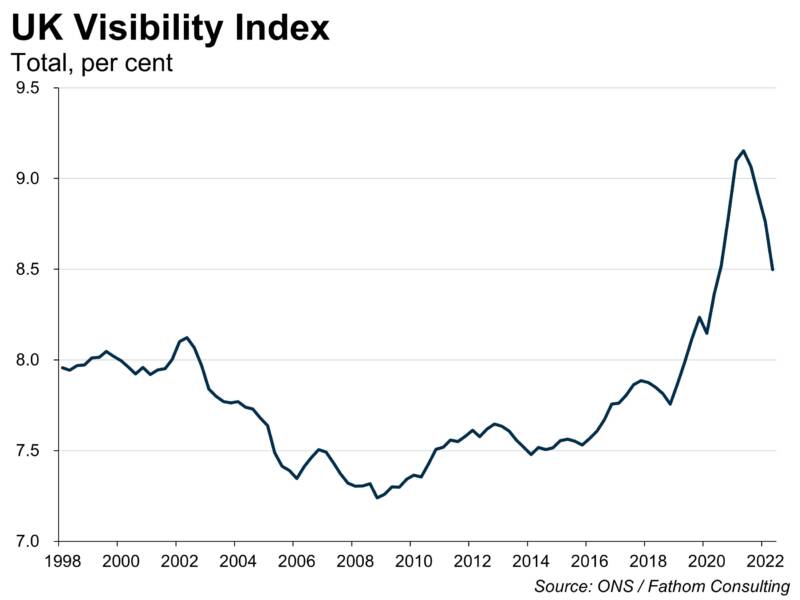

Shiller refers to a concept that was developed by Ori Heffetz: visibility. Heffetz’s idea was that information about the severity and duration of a downturn could perhaps be drawn from the revealed appetite of consumers for highly visible ‘conspicuous’ consumer goods and services. He proposed and built a ‘visibility index’ that captured the proportion of consumer spending that was devoted to conspicuous consumption. He noted that conspicuous consumption tends to fall in the early stages of a recession, a process that ensures the recession lasts longer than it needs to.

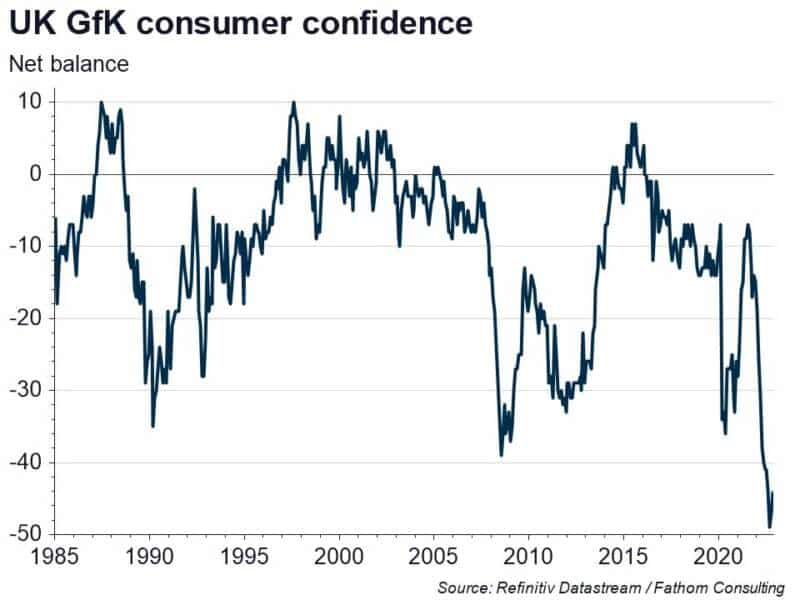

I think this is a very interesting idea. Much has been written about the dreadful state of consumer confidence in many advanced economies including the UK, and how that points to a severe recession in the offing.

But reading Shiller’s book I wondered whether the same would be true for conspicuous consumption. So we have constructed a UK version of Heffetz’s Visibility Index. It is very interesting, and not the same as confidence.

The COVID recession was extremely unusual in that it saw consumer confidence and consumer spending fall even while household income rose, thanks to government transfers. Perhaps even more extraordinary was the effect it had on conspicuous consumption. The visibility index rocketed, during the steepest recession of all time. It’s not just that people carried on at the same rate of visibility – they massively increased it. Within that overall picture, goods visibility increased while services visibility (not including tourism) collapsed initially before recovering more recently. The initial collapse in the conspicuous consumption of services was probably because those services include air travel, hairdressing and personal grooming, and cultural services (art galleries, museums, libraries etc), most of which were not available during lockdowns. Despite that enforced reduction, overall conspicuous consumption rose: we more than made up for it in our choice of which goods to buy.

What to make of that COVID spike? Those who could spend, did so, and did so conspicuously. That is surely to be welcomed. The alternative, with everyone tightening their belt whether they needed to or not, would have meant a worse recession even than the one we experienced.

More worrying is the recent move. Visibility is down and is falling precipitously. It seems that fears of another recession are prevalent and contagious. It’s likely we’re already in recession in the UK, and (which is the point of this blog) if people start to feel that they ought to tighten their belts, whether out of empathy with those who have been directly affected already or from other motives, that feeling is bound to aggravate the recession and it risks becoming self-fulfilling. It’s the recessionary equivalent of second-round effects of an inflationary shock.

The problem with conspicuous consumption is that it conflates greed and narcissism on the one hand with determined and deliberate positivity on the other. The former is generally regarded as in bad taste, especially when others are suffering, while the latter is for the public good. But so long as the motive and the narrative around it prove to be contagious, these strange bedfellows can provide a mechanism through which recession can be mitigated and the suffering that attends it can be alleviated. (As of course can other, more traditional channels of altruistic behaviour, including redistributive fiscal policy, and philanthropy.)

So spend, spend, spend! It’s time for the greedy narcissists and the determined optimists among us to stand up and be counted. We need you now! It doesn’t matter, in a macro sense, which of those you might be, and you’ll have to make your own minds up to which group I belong, as you picture me partying.

Me with a glass half full at a recent party

More by this author: