A sideways look at economics

In a capitalist system, is competition in the market always doomed to suffer a slow death? This sort of question takes on fresh urgency during economically challenging times, when ordinary people tend to struggle while giant corporations sail on regardless. I have attempted to strike a balance in my answer, but no matter how hard I try to weigh up the pros and cons with an even hand there is one ineluctable fact — namely, the concentration of production into the hands of a tiny number of giant corporates — which tips the scales of my argument. The data suggest that ever since the 1930s large corporations, like other conquerors before them, have been trying to take over the world. The difference is that, unlike most historic conquistadors, they have succeeded.

The 2023 Q1 earnings season is complete and yet again the usual discussion about ‘winners’ and ‘losers’ in the ‘battle’ against consensus forecasts has been rendered almost irrelevant in the face of the dominance of a few, mainly US, corporations. Come rain or shine these corporations increase their market share, adding a new dimension to one of capitalism’s Holy Grails: namely, economies of scale. They go after everything that is up for grabs, from a bank account to a trip to space, leveraging their huge balance sheets and resources to become… well, larger. Just as disconcerting are the record profits of energy companies, made on the back of the ongoing cost-of-living crisis. It is a struggle to ignore the elephant in the room. Here the ‘room’ is capitalism as an economic and political system, and the ‘elephant’ is the sky-high concentration of production in just a few corporate hands.

Is the increasing concentration of production somehow inevitable in modern industrial settings? That is anything but a new question: in fact, it is one of the perennial questions in economics. Since Marx (1867) in the mid-19th century, continuing through Marshall (1890) and onwards to present times, many have wondered whether this ever-increasing concentration is a coincidence or, perhaps, an economic law. Lenin (1916, p.10) famously stated in his description of capitalism: “The enormous growth of industry and the remarkably rapid concentration of production are one of the most characteristic features of capitalism.”

Lenin certainly believed that corporate concentration is inexorable in capitalist systems. So, is Lenin’s assertion supported by what has happened in the ensuing century? To answer, the logical starting point is to examine the concentration of production in corporate data. Usually, a researcher would use a sample of public corporations which are representative of the population, to measure corporate concentration and answer the question with acceptable levels of uncertainty. However, for once, I wanted 100% certainty, and I was after not a sample but the entire population. Obtaining the figures for all existing and perished corporations (that is, the whole population) is not easy in social sciences, where data coverage and generation are not as abundant and timely as in, for example, physics. To that end, I followed the tried-and-tested Fathom methodology of conducting an informed literature review, confident that in the era in which we live someone, somewhere, would have done the research instrumental to the question at hand. Sure enough, a web-search returned a recent study that examined a similar, albeit arguably more in-depth, question for the US economy. Luckily for me, the authors had digitised a rich database on US corporations from the historical publications of the Statistics of Income (SOI) and the associated Corporation Source Book from the Internal Revenue Service (IRS) — a dataset which they freely provide here. For over a century the SOI has been reporting annual statistics on the population of corporations by size buckets, including the number of businesses and their financial information: their assets and their receipts (i.e., revenue, net income, etc.). Bullseye!

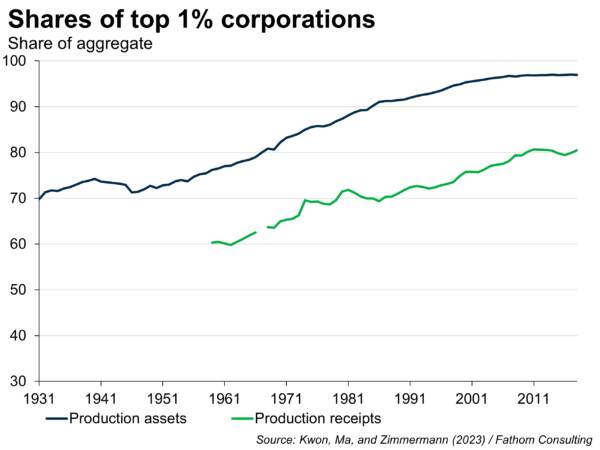

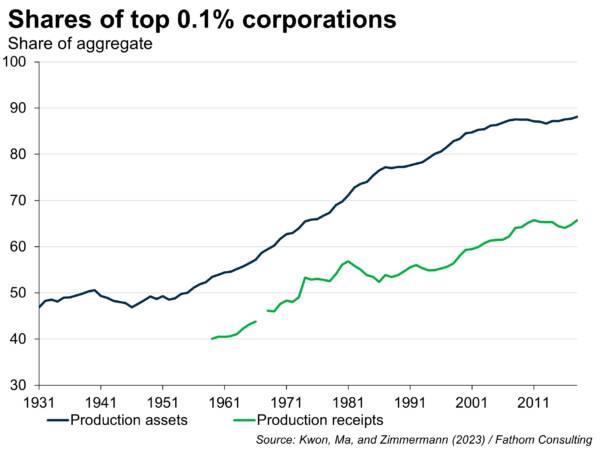

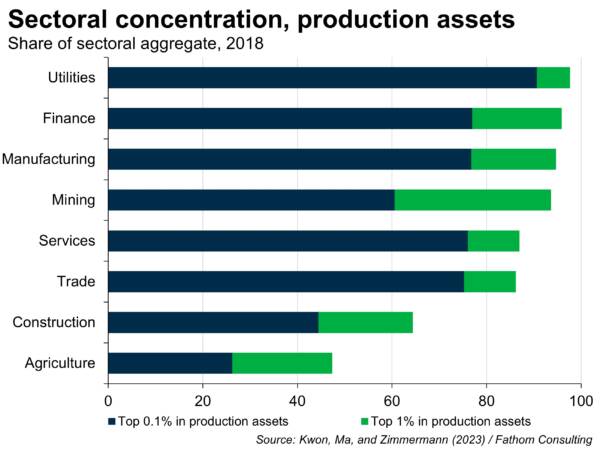

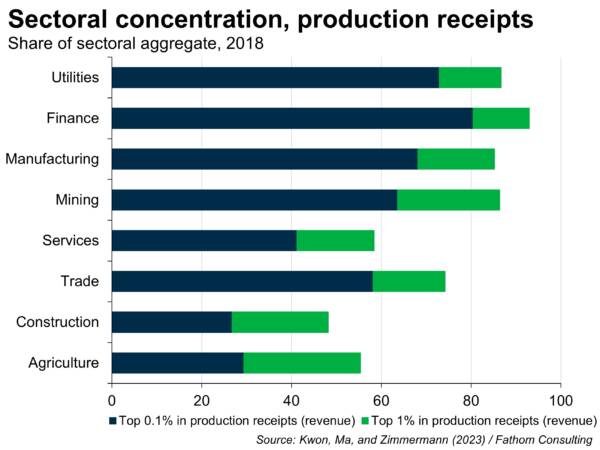

Employing the size buckets to estimate top businesses’ shares in aggregate, one can arrive at the following results. Between 1931 and 2018, the assets share of the top 1% of corporations has increased by 27 percentage points, from 70% to 97%. If we focus in on the top 0.1%, the dominance is even more evident – their share has increased by 40 percentage points, from 47% to 88%. Lenin was right, in other words. Using these industry-level size buckets, one can observe a general consolidation among the main sectors from the 1930s onwards, but the timing differs across industries. The manufacturing and mining sectors consolidated at a faster pace prior to the 1970s, while services, retail, and wholesale sectors have taken the lead since. Interestingly, the most consolidated sectors in 2018 were the utilities and finance sectors — both industries that have lately dominated the news, the one due to profiteering from high energy prices, and the other from a cavalier attitude towards asset risk management that has eventually blown up. Goodness knows, their PR departments must have been busy. Dominating a sector to the verge of oligopoly requires a good public image, particularly in tough times when the public is looking for a scapegoat for all economic problems.

What’s the cause of this persistence in corporate concentration? One factor that has been confirmed to be important is the rise of technology. The timing and the degree of rising concentration in the above industries closely aligns with rising technological intensity in the same sectors. For example, the top 1% share in the manufacturing industry strongly co-moves with its investment intensity on R&D and IT. The degree of concentration is also positively related to the fixed operating costs intensity. In other words, to the degree that higher fixed costs favour scalable production, large firms have the advantage. The rise of globalisation can only partly explain the results as it accelerated around the 1970s, when the rise in services concentration took hold. Another factor that came to the fore after the 2008 Global Financial Crisis (GFC) is rock-bottom interest rates — a setting that gave rise to corporate zombies, as Fathom has shown in an earlier note here. However, ultra-low rates also gave incentives to large companies to go after everything, as the risk to financing operations was negligible.

The research presented here settles, at least in my mind, the question of whether capitalism leads to higher concentration. It does! Should it be like that, though? Although I do like success stories, especially well-deserved ones given the risks that founders or boards have to take to beat others, I do not think that corporations should turn into behemoths, with the power to take over everything, potentially at the cost of the rest of us. Anti-trust regulation is a means to keep things under control. Another idea that is a bit more subtle but perhaps equally influential in the post-GFC world is for central banks to keep rates at levels that maintain material operational risk premia again.

More by this author:

A cynic’s guide to Valentine’s Day