A sideways look at economics

Banking crisis. Inflation. War. There are reasons to be gloomy. When it comes to the economy, however, the killjoys seem to hold too much sway right now. Yes, the COVID recession was severe. But it was also incredibly short, and the recovery has been much swifter than many expected. Since then, inflation has been high, but aggressive hiking cycles have (so far) been absorbed remarkably well. Meanwhile, Russia’s invasion of Ukraine and the subsequent impact on energy markets has had much less of a negative economic impact than many predicted. The same can be said about recent banking turmoil. As spring turns to summer, price pressures look to have peaked, while unemployment rates remain at multi-decade lows. Despite that, there is a general pessimism that does not seem to be justified by the economic data. As we millennials get old(er), we are starting to lose cultural sway to Gen Z. I’d guess it was one of the next generation who combined an increasingly popular slang term with the usual one for economic downturn to come up with a word that accurately describes the current situation: vibescession.

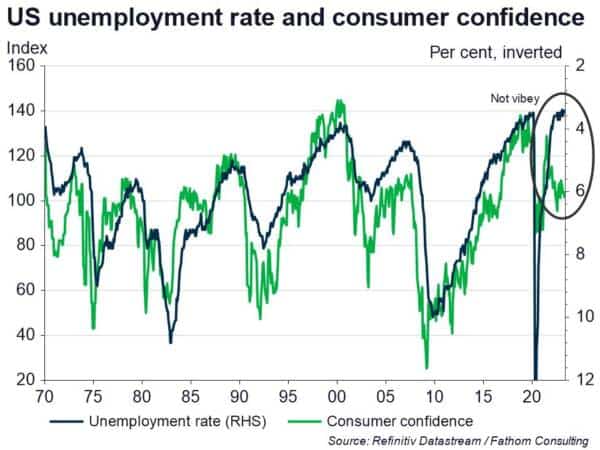

Most people will judge the state of the economy through the prism of the labour market. When jobs are easier to get, people feel better. There is a close, inverse relationship between US consumer confidence and the unemployment rate. When unemployment goes up, people lose confidence — and vice-versa. This makes sense. More people being out of work is a good proxy for broader economic conditions. Indeed, the so-called ‘Sahm rule’ finds that the US has never avoided recession when the unemployment rate increases by 0.5 percentage points relative to its low over a twelve-month period. Something strange is happening. Unemployment has fallen to multi-decade lows, but confidence remains in the doldrums. What gives?

One explanation for what might be deemed ‘irrational gloominess’ is the rise in prices. From onions in India to gas in Texas, the price of everyday items is highly salient across the world. Indeed, previous Fathom work finds that consumers in advanced economies are made equally unhappy by a one percentage point increase in the inflation rate as by a one percentage point increase in the unemployment rate. As the rise in inflation has been much larger than the drop in the unemployment rate, it’s not surprising that the vibes are off.

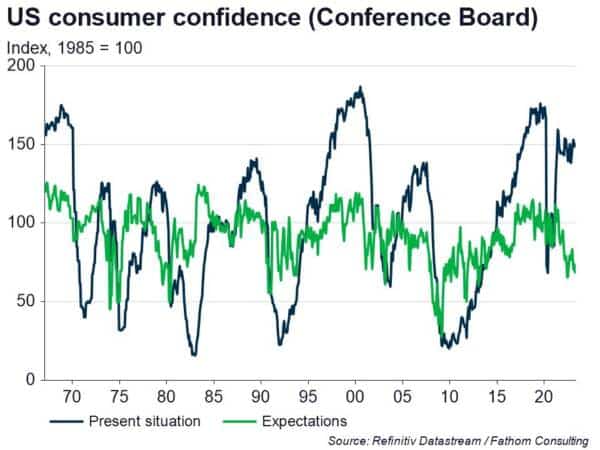

Another issue is that humans tend to be forward-looking. The US Conference Board index of consumer confidence asks respondents about their present situation and their expectations about the future. Confidence in the present situation remains high, largely shrugging off the jump in inflation. That makes sense given colossal excess savings, and continued strength in the labour market which has allowed consumption growth to remain positive in real terms — arguably the best measure of present living standards. The problem is how they see the future. Confidence there has been falling for two years, and is only just above the lows seen in COVID. So although people accept that things are good now, they don’t expect it to last.

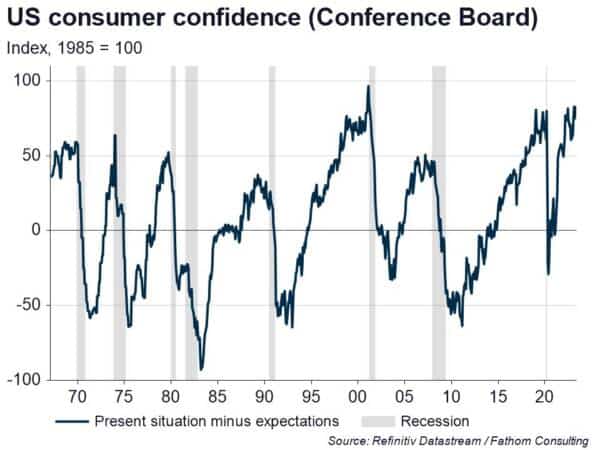

The gap between how respondents rate the present situation versus how they see the future is close to record highs, and this has been a good predictor of recession in the past. That suggests consumers may be rational after all. Indeed, in our Global Outlook, Spring 2023, we judged the odds of a US recession to be 60% in favour. However, that still leaves a very good chance that the world’s largest economy will be able to engineer a soft landing. Low confidence can become self-fulfilling: pessimism about the future can lower spending today, making a recession more likely. Gen Z are not only associated with ‘vibes’ but also the idea of manifestation. The latter may help in this situation. If we all manifest a soft landing, not only will that lift our collective mood, but it may also end up helping to achieve a soft landing. Even if it doesn’t, what’s the downside? If a recession is inevitable later in the year, we might as well enjoy the summer. There’ll be plenty of time to be downbeat in the winter.

More by this author

A guide to substitution in a high inflation world