A sideways look at economics

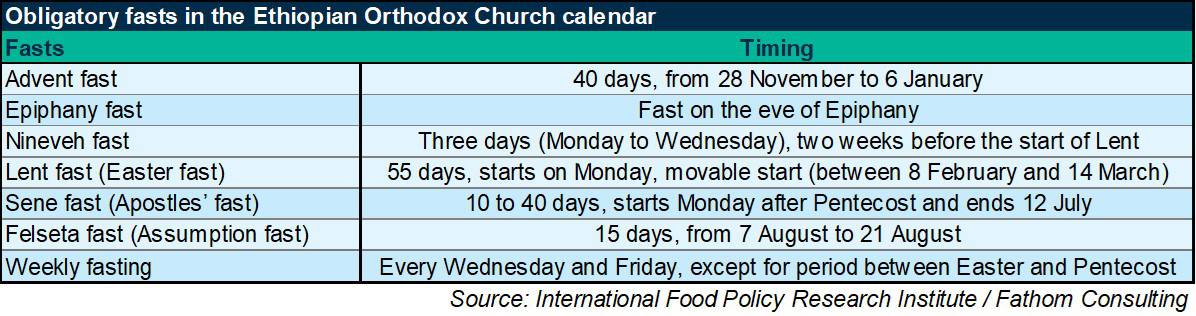

There are around 260 million Orthodox Christians in the world. Followers of the Julian calendar, they will celebrate Easter this weekend. While religious observance is a mostly private matter, it has wider societal ramifications. These can be small, such as receiving dates before dinner in certain London restaurants during the holy month of Ramadan. In Ethiopia, where I am writing this, it leads to a (frustrating) see-sawing availability of grilled meat in many local eateries. Ethiopia hosts the largest Orthodox Christian community outside of Europe, with almost half of its 100+ million population adherents. Surveys suggest that Ethiopian followers are among the world’s most devout: 98% say that religion is “very important”, compared to an average of 17% among former-USSR Orthodox communities, and 46% among Orthodox Christians in other European countries. This matters for observance. There are up to 180 days per year where followers are supposed to refrain from animal-sourced foods (ASF) — a practice followed by 78% of butchers-stroke-restaurants in the capital Addis Ababa, who shut up shop for around half the year. This includes a mighty 55-day fast ahead of Easter, which is observed by 87% of Orthodox Ethiopians.

With many in the advanced economies having been on a lengthy diet from hospitality venues over the past year, religious fasting may offer some insights into the near-term economic outlook. One of the biggest questions facing investors is how an expected increase in demand will affect prices. Perhaps the first economics lesson people are taught relates to supply and demand. Negative shifts in demand are said to lead to lower prices. Looking at the meat sub-component of Ethiopian CPI, one can see a clear ‘fasting’ impact on prices. Over the past four years, the non-seasonally adjusted meat CPI, in real terms, has decreased by 2.4% on average during pre-Easter fasting months, compared to a 0.6% increase during the rest of the year. Even though periods of fasting are known ahead of time, producers are apparently unable or unwilling to shift supply accordingly to result in a broadly unchanged price for consumers. Less predictable shifts in demand can lead to much greater price movements. According to Tridge, the price of garlic and ginger in Addis Ababa trebled in the hours after the first positive COVID-19 case was confirmed in the country as demand for both soared, with many viewing them as natural antidotes to the virus.

A second key question for economists is the extent to which consumers will make up for lost time once restrictions are eased. On the one hand, there is good reason to think that many will be eager to spend. That is our base case, and the pattern observed in Australia so far, which is further ahead in the unlocking cycle. However, Fed Chair Jay Powell made a pithy quote expressing the limits to this pent-up demand, saying “you can only go out to dinner once per night”. (Certain Fathomites are eager to prove him wrong on that front.) Evidence from Ethiopia’s Orthodox Christian community points to permanent declines in overall ASF consumption due to fasting. The share of ASF in the overall food budget in the majority-Orthodox Amhara region (7.9%) is much lower than in the majority-Muslim Somali region (16.5%). The difference broadly matches the share of fasting days in an average year, suggesting that once Easter feasts are out of the way, there is limited pent-up demand for ASF from practicing Orthodox Christians.

What can we gather from this? On demand, I’m not sure. Most people avoided bars and restaurants over the past year because they were closed or because they didn’t feel safe. It’s unclear whether pent-up demand will be as muted as that following religious fasting. Nonetheless, it’s not realistic for even the biggest hedonist to completely make up for lost time (and wine). On supply, there may be more to it. Even if businesses were certain about future shifts in demand, the experience of meat prices during periods of fasting suggest that supply would struggle to perfectly match them. Lingering uncertainty about future spending patterns risks increasing the size of any future imbalance. Reports of a shortage of vehicles at car rental companies, and bars and restaurants’ difficulty recruiting workers point to supply being constrained, with demand likely to outpace it in many ‘COVID-sensitive’ sectors. Higher prices are the likely result, at least in the short term.

So, to readers returning to bars, hotels and restaurants who get bigger bills than they are used to: you may feel better reminding yourself that this past year of abstinence will (hopefully) be a one-off, and not an annual tradition.

PS. If you happen to live somewhere where (Ethiopian) restaurants are open, doro wot is the traditional Easter dish. However, fittingly for these times, it is a dish best enjoyed home-cooked.