A sideways look at economics

One of my favourite black-and-white movies is the 1946 classic It’s a Wonderful Life. It is probably just the monetary economist in me, but I particularly like the scene with the bank run on Bailey Bros Building and Loan Association. With just his honeymoon money left, George Bailey reasons with the depositors to temper their withdrawal demands, kissing Miss Davis when she asks for just $17.50! At the end of the day, the bank has $2 left and he and the staff celebrate staying in business!

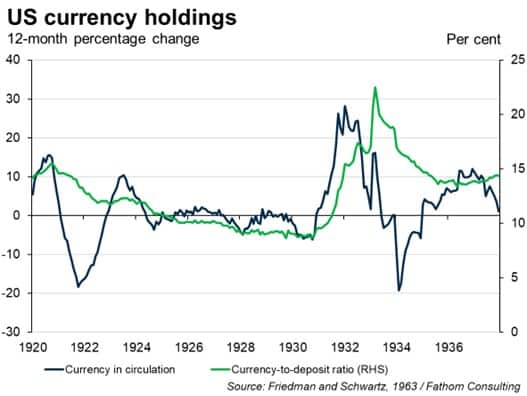

When fears mount about the stability of the banking system, the general public will often rapidly switch their bank deposits into cash (currency), which has no credit risk, in what is typically referred to as a ‘bank run’. Large surges in the value of currency in circulation nationally, or a sharp rise in the currency-to-deposit (C-D) ratio, have historically been key indicators of banking crises.[1]

The most famous bank runs occurred during the US Great Depression, beginning in the late 1920s. Consumers withdrew cash out of banks en masse amid fears about their failure, fuelling a surge in currency in circulation and the C-D ratio. This led to a collapse in the money supply as banks engaged in fire sales of their assets and slashed lending, attempting to raise funds to meet the withdrawal demands of depositors.[2] As a consequence, the US introduced deposit protection in 1933 to try to prevent future bank runs.

Unfortunately, bank runs are not just something from the history books and black-and-white movies. Despite the prevalence of deposit insurance, panic-driven switches into cash can still occur, even in developed economies. Indeed, there was a full-blown run on the UK’s Northern Rock bank in 2007, with customers queuing around the block at branches to get their money. There were also spikes in cash demand in the US, euro area and UK at the start of the Great Financial Crisis (GFC), with the C-D ratio briefly jumping in those countries.[3] The global pandemic also saw surges in demand for cash, but this wasn’t necessarily the result of fears of a banking crisis. C-D ratios actually fell sharply in some countries, as large stimulus checks significantly boosted consumers’ bank deposits.

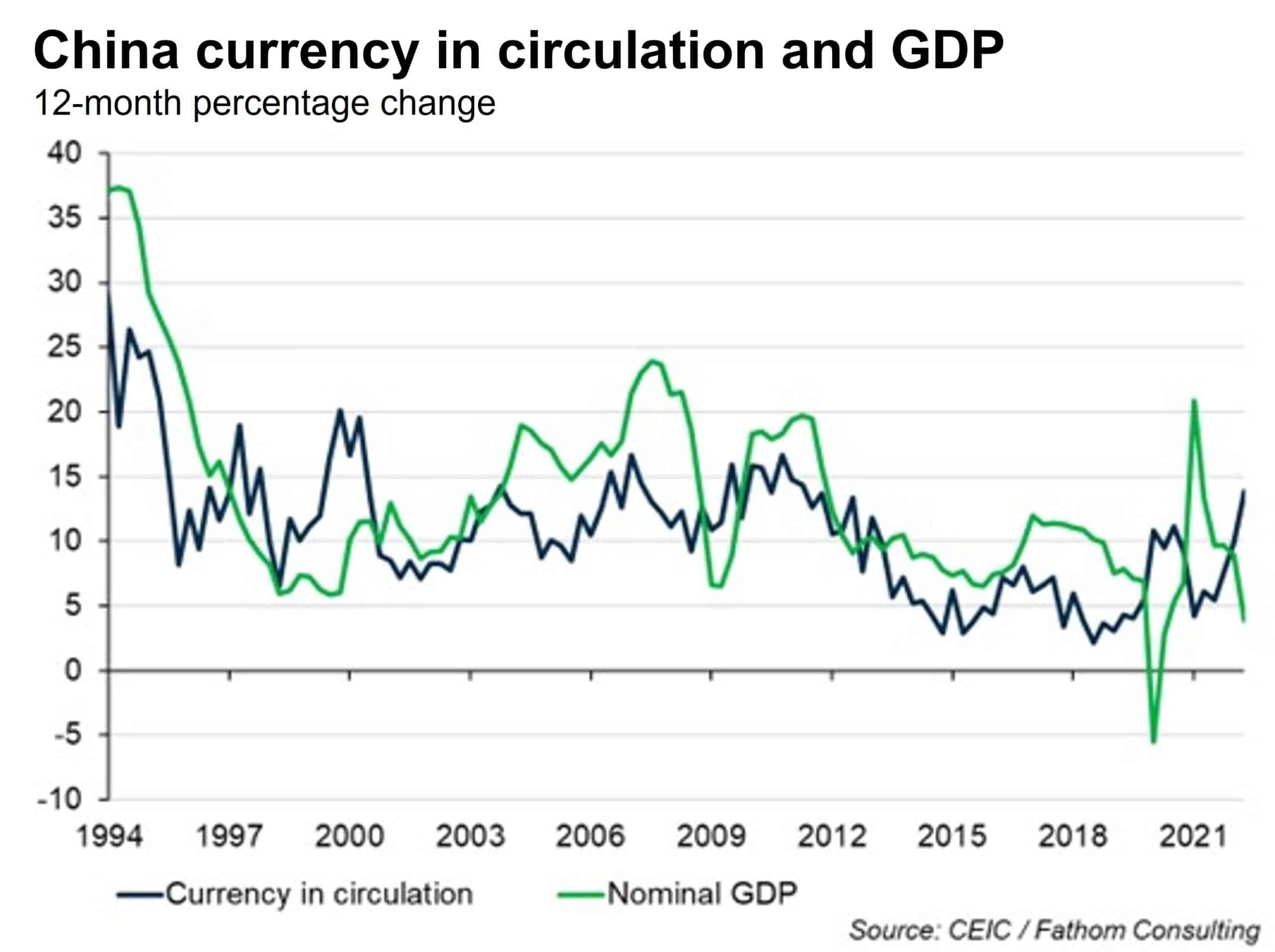

Like Sweden, China is a country where cash’s role in payments transactions has been falling sharply, currently accounting for just 23% and 16% of the number and value of consumer purchases,[4] while its share of GDP has fallen from 13% at the turn of the century to under 8% in 2021 (in Sweden it is far lower).

Nevertheless, the general public in China still appears to exhibit some penchant to hoard cash during times of panic or uncertainty. Trends in cash data can be a little difficult to analyse, given the slight timing differences of the Chinese New Year each year, which involves surging cash demand as families give each other money in red envelopes. Looking at the quarterly year-on-year data, cash demand significantly outstripped nominal GDP during the Asian financial crisis and China’s banking crisis in the second half of the 1990s, and there was a small spike at the height of the GFC. Between 2010 and 2019, cash grew at a much slower pace than GDP, likely reflecting its declining use as a medium of exchange. Nevertheless, there have been quite large spikes in cash demand in China since the onset of the pandemic, in 2020 and again this year — most likely due to the large outbreak in virus cases in Q1 and Q2. Cash in circulation is currently growing by 14% on a twelve-month basis.

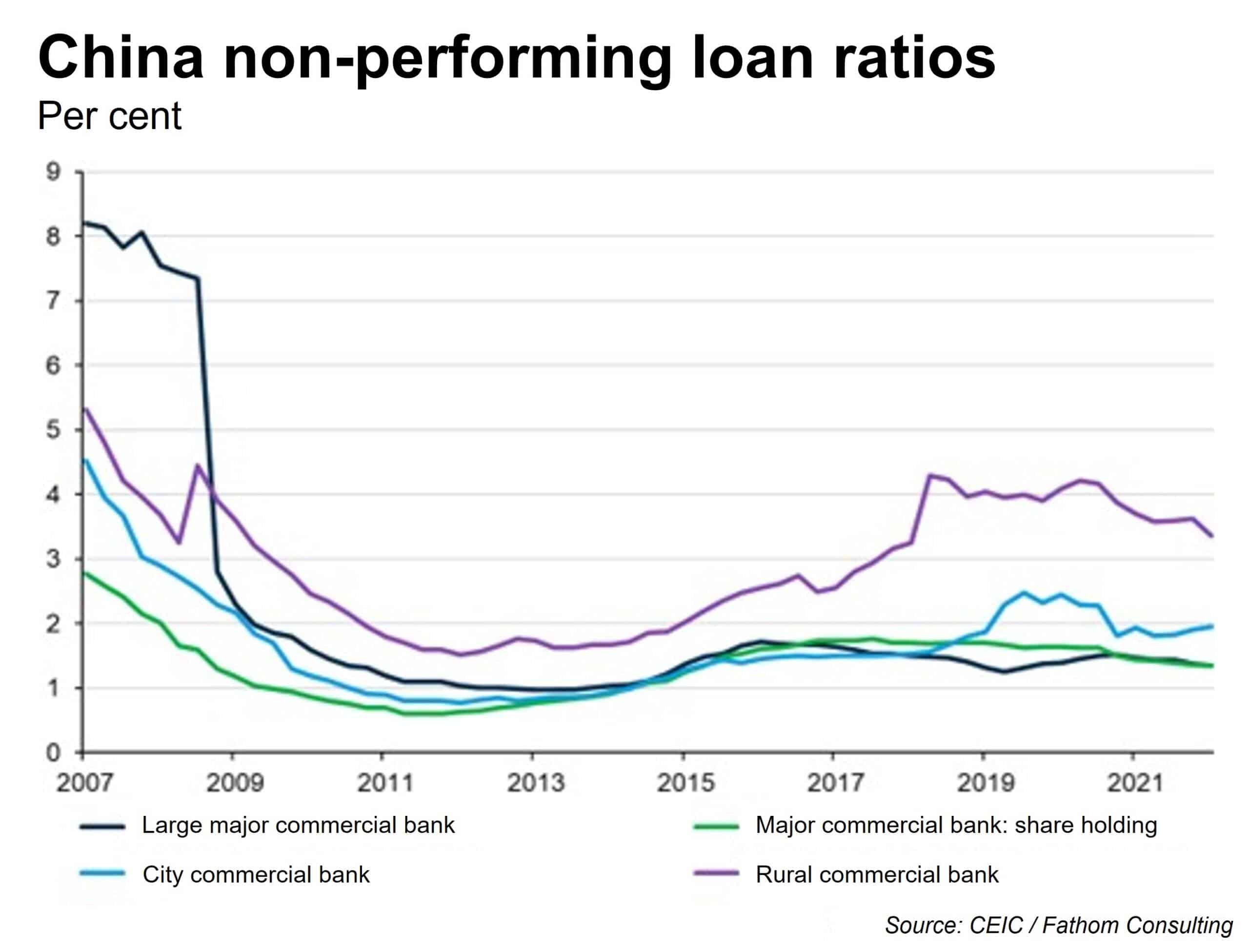

Concerns about the safety of bank deposits have recently led to highly-publicised protests in the Chinese provinces of Henan and Anhui, where several troubled, small, rural banks would not allow customers to withdraw their money.[5] Media reports suggested that fraudulent activity had occurred at these banks, and there were some initial suggestions that these deposits may not have been protected by China’s deposit insurance scheme. That said, the authorities do appear to be beginning to compensate depositors. This has occurred at the same time as a growing boycott of mortgage payments by buyers waiting to take possession of their unfinished homes, which has further increased jitters around China’s housing market and banking system.

With the economy and the all-important property sector struggling, there is an increasing risk of problems with the China banking sector over coming quarters and years. The smaller, rural commercial banks could be at particular risk, given their exposure to weaker local economies, lower capital adequacy ratios, and much higher non-performing loan ratios. While they only represent around 12% of China banking sector assets, any runs on such institutions could have a material spill-over effect on sentiment towards healthier segments of the banking system — particularly if further revelations of fraudulent activity emerge.

All in all, when analysing the prospects for the Chinese financial system, I will continue my heavy scrutiny of official economic releases, financial market variables, and our own proprietary indicators such as the Fathom Financial Vulnerability Indicator. But I will also be watching the public’s demand for cash particularly closely, for any signs of an incipient China banking panic. President Xi is said to be a fan of several Hollywood films, but he may not enjoy watching It’s A Wonderful Life anytime soon as he seeks to secure an unprecedented third term later this year!

[1] Some use the inverse of the C-D ratio, the deposit-to-currency ratio, with a fall pointing to a panic-driven shift into cash. Looking at countries that suffered banking crises in the interwar period between 1921-36, Bernanke and James (1991) note that “Most but not all of the major banking crises were associated with sharp drops in the deposit-currency ratio…”. The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison (nber.org)

[2] See Friedman and Schwartz (1963). A Monetary History of the United States, 1867-1960 | Princeton University Press

[3] See Ashworth and Goodhart (2015). The rise in C-D ratios was very modest compared with the Great Depression. Measuring public panic in the Great Financial Crisis | VOX, CEPR Policy Portal (voxeu.org)

[5] What you need to know about the Henan banking crisis | South China Morning Post (scmp.com) , 5 unanswered questions about the Henan bank crisis | South China Morning Post (scmp.com)

More by this author